Question

Question: Suggest a better approach for allocating overhead. Allocate costs using your approach and compare the costs of both jobs under the two systems. Other

Question: Suggest a better approach for allocating overhead. Allocate costs using your approach and compare the costs of both jobs under the two systems.

Other information from other questions

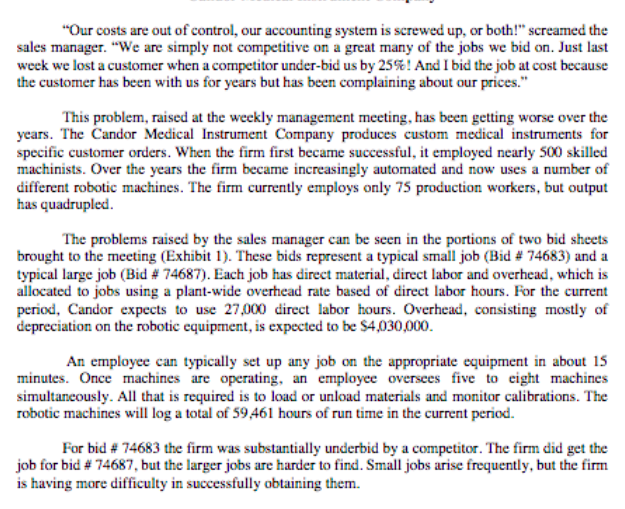

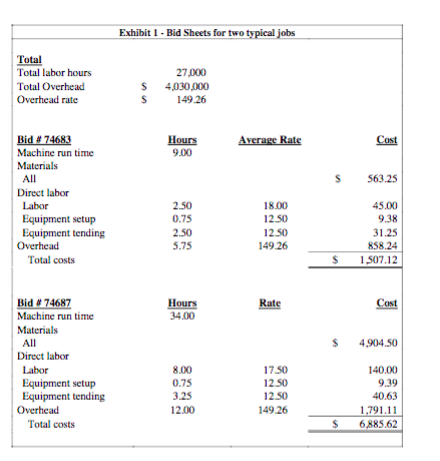

The total overhead cost ($4,030,000 )have been allocated based on the direct labour hours (27000). This works out to $149.26 as the overhead absorption rate. Since predominantly , machines are used in each department and the machine hours are more than the direct labour hours in each deparment, the machine hour rate should have been used for absorption of overhead costs. This will work out to $ 67.78 as against $149.26 as the overhead absorption rate as shown below.

Overhead cost /machine hours

$4,030,000/59,461= $67.78.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started