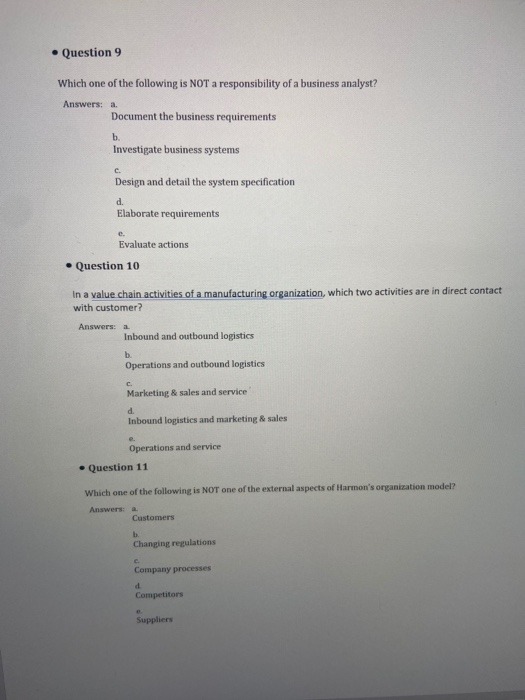

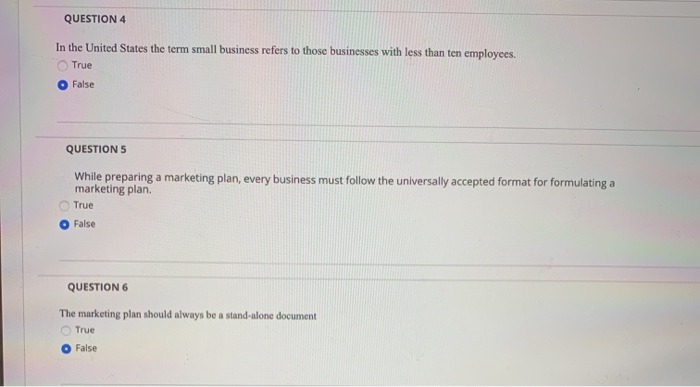

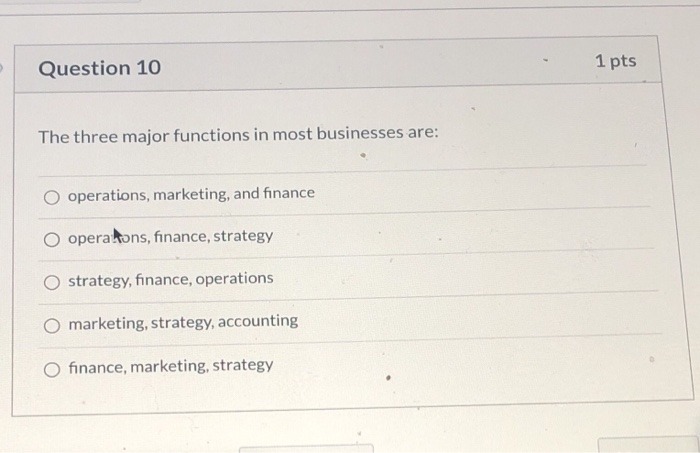

Question

Question: Show solution and explanation 1. Which statement is incorrect regarding property, plant and equipment (PPE)? a. PPE are tangible items that are held for

Question:

Show solution and explanation

1. Which statement is incorrect regarding property, plant

and equipment (PPE)?

a. PPE are tangible items that are held for use in the

production or supply of goods or services, for

rental to others, or for administrative purposes;

and are expected to be used during more than one

period.

b. The cost of an item of PPE shall be recognized as

an asset if, and only if, it is probable that future

economic benefits associated with the item will

flow to the entity and the cost of the item can be

measured reliably.

c. An item of PPE should be measured on initial

recognition at its cost.

d. PPE are presented in the statement of financial

position either as current or noncurrent.

2. Which of the following will be most likely included in

the line item property, plant and equipment in an

entity's statement of financial position?

a. Bearer animals

b. Land held for sale in the ordinary course of

business

c. Land and building for rental to others

d. Equipment for rental to others

3. Which of the following will be least likely included in

the line item property, plant and equipment in an

entity's statement of financial position?

a. Spare parts, stand-by equipment and servicing

equipment

b. Equipment acquired for safety or environmental

reasons

c. Moulds, tools and dies

d. Production supplies

4. The following information pertains to Queen

Corporation's property, plant and equipment:

Carrying amount, beginning P5,000,000

Acquisitions 1,800,000

Capitalized subsequent expenditures 500,000

Repairs and maintenance 160,000

Reclassifications to 380,000

Reclassifications from 410,000

Disposals/retirements 1,240,000

Depreciation 630,000

Impairment 290,000

The carrying amount of Queen's property, plant and

equipment at the end of the period is

a. P5,110,000 c. P5,170,000

b. P5,140,000 d. P5,270,000

5. The cost of an item of property, plant and equipment

comprises:

I. Its purchase price, including import duties and

non-refundable purchase taxes, after deducting

trade discounts and rebates.

II. Any costs directly attributable to bringing the asset

to the location and condition necessary for it to be

capable of operating in the manner intended by

management.

