Question

Question text Internal Service Fund Financial Statements At the beginning of fiscal year 2014, the City of Wooster established a central supplies storehouse to service

Question text

Internal Service Fund Financial Statements

At the beginning of fiscal year 2014, the City of Wooster established a central supplies storehouse to service its several funds. The general fund contributed $26,000,000 (nonrefundable) to aid in the establishment of the supplies storehouse. It was agreed that the storehouse would charge other funds for the purchase price of supplies plus 15%. During the year, the storehouse purchased $22,000,000 of supplies, paid operating expenses of $3,000,000, and billed other funds for $21,275,000. All accounts are settled except $1,200,000 remaining to be collected from the general fund for supplies billed.

Required

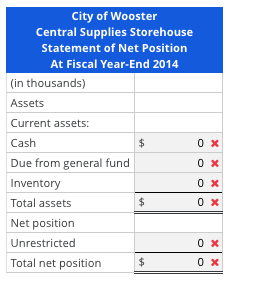

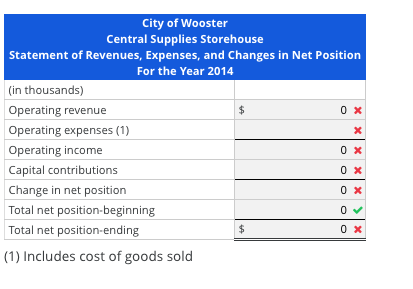

Prepare the statement of revenues, expenses, and changes in net position for fiscal 2014, and the statement of net position at the end of fiscal 2014 for the central supplies storehouse.

- Enter your answers in thousands. For example, $1,000,000 is $1,000.

- Use a negative sign with your answer for operating income (loss) to indicate an operating loss; otherwise, do not use a negative sign with your answers.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started