Question

Question: table[[,table[[July 1],[(Beginning)]],table[[September 30],[(Ending)]]],[Direct materials inventory,$96,800,$114,400 table [ [ , table [ [ July 1 ] , [ ( Beginning ) ] ]

Question: \table[[,\table[[July 1],[(Beginning)]],\table[[September 30],[(Ending)]]],[Direct materials inventory,$96,800,$114,400

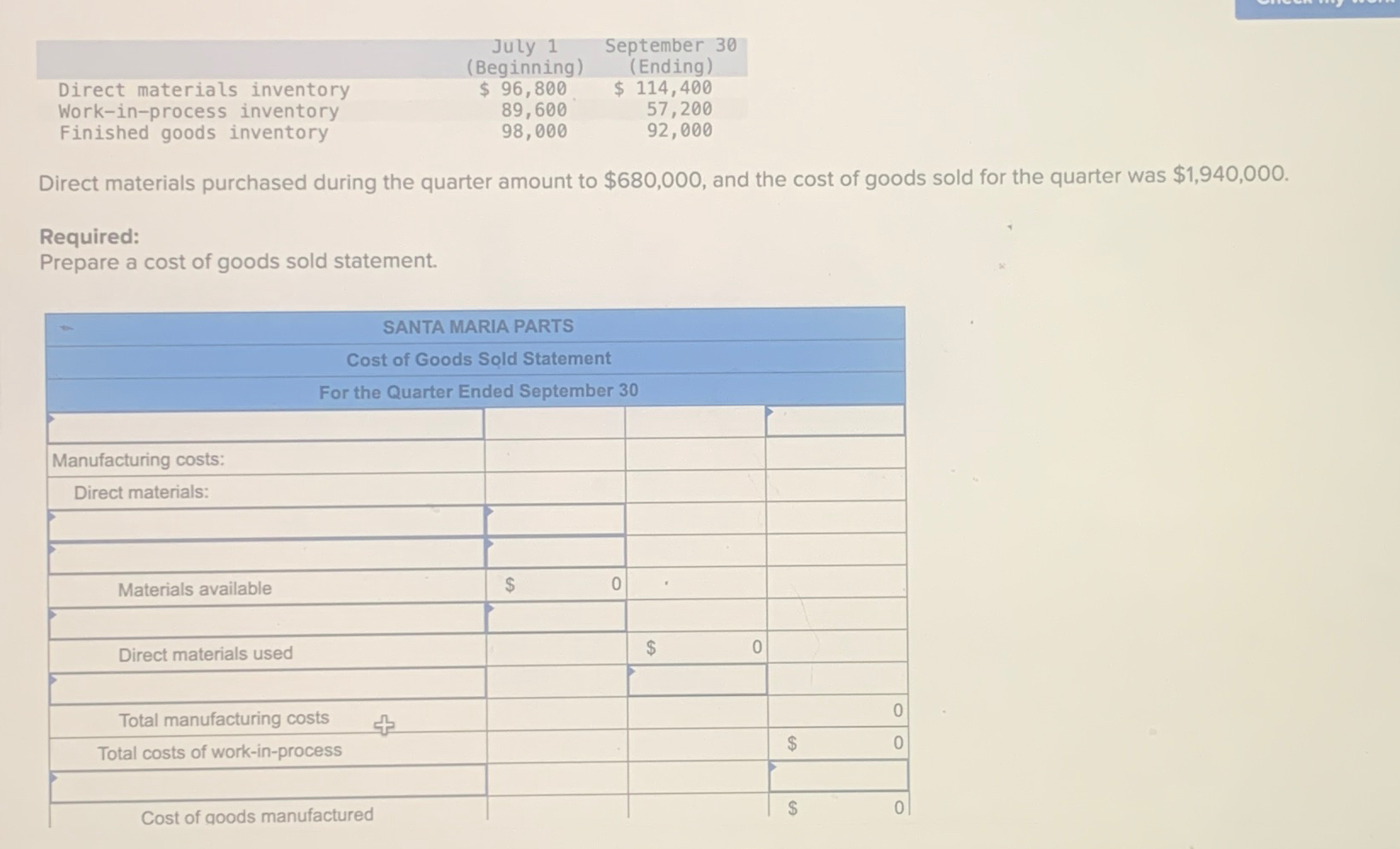

Direct materials inventory Work-in-process inventory Finished goods inventory July 1 (Beginning) $ 96,800 89,600 98,000 September 30 (Ending) $ 114,400 57,200 92,000 Direct materials purchased during the quarter amount to $680,000, and the cost of goods sold for the quarter was $1,940,000. Required: Prepare a cost of goods sold statement. Manufacturing costs: Direct materials: SANTA MARIA PARTS Cost of Goods Sold Statement For the Quarter Ended September 30 Materials available Direct materials used Total manufacturing costs Total costs of work-in-process Cost of goods manufactured 0 $ 0 0 $ 0 $ 0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Corporate Finance

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe

13th International Edition

1265533199, 978-1265533199

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App