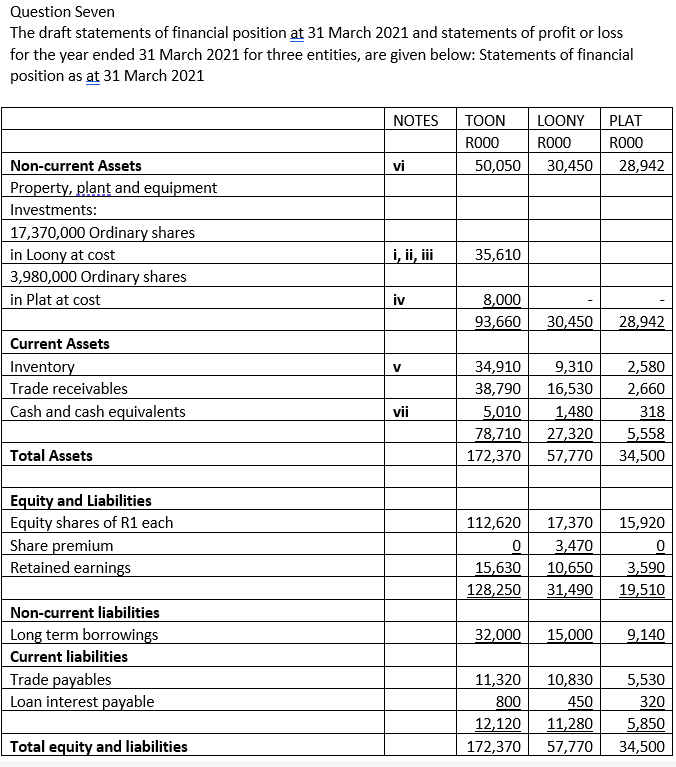

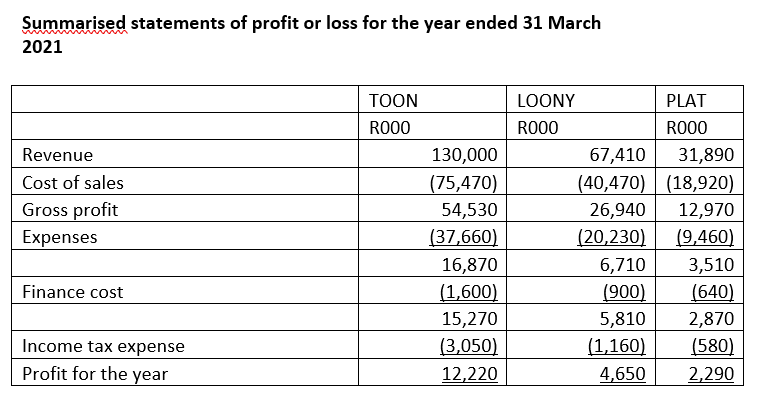

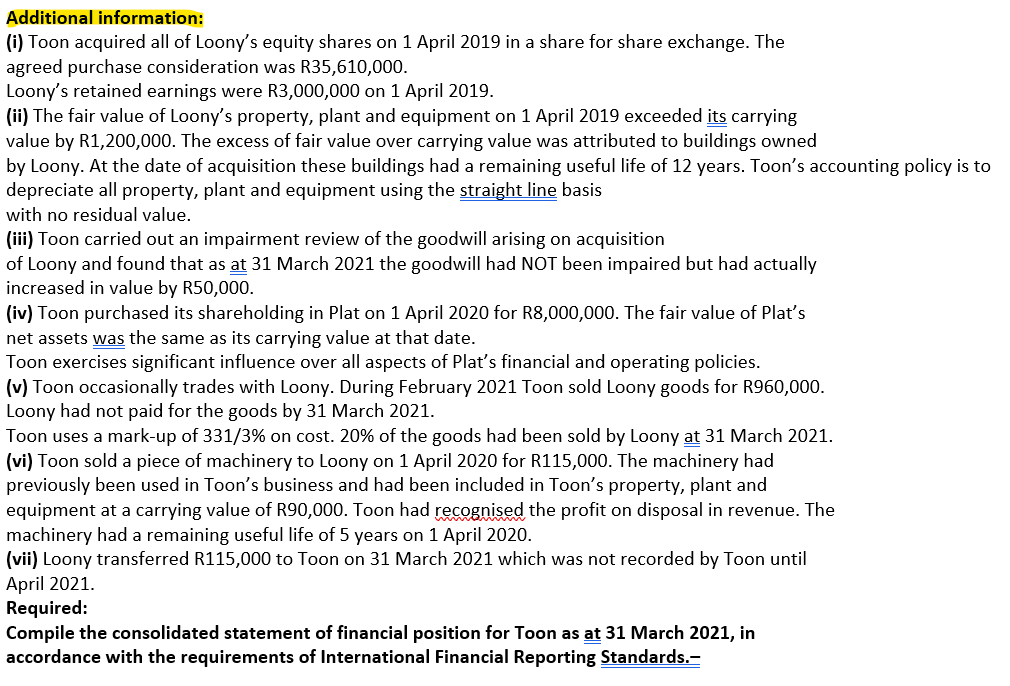

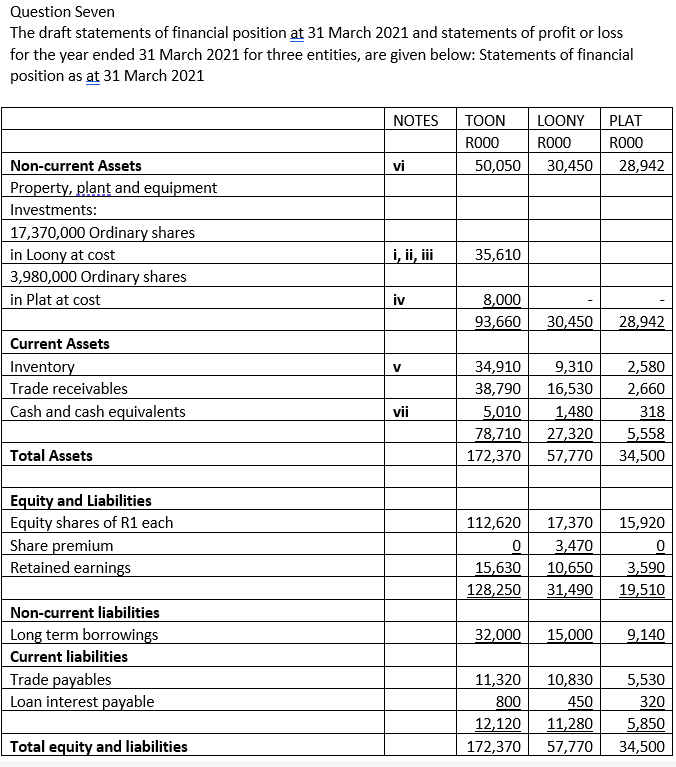

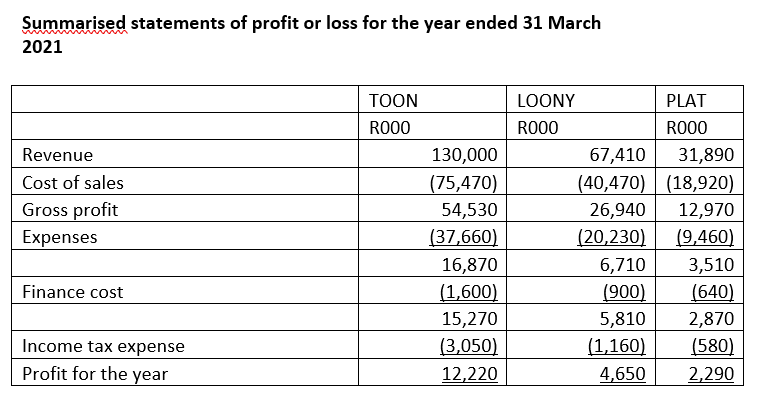

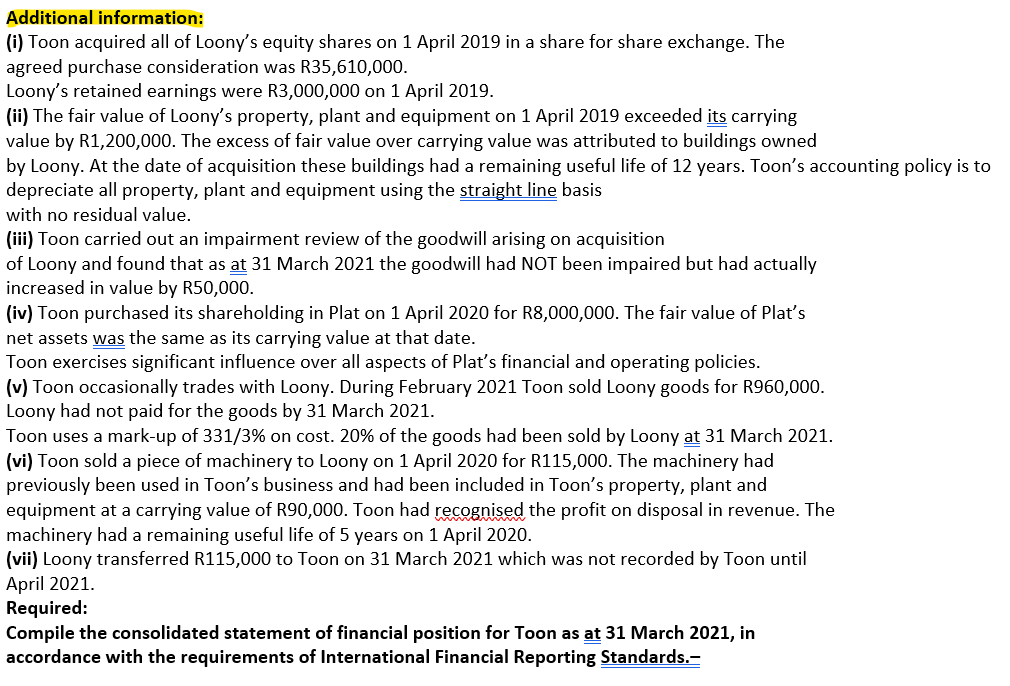

Question Seven The draft statements of financial position at 31 March 2021 and statements of profit or loss for the year ended 31 March 2021 for three entities, are given below: Statements of financial Summarised statements of profit or loss for the year ended 31 March 2021 Additional information: (i) Toon acquired all of Loony's equity shares on 1 April 2019 in a share for share exchange. The agreed purchase consideration was R35,610,000. Loony's retained earnings were R3,000,000 on 1 April 2019. (ii) The fair value of Loony's property, plant and equipment on 1 April 2019 exceeded its carrying value by R1,200,000. The excess of fair value over carrying value was attributed to buildings owned by Loony. At the date of acquisition these buildings had a remaining useful life of 12 years. Toon's accounting policy is depreciate all property, plant and equipment using the straight line basis with no residual value. (iii) Toon carried out an impairment review of the goodwill arising on acquisition of Loony and found that as at 31 March 2021 the goodwill had NOT been impaired but had actually increased in value by R50,000. (iv) Toon purchased its shareholding in Plat on 1 April 2020 for R8,000,000. The fair value of Plat's net assets was the same as its carrying value at that date. Toon