Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question: set out the accounting adjustments required to correct the financial statements for Metalwise plc for the year ended 31 December 2020. calculate the current

Question:

set out the accounting adjustments required to correct the financial statements for Metalwise plc for the year ended 31 December 2020.

calculate the current and deferred tax liabilities for Metalwise plc for the year ended 31 December 2020.

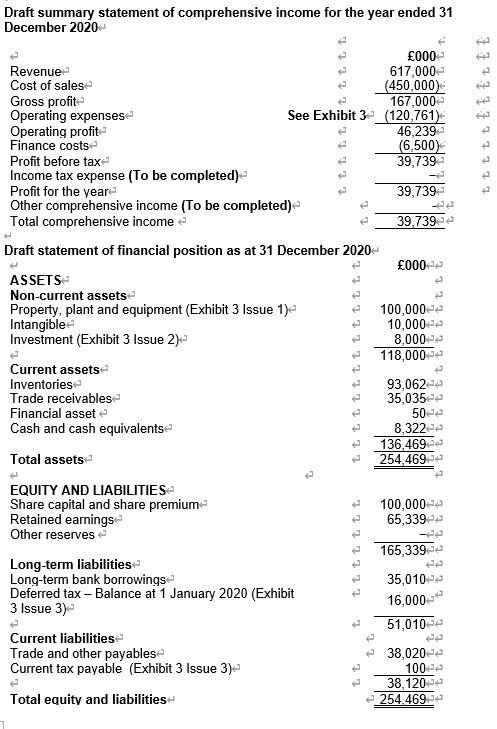

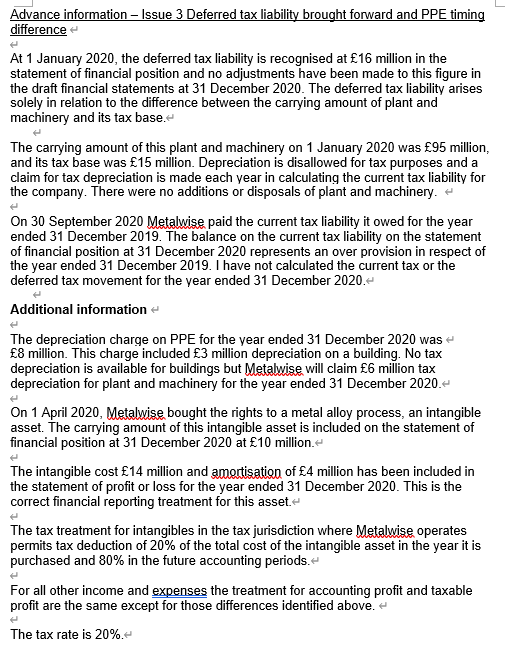

Draft summary statement of comprehensive income for the year ended 31 December 2020- Et ttttt ttttt tt :39.739 000 Revenue 617,000 Cost of sales- (450,000) Gross profit 167,000 Operating expenses See Exhibit 3e_(120,761) Operating profite 46,239 Finance costs (6,500) Profit before tax 39,739 Income tax expense (To be completed) Profit for the year 39,739 Other comprehensive income (To be completed) Total comprehensive income e Draft statement of financial position as at 31 December 2020- 000 ASSETS Non-current assets Property, plant and equipment (Exhibit 3 Issue 1) 100,000- Intangible 10,000 Investment (Exhibit 3 Issue 2) 118,000 Current assets Inventoriese Trade receivables 35,035 Financial assete Cash and cash equivalents 8,322 136,46920 Total assets 254,469 :93,062 tttt 100,000 100,000 q :65,339 - EQUITY AND LIABILITIES Share capital and share premium Retained earnings Other reserves 2 Long-term liabilities Long-term bank borrowingse Deferred tax - Balance at 1 January 2020 (Exhibit 3 Issue 3) ttttttt - 165,339 :35,010 16,000- 51,010 ee Current liabilities Trade and other payables- Current tax payable (Exhibit 3 Issue 3) 38,020 100 100- 38,120- 254.4699 Total equity and liabilities Advance information - Issue 3 Deferred tax liability brought forward and PPE timing difference At 1 January 2020, the deferred tax liability is recognised at 16 million in the statement of financial position and no adjustments have been made to this figure in the draft financial statements at 31 December 2020. The deferred tax liability arises solely in relation to the difference between the carrying amount of plant and machinery and its tax base. The carrying amount of this plant and machinery on 1 January 2020 was 95 million, and its tax base was 15 million. Depreciation is disallowed for tax purposes and a claim for tax depreciation is made each year in calculating the current tax liability for the company. There were no additions or disposals of plant and machinery. On 30 September 2020 Metalwise paid the current tax liability it owed for the year ended 31 December 2019. The balance on the current tax liability on the statement of financial position at 31 December 2020 represents an over provision in respect of the year ended 31 December 2019. I have not calculated the current tax or the deferred tax movement for the year ended 31 December 2020. Additional information The depreciation charge on PPE for the year ended 31 December 2020 was 8 million. This charge included 3 million depreciation on a building. No tax depreciation is available for buildings but Metalwise will claim 6 million tax depreciation for plant and machinery for the year ended 31 December 2020.- On 1 April 2020, Metalwise bought the rights to a metal alloy process, an intangible asset. The carrying amount of this intangible asset is included on the statement of financial position at 31 December 2020 at 10 million The intangible cost 14 million and amortisation of 4 million has been included in the statement of profit or loss for the year ended 31 December 2020. This is the correct financial reporting treatment for this asset. The tax treatment for intangibles in the tax jurisdiction where Metalwise operates permits tax deduction of 20% of the total cost of the intangible asset in the year it is purchased and 80% in the future accounting periods. For all other income and expenses the treatment for accounting profit and taxable profit are the same except for those differences identified above. The tax rate is 20%.