Answered step by step

Verified Expert Solution

Question

1 Approved Answer

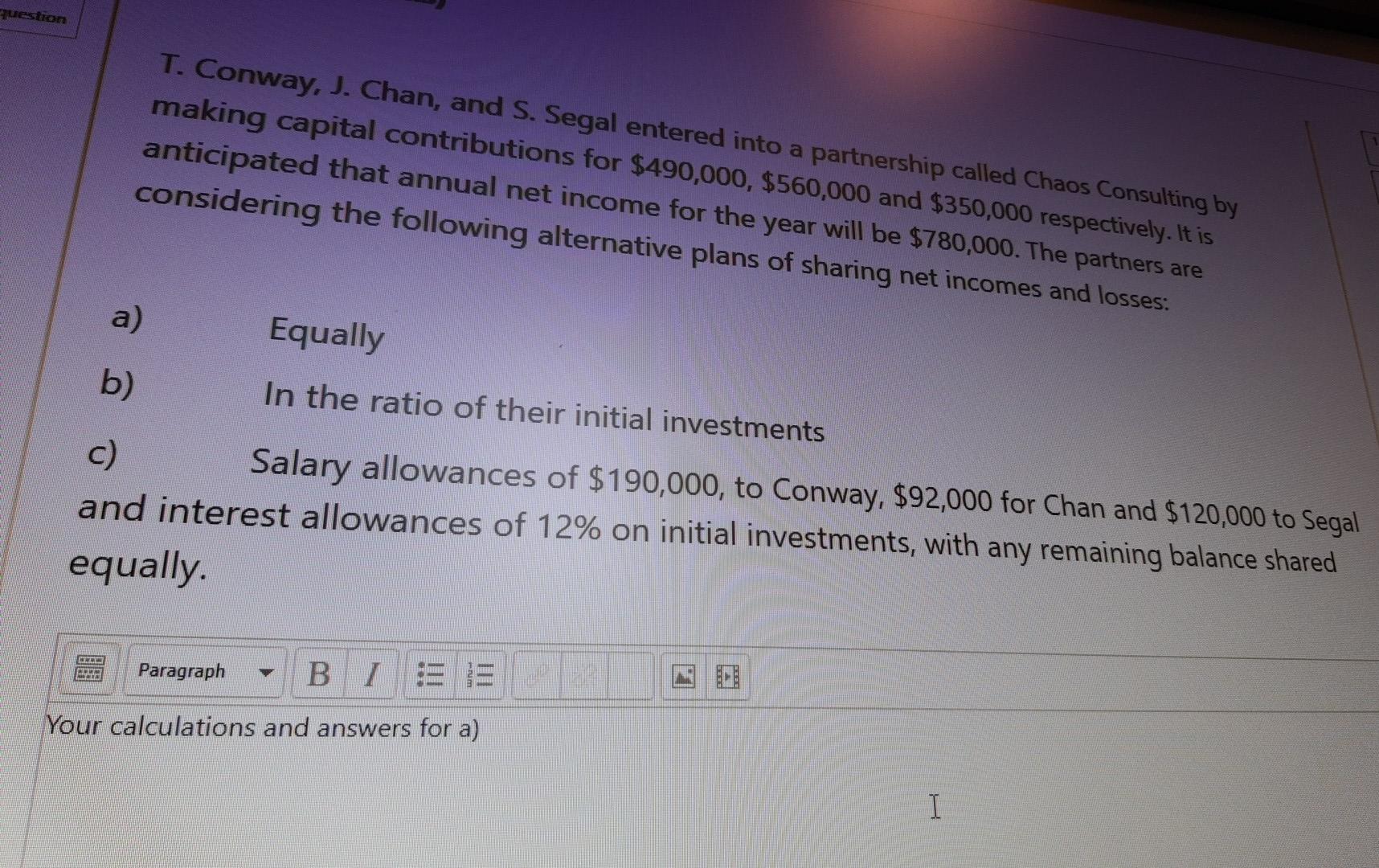

question T. Conway, J. Chan, and S. Segal entered into a partnership called Chaos Consulting by making capital contributions for $490,000, $560,000 and $350,000 respectively.

question T. Conway, J. Chan, and S. Segal entered into a partnership called Chaos Consulting by making capital contributions for $490,000, $560,000 and $350,000 respectively. It is anticipated that annual net income for the year will be $780,000. The partners are considering the following alternative plans of sharing net incomes and losses: a) Equally b) In the ratio of their initial investments c) Salary allowances of $190,000, to Conway, $92,000 for Chan and $120,000 to Segal and interest allowances of 12% on initial investments, with any remaining balance shared equally Paragraph B TEE Your calculations and answers for a) I question T. Conway, J. Chan, and S. Segal entered into a partnership called Chaos Consulting by making capital contributions for $490,000, $560,000 and $350,000 respectively. It is anticipated that annual net income for the year will be $780,000. The partners are considering the following alternative plans of sharing net incomes and losses: a) Equally b) In the ratio of their initial investments c) Salary allowances of $190,000, to Conway, $92,000 for Chan and $120,000 to Segal and interest allowances of 12% on initial investments, with any remaining balance shared equally Paragraph B TEE Your calculations and answers for a)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started