Question:

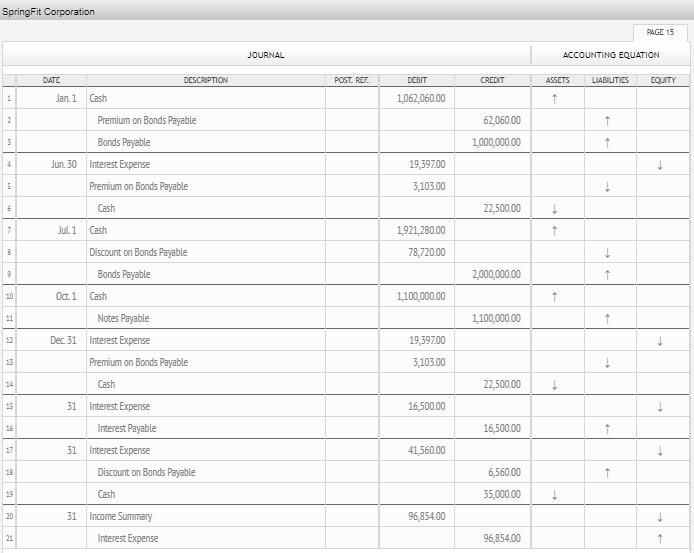

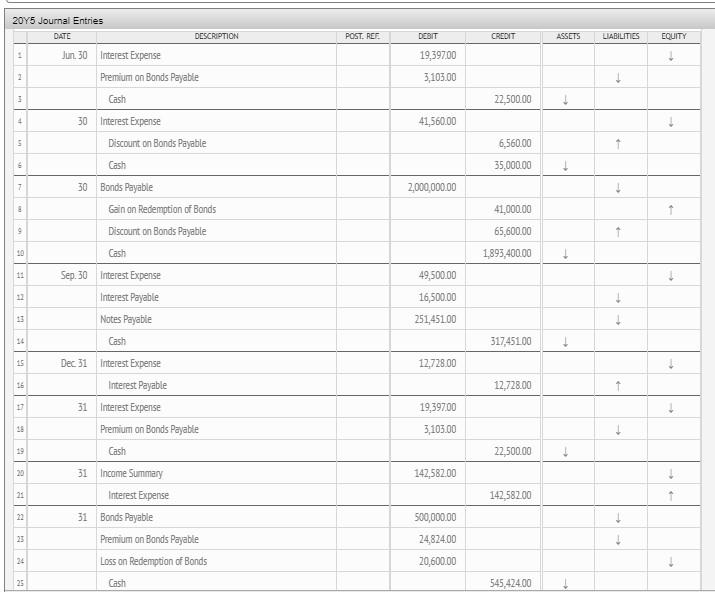

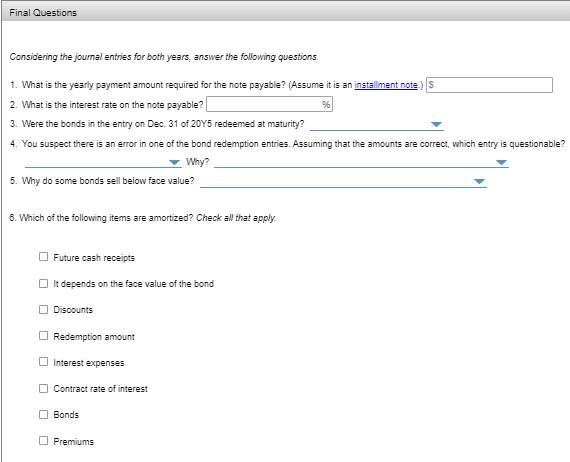

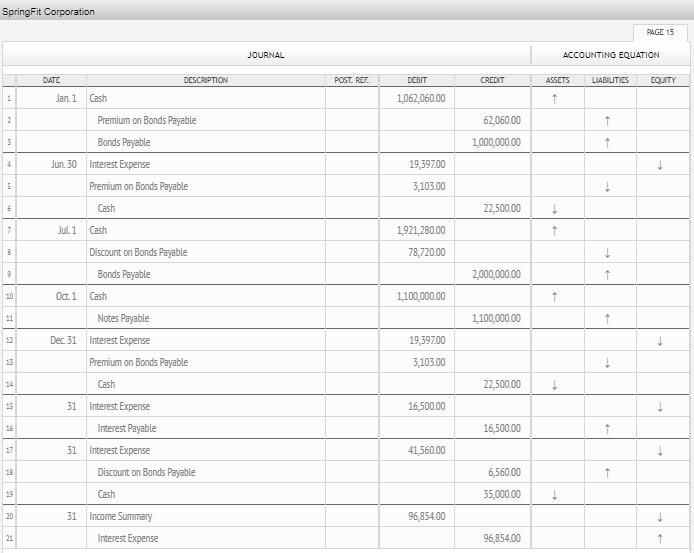

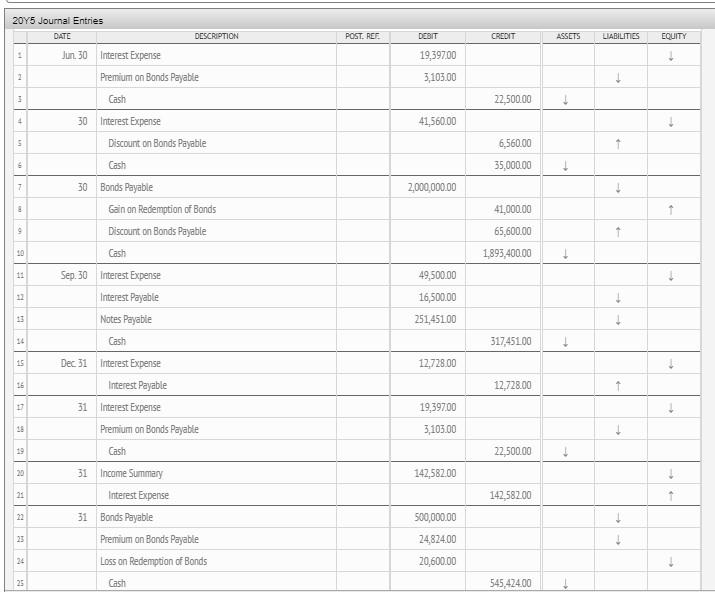

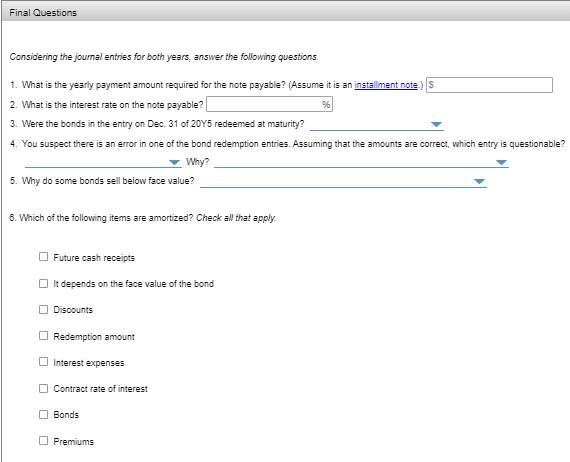

SpringFit Corporation PAGE 15 JOURNAL ACCOUNTING EQUATION DATE DESCRIPTION POST. RET CREDIT LIABILITIES EQUITY DEBIT 1,062,060.00 ASSETS 1 . Jan 1 Cash 2 1 62,060.00 1,000,000.00 3 Premium on Bonds Payable Bonds Payable Jun 30 interest Expense Premium on Bonds Payable 4 19,397.00 5 3,103.00 Cash 22,500.00 7 JUL 1 Cash 1921,280.00 78,720.00 3 9 2,000,000.00 9 10 1,100,000.00 1 11 1.100,000.00 13 19.397.00 3,103.00 Discount on Bonds Payable Bonds Payable Oct 1 Cash Notes Payable Dec 31 interest Expense Premium on Bonds Payable Cash 31 Interest Expense Interest Payable 31 interest Expense Discount on Bands Payable Cash 14 22,500.00 15 16,500.00 16,500.00 17 41,560.00 18 6,560.00 35,000.00 10 + 20 31 Income Summary 96,854.00 21 Interest Expense 96,854.00 POST. REF DEBIT CREDIT ASSETS LIABILITIES EQUITY 20Y5 Journal Entries DATE DESCRIPTION . Jun 30 Interest Expense 2 Premium on Bonds Payable 19,397.00 3,103.00 3 Cash 22,500.00 4 41,560.00 5 1 6,560.00 35,000.00 + 7 2,000,000.00 3 41,000.00 1 9 1 . 