exercises significant influence over all aspects of Plat's financial and operating policies. (v) Toon occasionally trades with Loony. During February 2021 Toon sold Loony goods for R960,000. Loony had not paid for the goods by 31 March 2021. Toon uses a mark-up of 331/3\% on cost. 20% of the goods had been sold by Loony at 31 March 2021. (vi) Toon sold a piece of machinery to Loony on 1 April 2020 for R115,000. The machinery had previously been used in Toon's business and had been included in Toon's property, plant and equipment at a carrying value of R90,000. Toon had recognised the profit on disposal in revenue. The machinery had a remaining useful life of 5 years on 1 April 2020. (vii) Loony transferred R115,000 to Toon on 31 March 2021 which was not recorded by Toon until April 2021. Required: Compile the consolidated statement of financial position for Toon as at 31 March 2021, in Question Seven The draft statements of financial position at 31 March 2021 and statements of profit or loss for the year ended 31 March 2021 for three entities, are given below: Statements of financial Summarised statements of profit or loss for the year ended 31 March 2021 Additional information: (i) Toon acquired all of Loony's equity shares on 1 April 2019 in a share for share exchange. The agreed purchase consideration was R35,610,000. Loony's retained earnings were R3,000,000 on 1 April 2019. (ii) The fair value of Loony's property, plant and equipment on 1 April 2019 exceeded its carrying value by R1,200,000. The excess of fair value