Answered step by step

Verified Expert Solution

Question

1 Approved Answer

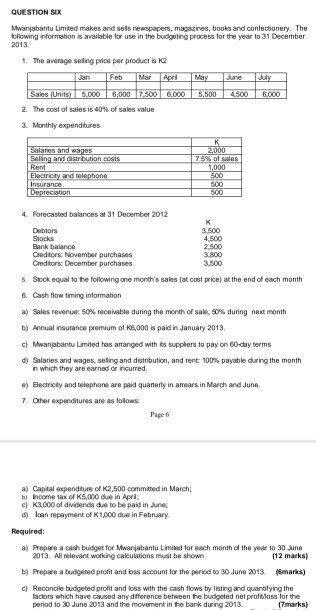

QUESTION SIX Mwanjabant Limited makes and sells newspapers, magazines, books and confectionery. The following information is available for use in the budgeting process for the

QUESTION SIX Mwanjabant Limited makes and sells newspapers, magazines, books and confectionery. The following information is available for use in the budgeting process for the year to 31 December 2013 1. The average selling price per product is Jan Feb Apri May June July Sales (Units) 5,000 6,000 7.500 6.000 5,500 4500 6.000 2. The cost of sales is 40% of sales value 3. Monthly expenditures Salaries and wages Selling and distribution costs Rent Electricity and telephone Insurance Depreciation K 2,000 7.5% of sales 1,000 500 500 500 4. Forecasted balances at 31 December 2012 K Debtors 3.500 Stocks 4.500 Bank balance 2.500 Creditors: November purchases 3.800 Creditors: December purchases 3.500 5. Stock equal to the following one month's sales (at cost price) at the end of each month 6. Cash flow timing information a) Sales revenue: 50% receivable during the month of sale, 50% during next month b) Annual insurance premium of 5,000 is paid in January 2013 C) Mwanjabant Limited has arranged with its suppliers to pay on 60-day terms d) Salaries and wages, seling and distribution, and rent 100% payable during the month in which they are earned or incurred. .) Electricity and telephone are paid quarterly in amears in March and June. 7. Other expenditures are as follows: Page 6 a) Capital expenditure of 2,500 committed in March: b Income tax of K5,000 due in April C) K3.000 of dividends due to be paid inne loan repayment of 1,000 due in February Required: a) Prepare a cash budget for Mwanjabant Limited for each month of the year to 30 June 2013. All relevant working calculations must be shown (12 marks) b) Prepare a budgeted profit and loss account for the period to 30 June 2013 (marks) c) Reconcile budgeted profit and loss with the cash flows by listing and quantifying the factors which have caused any difference between the budgeted net prottloss for the period to 30 June 2013 and the movement in the bank during 2013 [7marks) QUESTION SIX Mwanjabant Limited makes and sells newspapers, magazines, books and confectionery. The following information is available for use in the budgeting process for the year to 31 December 2013 1. The average selling price per product is Jan Feb Apri May June July Sales (Units) 5,000 6,000 7.500 6.000 5,500 4500 6.000 2. The cost of sales is 40% of sales value 3. Monthly expenditures Salaries and wages Selling and distribution costs Rent Electricity and telephone Insurance Depreciation K 2,000 7.5% of sales 1,000 500 500 500 4. Forecasted balances at 31 December 2012 K Debtors 3.500 Stocks 4.500 Bank balance 2.500 Creditors: November purchases 3.800 Creditors: December purchases 3.500 5. Stock equal to the following one month's sales (at cost price) at the end of each month 6. Cash flow timing information a) Sales revenue: 50% receivable during the month of sale, 50% during next month b) Annual insurance premium of 5,000 is paid in January 2013 C) Mwanjabant Limited has arranged with its suppliers to pay on 60-day terms d) Salaries and wages, seling and distribution, and rent 100% payable during the month in which they are earned or incurred. .) Electricity and telephone are paid quarterly in amears in March and June. 7. Other expenditures are as follows: Page 6 a) Capital expenditure of 2,500 committed in March: b Income tax of K5,000 due in April C) K3.000 of dividends due to be paid inne loan repayment of 1,000 due in February Required: a) Prepare a cash budget for Mwanjabant Limited for each month of the year to 30 June 2013. All relevant working calculations must be shown (12 marks) b) Prepare a budgeted profit and loss account for the period to 30 June 2013 (marks) c) Reconcile budgeted profit and loss with the cash flows by listing and quantifying the factors which have caused any difference between the budgeted net prottloss for the period to 30 June 2013 and the movement in the bank during 2013 [7marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started