Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question Seven VEG is an entity that started trading in January 2021 manufacturing and selling vegetable smoothie drinks. The entity uses innovative technology that

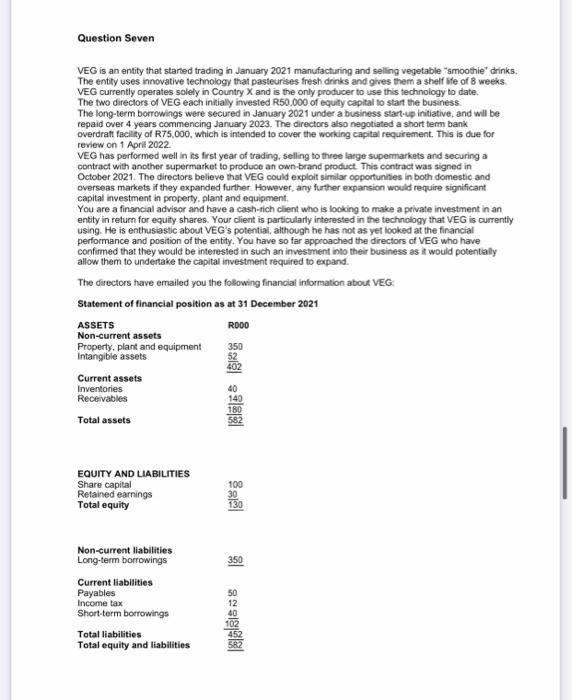

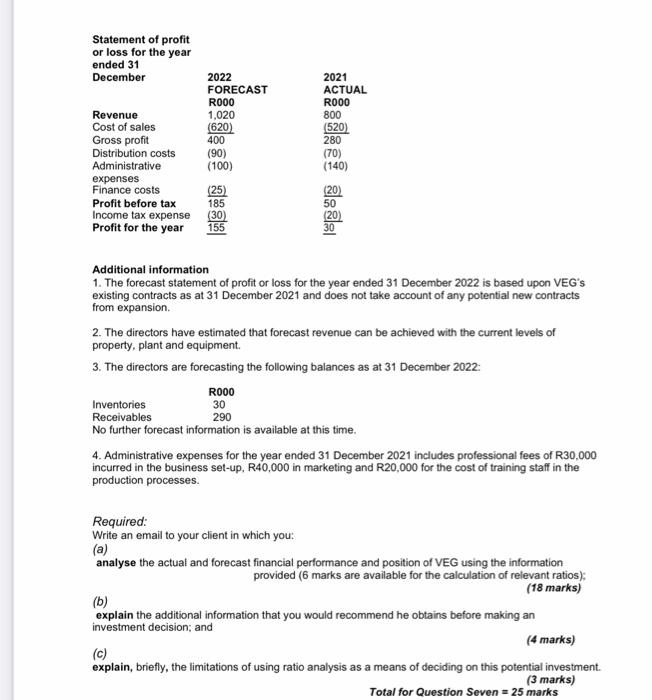

Question Seven VEG is an entity that started trading in January 2021 manufacturing and selling vegetable "smoothie" drinks. The entity uses innovative technology that pasteurises fresh drinks and gives them a shelf life of 8 weeks VEG currently operates solely in Country X and is the only producer to use this technology to date. The two directors of VEG each initially invested R50,000 of equity capital to start the business. The long-term borrowings were secured in January 2021 under a business start-up initiative, and will be repaid over 4 years commencing January 2023. The directors also negotiated a short term bank overdraft facility of R75,000, which is intended to cover the working capital requirement. This is due for review on 1 April 2022. VEG has performed well in its first year of trading, selling to three large supermarkets and securing a contract with another supermarket to produce an own-brand product. This contract was signed in October 2021. The directors believe that VEG could exploit similar opportunities in both domestic and overseas markets if they expanded further. However, any further expansion would require significant capital investment in property, plant and equipment. You are a financial advisor and have a cash-rich client who is looking to make a private investment in an entity in return for equity shares. Your client is particularly interested in the technology that VEG is currently using. He is enthusiastic about VEG's potential, although he has not as yet looked at the financial performance and position of the entity. You have so far approached the directors of VEG who have confirmed that they would be interested in such an investment into their business as it would potentially allow them to undertake the capital investment required to expand. The directors have emailed you the following financial information about VEG: Statement of financial position as at 31 December 2021 ASSETS R000 Non-current assets Property, plant and equipment 350 Intangible assets 52 402 Current assets Inventories 40 Receivables 140 180 Total assets EQUITY AND LIABILITIES Share capital Retained earnings Total equity Non-current liabilities. Long-term borrowings Current liabilities Payables Income tax Short-term borrowings Total liabilities Total equity and liabilities 100 30 130 350 12 sglas

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started