- Draft summary statement of comprehensive income for the year ended 31 December 2020- Et ttttt ttttt tt :39.739 000 Revenue 617,000 Cost of sales- (450,000) Gross profit 167,000 Operating expenses See Exhibit 3e_(120,761) Operating profite 46,239 Finance costs (6,500) Profit before tax 39,739 Income tax expense (To be completed) Profit for the year 39,739 Other comprehensive income (To be completed) Total comprehensive income e Draft statement of financial position as at 31 December 2020- 000 ASSETS Non-current assets Property, plant and equipment (Exhibit 3 Issue 1) 100,000- Intangible 10,000 Investment (Exhibit 3 Issue 2) 118,000 Current assets Inventoriese Trade receivables 35,035 Financial assete Cash and cash equivalents 8,322 136,46920 Total assets 254,469 :93,062 tttt 100,000 100,000 q :65,339 - EQUITY AND LIABILITIES Share capital and share premium Retained earnings Other reserves 2 Long-term liabilities Long-term bank borrowingse Deferred tax - Balance at 1 January 2020 (Exhibit 3 Issue 3) ttttttt - 165,339 :35,010 16,000- 51,010 ee Current liabilities Trade and other payables- Current tax payable (Exhibit 3 Issue 3) 38,020 100 100- 38,120- 254.4699 Total equity and liabilities Advance information - Issue 3 Deferred tax liability brought forward and PPE timing difference At 1 January 2020, the deferred tax liability is recognised at 16 million in the statement of financial position and no adjustments have been made to this figure in the draft financial statements at 31 December 2020. The deferred tax liability arises solely in relation to the difference between the carrying amount of plant and machinery and its tax base. The carrying amount of this plant and machinery on 1 January 2020 was 95 million, and its tax base was 15 million. Depreciation is disallowed for tax purposes and a claim for tax depreciation is made each year in calculating the current tax liability for the company. There were no additions or disposals of plant and machinery. On 30 September 2020 Metalwise paid the current tax liability it owed for the year ended 31 December 2019. The balance on the current tax liability on the statement of financial position at 31 December 2020 represents an over provision in respect of the year ended 31 December 2019. I have not calculated the current tax or the deferred tax movement for the year ended 31 December 2020. Additional information The depreciation charge on PPE for the year ended 31 December 2020 was 8 million. This charge included 3 million depreciation on a building. No tax depreciation is available for buildings but Metalwise will claim 6 million tax depreciation for plant and machinery for the year ended 31 December 2020.- On 1 April 2020, Metalwise bought the rights to a metal alloy process, an intangible asset. The carrying amount of this intangible asset is included on the statement of financial position at 31 December 2020 at 10 million The intangible cost 14 million and amortisation of 4 million has been included in the statement of profit or loss for the year ended 31 December 2020. This is the correct financial reporting treatment for this asset. The tax treatment for intangibles in the tax jurisdiction where Metalwise operates permits tax deduction of 20% of the total cost of the intangible asset in the year it is purchased and 80% in the future accounting periods. For all other income and expenses the treatment for accounting profit and taxable profit are the same except for those differences identified above. The tax rate is 20%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started