Question

QUESTION*** Sensitivity analysis Consider and analyze two additional scenarios (one optimistic scenario and one pessimistic scenario). In each scenario you will need to change the

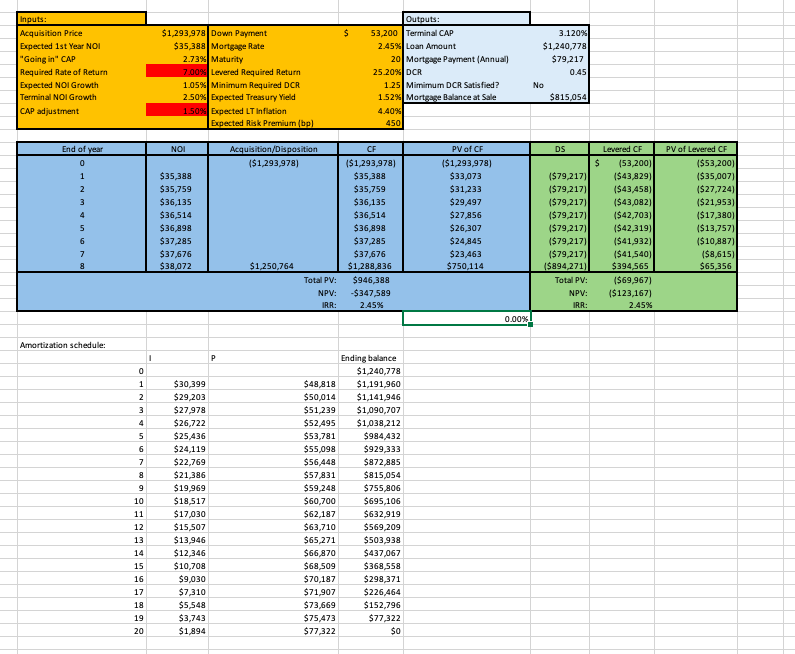

QUESTION*** Sensitivity analysis Consider and analyze two additional scenarios (one optimistic scenario and one pessimistic scenario). In each scenario you will need to change the NOI and/or NOI growth and/or the terminal CAP rate. You will need to articulate the reasons for the possible changes and their magnitude.

Excel sheet included:

Original information: In this report you will consider a hypothetical purchase of a real estate income producing property and evaluate the expected levered-before-tax returns on a property of your choice. Ultimately, you should decide whether committing your capital to the real estate property that you considered is a wise decision. You will be working on this assignment in a group of four to six students. The assignment is due on or before October 17th at 11:55 p.m. EST. By that time you should submit an electronic copy (via email) of your assignment. If you turn your assignment late, 10% will be deducted from your grade for every calendar-day delay. Additionally, during our class period on October 18th, your team will give a 10-minute class presentation (in person or via Zoom), summarizing the findings of the report.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started