over carrying value was attributed to buildings owned by Loony. At the date of acquisition these buildings had a remaining useful life of 12 years. Toon's accounting policy is depreciate all property, plant and equipment using the straight line basis with no residual value. (iii) Toon carried out an impairment review of the goodwill arising on acquisition of Loony and found that as at 31 March 2021 the goodwill had NOT been impaired but had actually increased in value by R50,000. (iv) Toon purchased its shareholding in Plat on 1 April 2020 for R8,000,000. The fair value of Plat's net assets was the same as its carrying value at that date. Toon exercises significant influence over all aspects of Plat's financial and operating policies. (v) Toon occasionally trades with Loony. During February 2021 Toon sold Loony goods for R960,000. Loony had not paid for the goods by 31 March 2021. Toon uses a mark-up of 331/3\% on cost. 20% of the goods had been sold by Loony at 31 March 2021. (vi) Toon sold a piece of machinery to Loony on 1 April 2020 for R115,000. The machinery had previously been used in Toon's business and had been included in Toon's property, plant and equipment at a carrying value of R90,000. Toon had recognised the profit on disposal in revenue. The machinery had a remaining useful life of 5 years on 1 April 2020. (vii) Loony transferred R115,000 to Toon on 31 March 2021 which was not recorded by Toon until April 2021. Required: Compile the consolidated statement of financial position for Toon as at 31 March 2021, in