Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question: Suppose instead the firm considers hedging its net foreign exchange exposures in each currency with money market hedges. What will the firm pay or

Question: Suppose instead the firm considers hedging its net foreign exchange exposures in each currency with money market hedges. What will the firm pay or receive (number of $) for CAD and AUD 6 months from Jan.2 (i.e. on July 2) if it hedges its risks using money market hedges (given the data provided in the problem)?

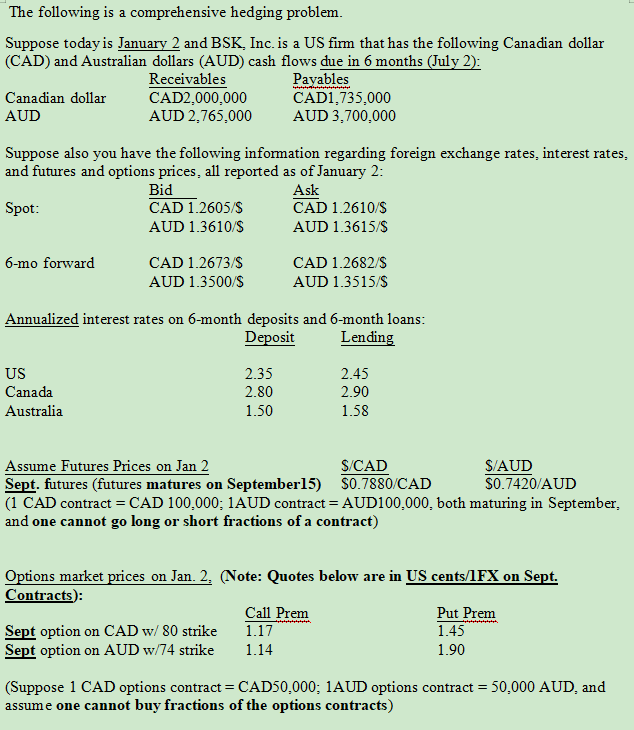

The following is a comprehensive hedging problem. Suppose today is January 2 and BSK, Inc. is a US firm that has the following Canadian dollar (CAD) and Australian dollars (AUD) cash flows due in 6 months (July 2): Receivables Payables Canadian dollar CAD2,000,000 CAD1,735,000 AUD AUD 2,765,000 AUD 3,700,000 Suppose also you have the following information regarding foreign exchange rates, interest rates, and futures and options prices, all reported as of January 2: Bid Ask Spot: CAD 1.2605/$ CAD 1.2610/$ AUD 1.3610/S AUD 1.3615/5 6-mo forward CAD 1.2673/$ CAD 1.2682/5 AUD 1.3500/$ AUD 1.3515/5 Annualized interest rates on 6-month deposits and 6-month loans: Deposit Lending US Canada Australia 2.35 2.80 1.50 2.45 2.90 1.58 Assume Futures Prices on Jan 2 S/CAD S/AUD Sept. futures (futures matures on September15) $0.7880/CAD $0.7420/AUD (1 CAD contract = CAD 100,000: 1AUD contract = AUD100.000, both maturing in September, and one cannot go long or short fractions of a contract) Options market prices on Jan. 2. (Note: Quotes below are in US cents/1FX on Sept. Contracts): Call Prem Put Prem Sept option on CAD w/80 strike 1.17 1.45 Sept option on AUD w/74 strike 1.14 1.90 44 (Suppose 1 CAD options contract = CAD50.000; 1AUD options contract = 50,000 AUD, and assume one cannot buy fractions of the options contracts)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started