10 65,600.00 1,893,400.00 11 12 49,500.00 16,500.00 251,451.00 1 13 30 Interest Expense Discount on Bonds Payable Cash 30 Bonds Payable Gain on Redemption of Bands Discount on Bonds Payable Cash Sep 30 Interest Expense Interest Payable Notes Payable Cash Dec 31 Interest Expense Interest Payable 31 Interest Expense Premium on Bonds Payable Cash 31 Income Summary Interest Expense 31 Bonds Payable Premium on Bonds Payable Loss on Redemption of Bonds 317,451.00 + 15 12,728.00 16 12,728.00 17 19,397.00 3,103.00 16 19 22,500.00 20 142,582.00 21 142,582.00 . 22 500,000.00 23 24,824.00 20,600.00 24 . 25 Cash 545,424.00 Final Questions Considering the journal entries for both years, answer the following questions 1. What is the yearly payment amount required for the note payable? (Assume it is an installment notes 2. What is the interest rate on the note payable? 3. Were the bonds in the entry on Dec. 31 of 2075 redeemed at maturity? 4. You suspect there is an error in one of the bond redemption entries. Assuming that the amounts are correct, which entry is questionable? Why? 5. Why do some bonds sell below face value? 6. Which of the following items are amortized? Check all that apply Future cash receipts It depends on the face value of the bond Discounts Redemption amount Interest expenses O Contract rate of interest Bonds Premiums