III. The initial estimate of the costs of dismantling and

removing the item and restoring the site on which

it is located, the obligation for which an entity

incurs either when the item is acquired or as a

consequence of having used the item during a

particular period for purposes other than to

produce inventories during that period.

a. I, II, and III c. I and III only

b. I and II only d. I only

6. Costs directly attributable to bringing the asset to the

location and condition necessary for it to be capable of

operating in the manner intended by management

exclude

a. Costs of employee benefits arising directly from

the construction or acquisition of the item of

property, plant and equipment.

b. Costs of site preparation.

c. Initial delivery and handling costs

d. Administration and other general overhead costs.

7. Costs directly attributable to bringing the asset to the

location and condition necessary for it to be capable of

operating in the manner intended by management

exclude

a. Installation and assembly costs.

b. Costs of testing whether the asset is functioning

properly.

c. Professional fees.

d. Costs of opening a new facility.

8. The cost of an item of property, plant and equipment

may include

a. Costs of introducing a new product or service.

b. Costs of advertising and promotional activities.

c. Costs of conducting business in a new location or

with a new class of customer.

d. Costs incurred relating to leases of assets that are

used to construct an item of property, plant and

equipment, such as depreciation of right-of-use

assets.

9. Extra Corporation is installing a new machine at its

production facility. It has incurred these costs:

Purchase price (including input tax of

P300,000)

P2,800,000

Initial delivery and handling costs 200,000

Costs of site preparation 600,000

Consultants used for advice on the

acquisition of the machine

700,000

Installation and assembly costs 500,000

Costs of testing 100,000

Costs of training employees on how to

use the machine

80,000

Estimated dismantling costs to be

incurred after 7 years

300,000

Operating losses before commercial

production

400,000

The cost of the machine is

a. P5,200,000 c. P4,900,000

b. P4,980,000 d. P4,200,000

10. Seller Co. sold a used asset to Buyer Co. for P800,000,

accepting a five-year 6% note for the entire amount.

Buyer's incremental borrowing rate was 14%. The

annual payment of principal and interest on the note

was to be P189,930. The asset could have been sold

at an established cash price of P651,460. The present

value of an ordinary annuity of P1 at 8% for five

periods is 3.99. The asset should be capitalized on

buyer's books at

a. P949,650 c. P757,820

b. P800,000 d. P651,460

11. Imus Company acquired two items of machinery as

follows:

? On January 1, 2020, Imus Company acquired used

machinery by issuing to the seller a three-year,

12% interest note for P3,000,000.

? On December 30, 2020, Imus Company purchased

a machine in exchange for a noninterest bearing

note requiring three payments of P1,000,000. The

first payment was made on December 30, 2020,

and the others are due annually on December 30.

The prevailing rate of interest for this type of note

at date of issuance was 12%. The present value of

an ordinary annuity of 1 at 12% is 1.69 for two

periods and 2.40 for three periods.

What is the total cost of the machinery?

a. P4,820,000 c. P5,690,000

b. P5,400,000 d. P6,000,000

12. Cavite Company acquired land and building by issuing

60,000, P100 par value, ordinary shares. On the date

of acquisition, the shares had a fair value of P150 per

share and the land and building had fair value of

P2,000,000 and P6,000,000 respectively.

During the year, Cavite also received land from a

shareholder to facilitate the construction of a plant in

the city. Cavite paid P100,000 for the land transfer.

The land's fair value is P1,500,000.

As a result of these acquisitions, Cavite Company's

equity had a net increase of

a. P10,500,000 c. P9,400,000

b. P 9,500,000 d. P7,400,000

Use the following information for the next two questions.

Company A had a machine with a carrying amount of

P450,000. Company B had a delivery vehicle with a

carrying amount of P300,000. Companies A and B

exchanged the machine and vehicle, and Company B paid

an additional P90,000 cash as part of the exchange.

Assume that the fair value of the delivery vehicle is

P420,000. The exchange has commercial substance.

13. How much gain or loss should be recorded by

Company A?

a. P30,000 loss c. P120,000 loss

b. P60,000 gain d. P120,000 gain

14. How much gain or loss should be recorded by

Company B?

a. P30,000 loss c. P120,000 loss

b. P60,000 gain d. P120,000 gain

Use the following information for the next two questions.

Payor Inc. and Recipient Co. have an exchange with no

commercial substance. The asset given up by Payor Inc.

has a book value of P12,000 and a fair value of P15,000.

The asset given up by Recipient Co. has a book value of

P20,000 and a fair value of P19,000. Boot of P4,000 is

received by Recipient Co.

15. Payor Inc. should record the asset received at

a. P15,000 c. P19,000

b. P16,000 d. P20,000

16. Recipient Co. should record the asset received at

a. P15,000 c. P19,000

b. P16,000 d. P20,000

Use the following information for the next two questions.

A used delivery truck was traded in for a new truck.

Information relating to the trucks follows:

Used truck:

Cost P1,600,000

Accumulated depreciation 1,200,000

New truck:

List price 1,950,000

Cash price without trade-in 1,900,000

Cash price with trade-in 1,560,000

17. If the fair value of the used truck is P320,000, the cost

of the new truck is

a. P1,960,000 c. P1,880,000

b. P1,900,000 d. P1,560,000

18. If the fair value of the old truck is not determinable,

the loss on trade-in is

a. P350,000 c. P10,000

b. P 60,000 d. Nil

question

Read case on Page 624, Answer these questions. 1. What specific type of wholesaler is Joe? 2. Evaluate Joe's marketing strategy for his current lumber business and be sure to mention the components. 10 pts 3. Contrast the components of the marketing strategy for the arbor products wth his current lumber business. 10 pts 4. What should he do now- which option should he take, Be sure to give a justification for the specific recommendation?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started