Question

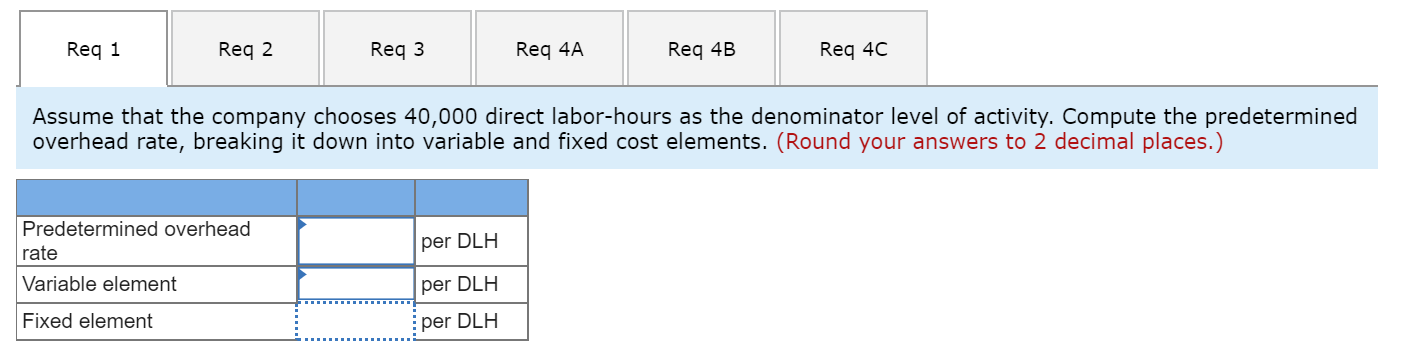

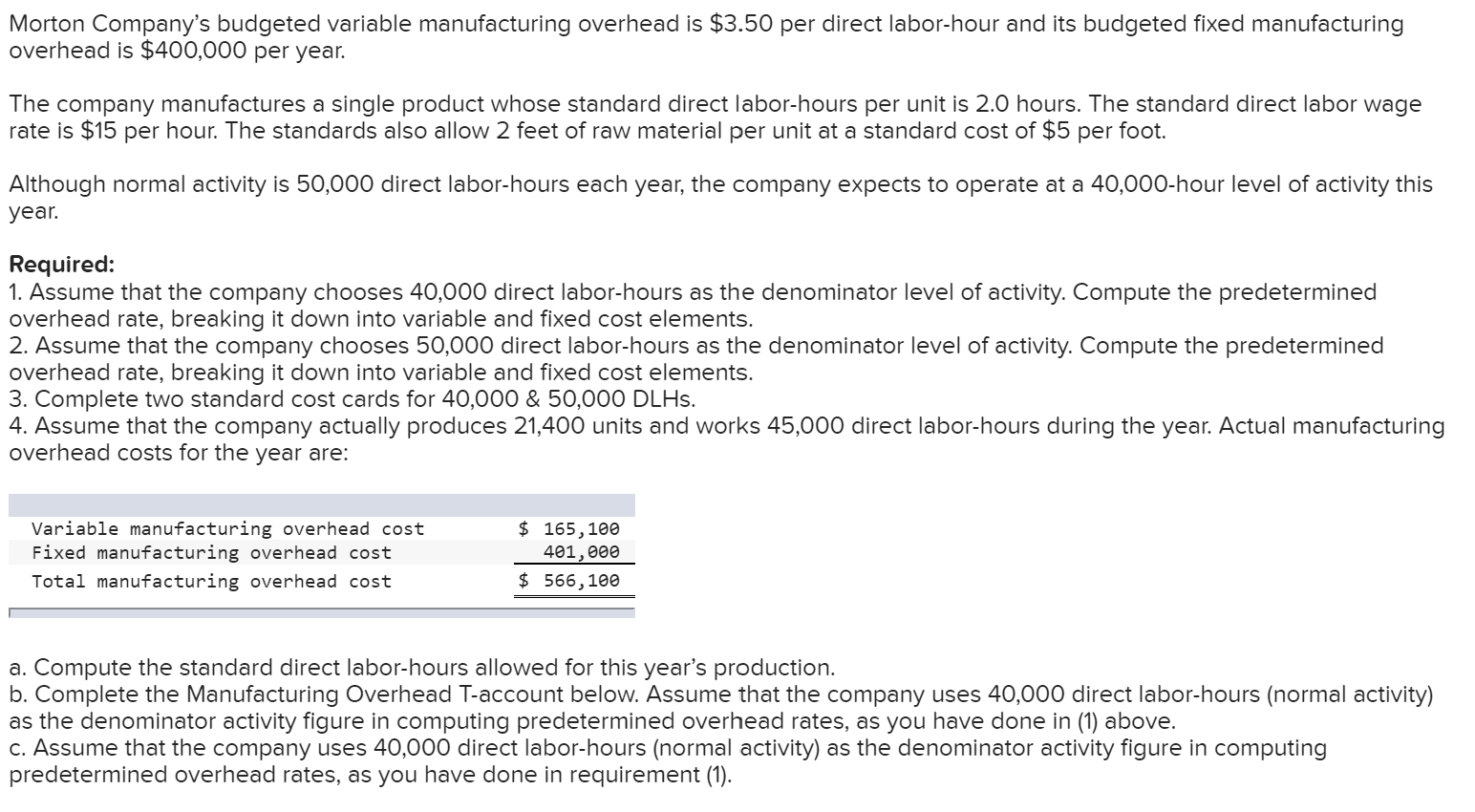

Req 1

Req 1

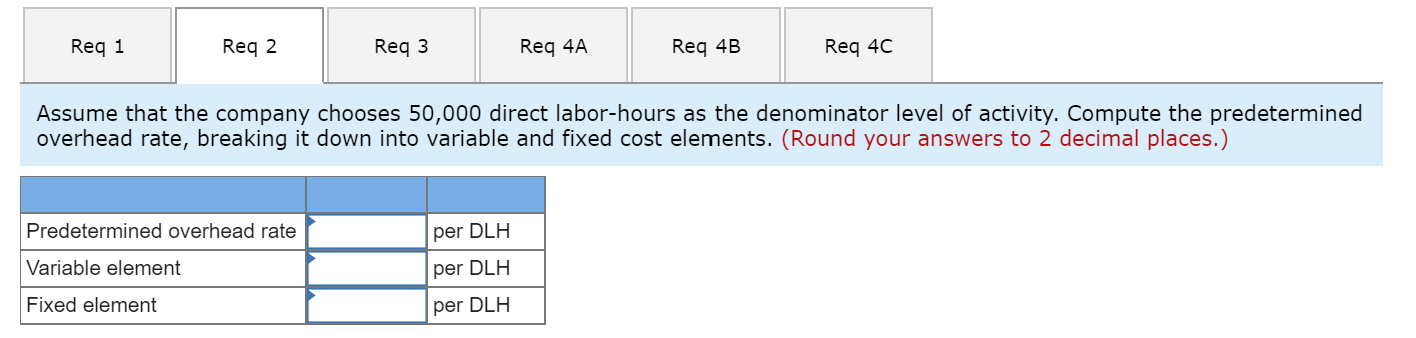

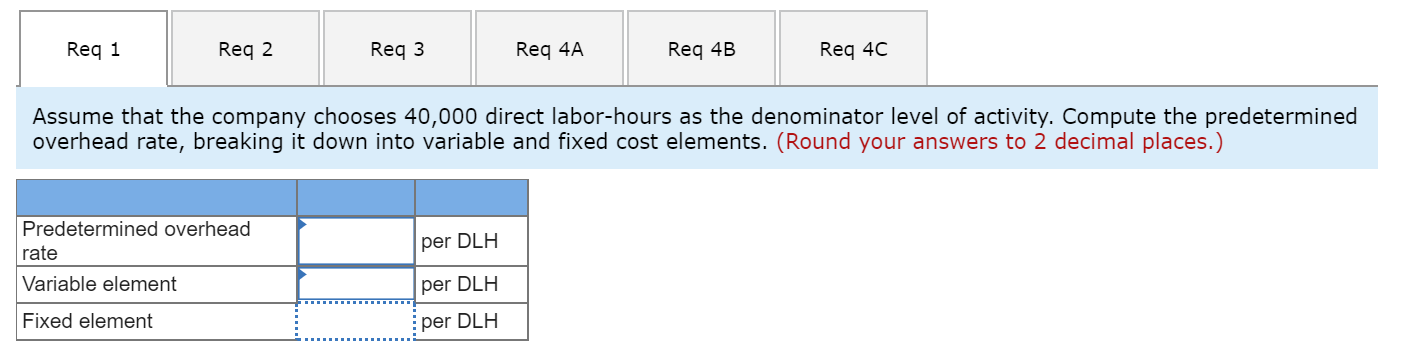

Req 2

Req 2

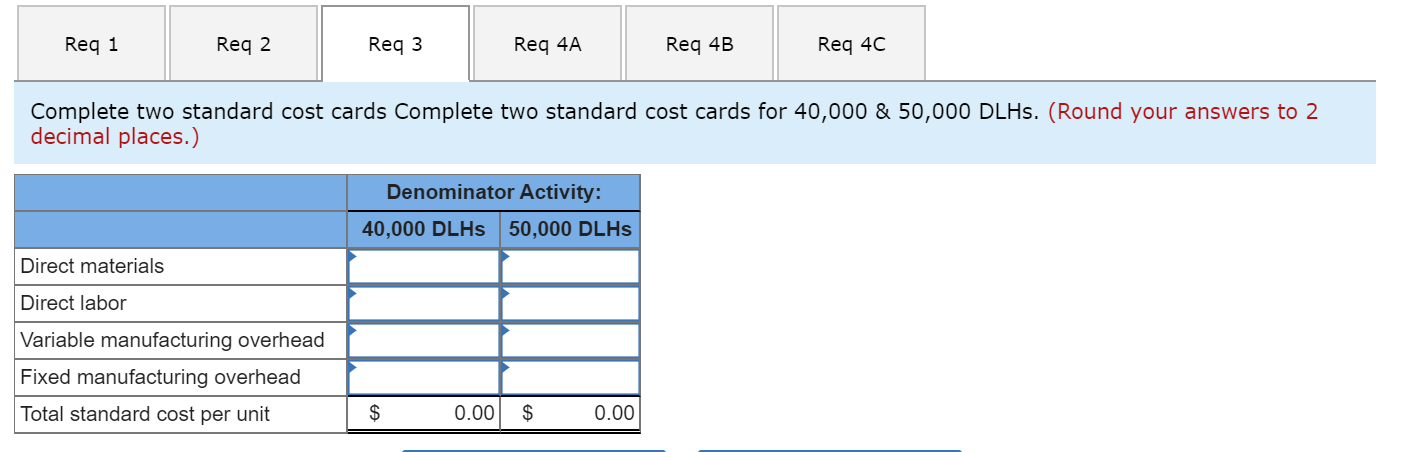

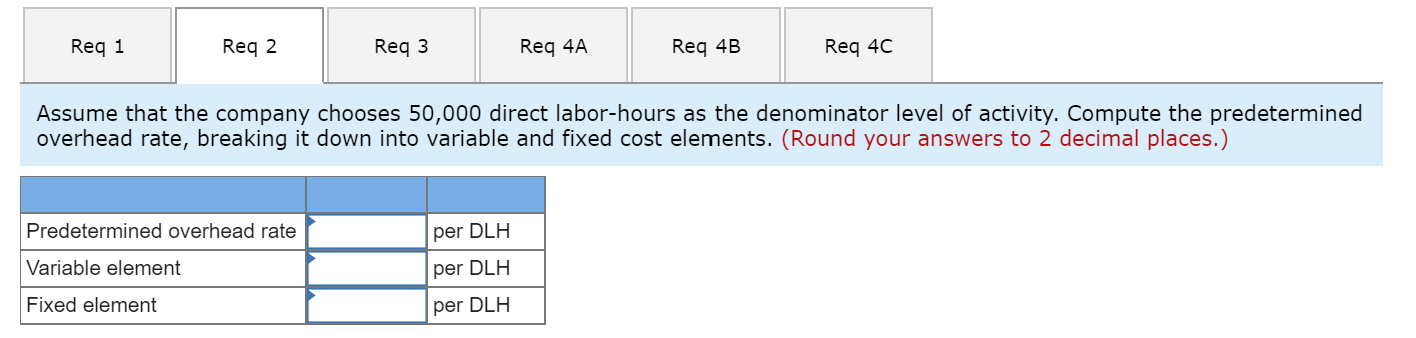

Req 3

Req 3

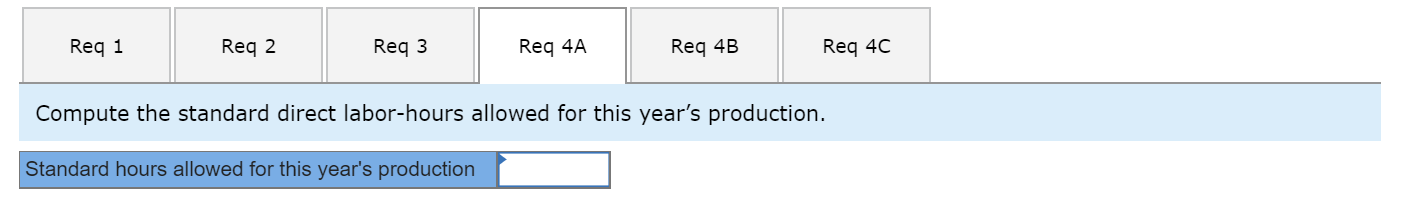

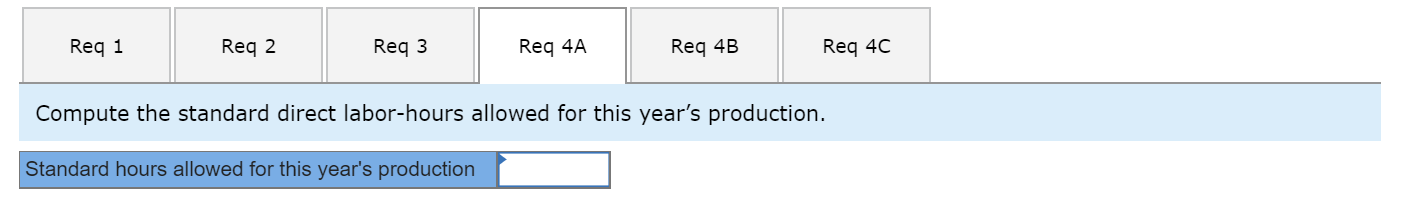

Req 4A

Req 4A

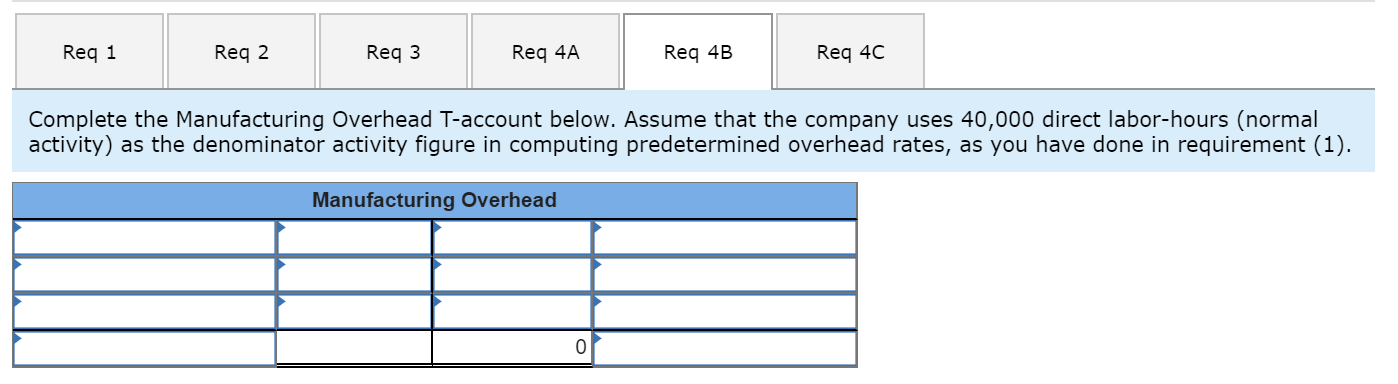

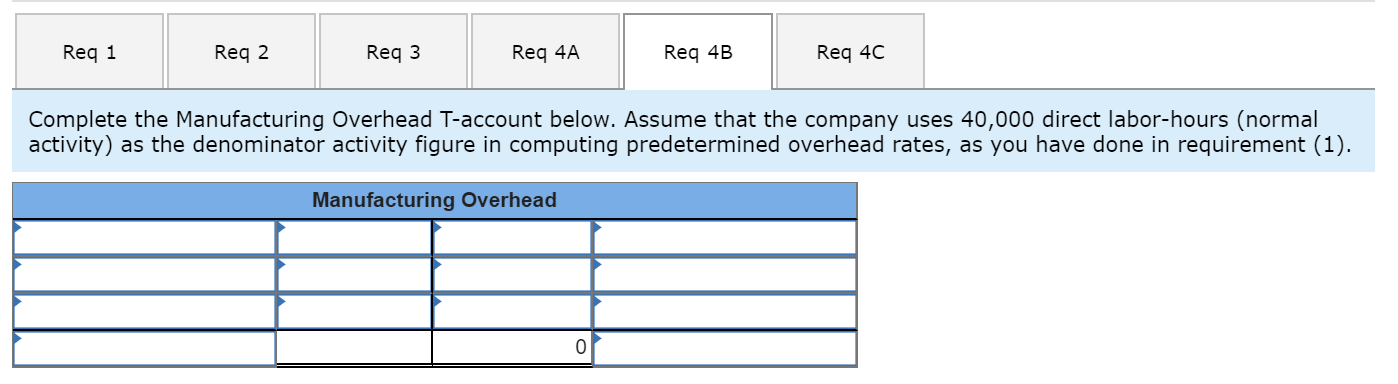

Req 4B

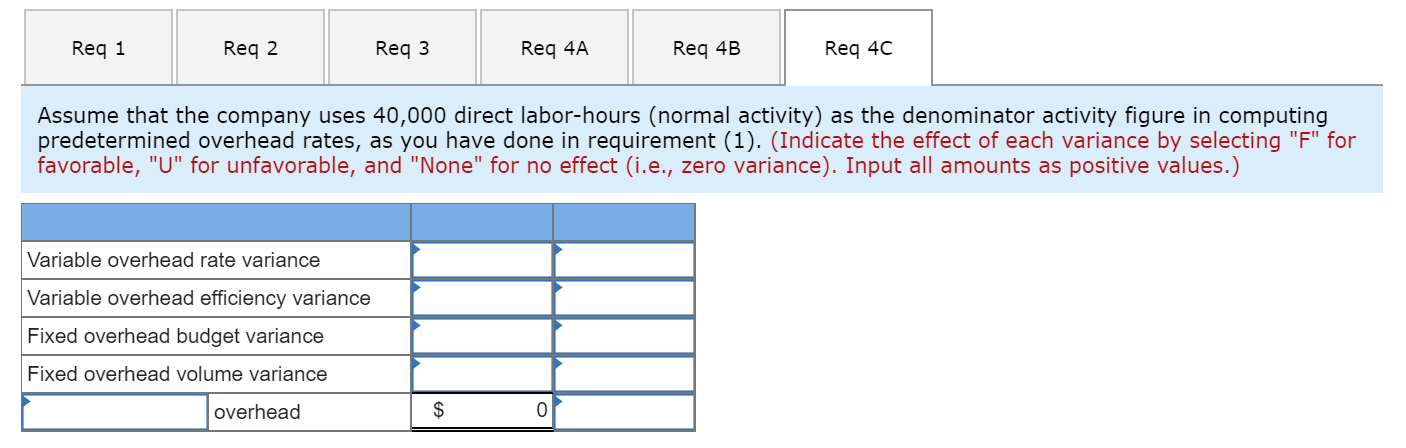

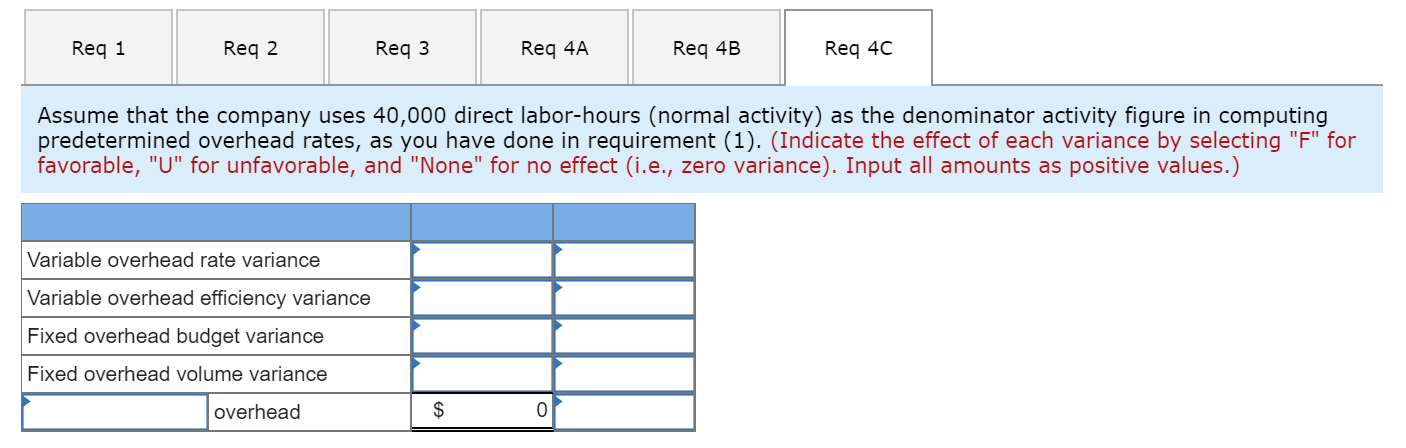

