Answered step by step

Verified Expert Solution

Question

1 Approved Answer

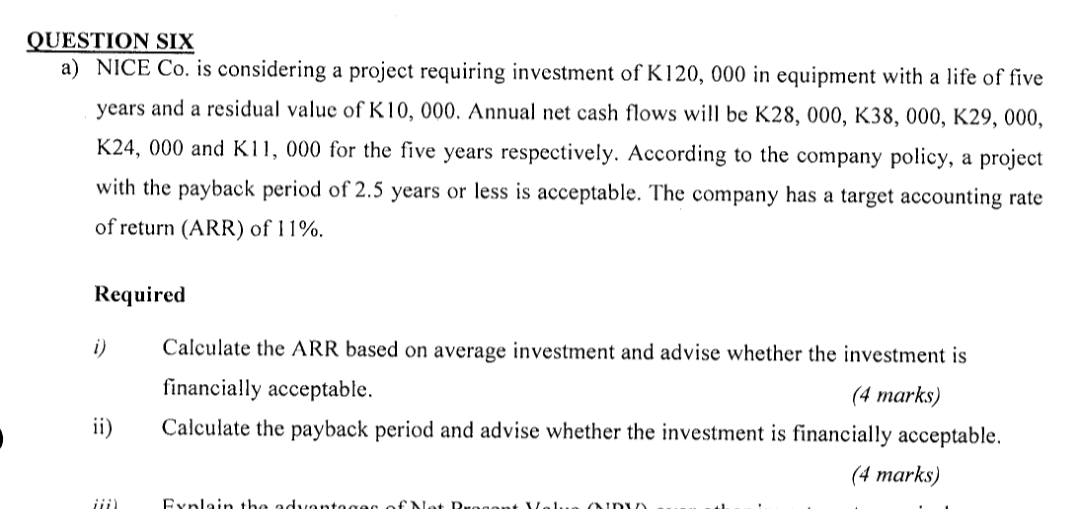

QUESTION SIX a) NICE Co. is considering a project requiring investment of K120,000 in equipment with a life of five years and a residual value

QUESTION SIX a) NICE Co. is considering a project requiring investment of K120,000 in equipment with a life of five years and a residual value of K10,000. Annual net cash flows will be K28, 000, K38,000, K29,000, K24, 000 and KII, 000 for the five years respectively. According to the company policy, a project with the payback period of 2.5 years or less is acceptable. The company has a target accounting rate of return (ARR) of 11%. Required i) Calculate the ARR based on average investment and advise whether the investment is financially acceptable. (4 marks) Calculate the payback period and advise whether the investment is financially acceptable. (4 marks) ii) Fynlain the advantage of + Yll NIDI

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started