Question

Question six: (10 marks) The following is the card goods for Pablo Company for November 2017: data Balance 4 8 13 21 29 # units

Question six:

(10 marks)

The following is the card goods for Pablo Company for November 2017:

data

Balance

4

8

13

21 29

# units

purchased

600

1500 800

1200

700 500

Unit cost data

6

6.08 6.4

6.5

6.5 6.79

3 9

11

23

27

sold

500 @ $10

1300 @ 10

500 @11

1200@11

900 @ 12

Assuming the company used periodic inventory system under weighted average flow cost method.

Required:

1) Calculate the ending inventory.

2) If the company uses the cost method to record the net realizable value and the beginning balance was 300 credit with net realizable value for this year for ending inventory $4700, recorded the required entries. 3) If the company uses the lose method to record the net realizable value and the beginning balance was$ 400 debit with net realizable value for this year for ending inventory S5000, recorded the required entries.

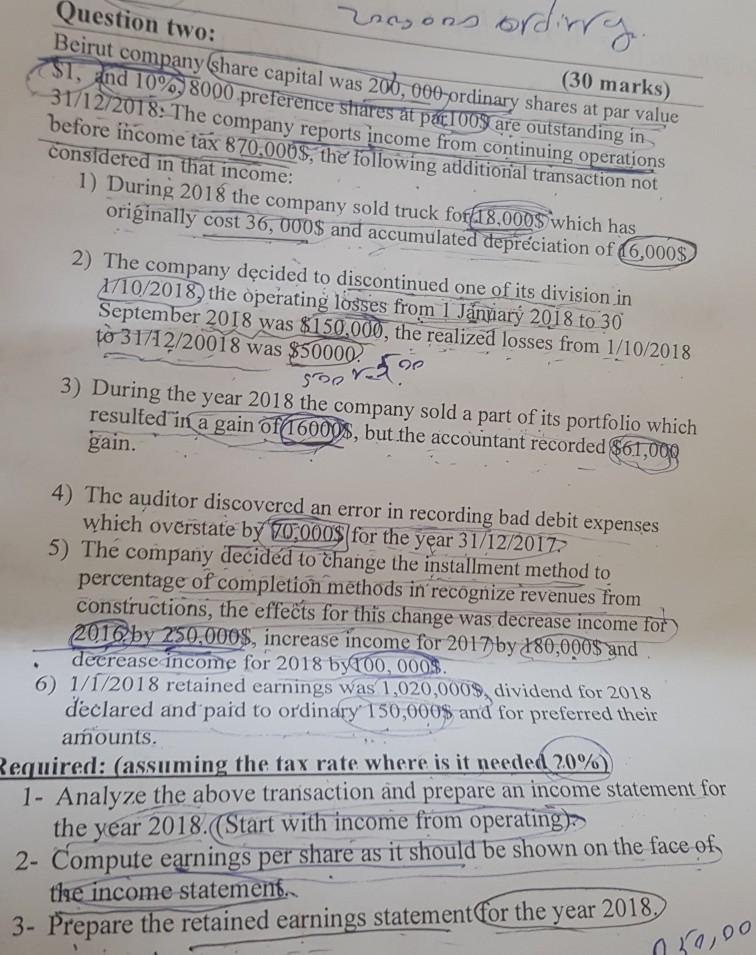

ordinry. Question two: (30 marks) Beirut company share capital was 200, 000-ordinary shares at par value $1, and 10%, 8000 preference shares at pac100% are outstanding in 31/12/2018: The company reports income from continuing operations before income tax 870.000$, the following additional transaction not considered in that income: 1) During 2018 the company sold truck for 18,000$ which has originally cost 36, 000$ and accumulated depreciation of 16,000$ 2) The company decided to discontinued one of its division in 1/10/2018, the operating losses from 1 Janary 2018 to 30 September 2018 was $150,000, the realized losses from 1/10/2018 to 31/12/20018 was $50000. Son 3) During the year 2018 the company sold a part of its portfolio which resulted in a gain of 16000$, but the accountant recorded $61,000 gain. 4) The auditor discovered an error in recording bad debit expenses which overstate by 70.000$ for the year 31/12/2017 5) The company decided to change the installment method to percentage of completion methods in recognize revenues from constructions, the effects for this change was decrease income for 2010 by 250,000$, increase income for 2017 by 80,000$ and decrease income for 2018 by 100, 000$. 6) 1/1/2018 retained earnings was 1,020,000$, dividend for 2018 declared and paid to ordinary 150,000$ and for preferred their amounts. Required: (assuming the tax rate where is it needed 20%) 1- Analyze the above transaction and prepare an income statement for the year 2018.(Start with income from operating) 2- Compute earnings per share as it should be shown on the face of the income statement. 3- Prepare the retained earnings statement for the year 2018. no,oo ordinry. Question two: (30 marks) Beirut company share capital was 200, 000-ordinary shares at par value $1, and 10%, 8000 preference shares at pac100% are outstanding in 31/12/2018: The company reports income from continuing operations before income tax 870.000$, the following additional transaction not considered in that income: 1) During 2018 the company sold truck for 18,000$ which has originally cost 36, 000$ and accumulated depreciation of 16,000$ 2) The company decided to discontinued one of its division in 1/10/2018, the operating losses from 1 Janary 2018 to 30 September 2018 was $150,000, the realized losses from 1/10/2018 to 31/12/20018 was $50000. Son 3) During the year 2018 the company sold a part of its portfolio which resulted in a gain of 16000$, but the accountant recorded $61,000 gain. 4) The auditor discovered an error in recording bad debit expenses which overstate by 70.000$ for the year 31/12/2017 5) The company decided to change the installment method to percentage of completion methods in recognize revenues from constructions, the effects for this change was decrease income for 2010 by 250,000$, increase income for 2017 by 80,000$ and decrease income for 2018 by 100, 000$. 6) 1/1/2018 retained earnings was 1,020,000$, dividend for 2018 declared and paid to ordinary 150,000$ and for preferred their amounts. Required: (assuming the tax rate where is it needed 20%) 1- Analyze the above transaction and prepare an income statement for the year 2018.(Start with income from operating) 2- Compute earnings per share as it should be shown on the face of the income statement. 3- Prepare the retained earnings statement for the year 2018. no,ooStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started