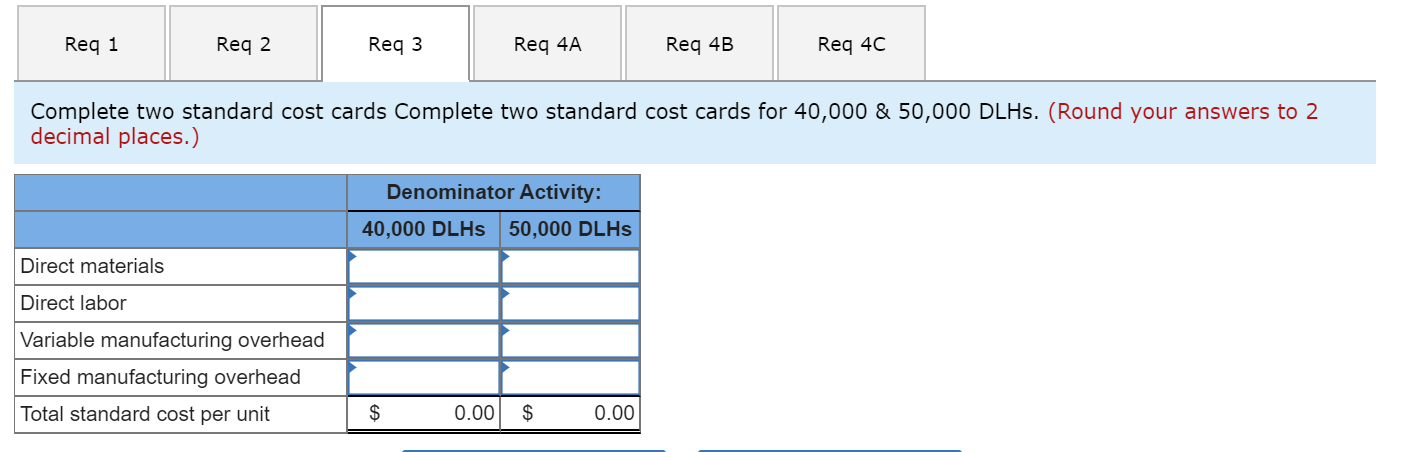

Req 4C

Req 4C

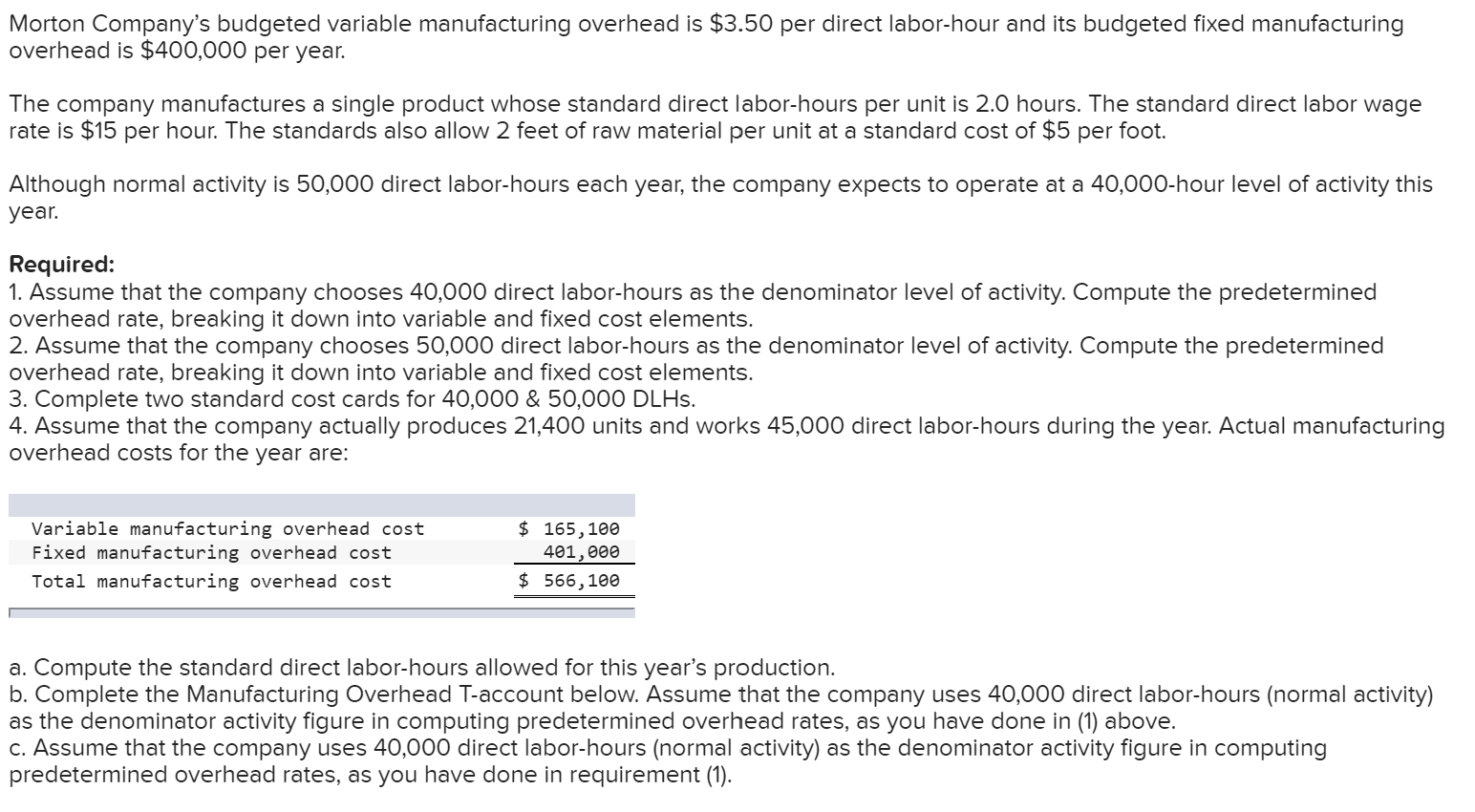

Morton Company's budgeted variable manufacturing overhead is $3.50 per direct labor-hour and its budgeted fixed manufacturing overhead is $400,000 per year. The company manufactures a single product whose standard direct labor-hours per unit is 2.0 hours. The standard direct labor wage rate is $15 per hour. The standards also allow 2 feet of raw material per unit at a standard cost of $5 per foot. Although normal activity is 50,000 direct labor-hours each year, the company expects to operate at a 40,000-hour level of activity this year. Required: 1. Assume that the company chooses 40,000 direct labor-hours as the denominator level of activity. Compute the predetermined overhead rate, breaking it down into variable and fixed cost elements. 2. Assume that the company chooses 50,000 direct labor-hours as the denominator level of activity. Compute the predetermined overhead rate, breaking it down into variable and fixed cost elements. 3. Complete two standard cost cards for 40,000 & 50,000 DLHS. 4. Assume that the company actually produces 21,400 units and works 45,000 direct labor-hours during the year. Actual manufacturing overhead costs for the year are: Variable manufacturing overhead cost Fixed manufacturing overhead cost Total manufacturing overhead cost $ 165,100 401,000 $ 566,100 a. Compute the standard direct labor-hours allowed for this year's production. b. Complete the Manufacturing Overhead T-account below. Assume that the company uses 40,000 direct labor-hours (normal activity) as the denominator activity figure in computing predetermined overhead rates, as you have done in (1) above. C. Assume that the company uses 40,000 direct labor-hours (normal activity) as the denominator activity figure in computing predetermined overhead rates, as you have done in requirement (1). Req 1 Reg 2 Req3 Req 4A Req 4B Req 40 Assume that the company chooses 40,000 direct labor-hours as the denominator level of activity. Compute the predetermined overhead rate, breaking it down into variable and fixed cost elements. (Round your answers to 2 decimal places.) per DLH Predetermined overhead rate Variable element per DLH Fixed element per DLH Req 1 Req 2 Reg 3 Req 4A Req 4B Req 40 Assume that the company chooses 50,000 direct labor-hours as the denominator level of activity. Compute the predetermined overhead rate, breaking it down into variable and fixed cost elements. (Round your answers to 2 decimal places.) like ouinator de cel sofeasticity.comparte este predete Predetermined overhead rate Variable element Fixed element per DLH per DLH per DLH Req 1 Req 2 Req3 Req 3 Req 4A Req 4A Req 48 Reg 40 Complete two standard cost cards Complete two standard cost cards for 40,000 & 50,000 DLHs. (Round your answers to 2 decimal places.) Denominator Activity: 40,000 DLHs 50,000 DLHs Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Total standard cost per unit 0.00 $ 0.00 Req 1 | Req 2 Reqz Req 3 Req3 Req 4A RegaA Req 4B REGAB Req 40 Compute the standard direct labor-hours allowed for this year's production. Standard hours allowed for this year's production Req 1 Reg 2 Req3 Req 4A Req 4B Req 40 Complete the Manufacturing Overhead T-account below. Assume that the company uses 40,000 direct labor-hours (normal activity) as the denominator activity figure in computing predetermined overhead rates, as you have done in requirement (1). Manufacturing Overhead Req 1 Req 2 Req3 Req 4A Req 4B Req 40 Assume that the company uses 40,000 direct labor-hours (normal activity) as the denominator activity figure in computing predetermined overhead rates, as you have done in requirement (1). (Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values.) Variable overhead rate variance Variable overhead efficiency variance Fixed overhead budget variance Fixed overhead volume variance overhead $

Req 1

Req 1 Req 2

Req 2 Req 3

Req 3 Req 4A

Req 4A

Req 4C

Req 4C