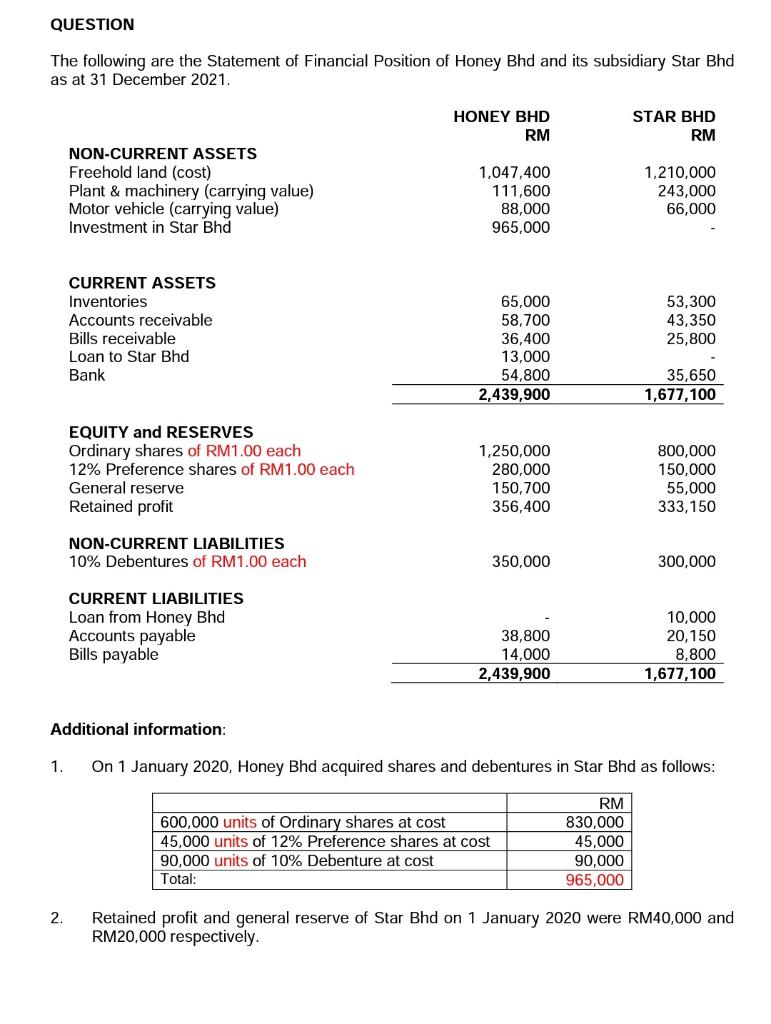

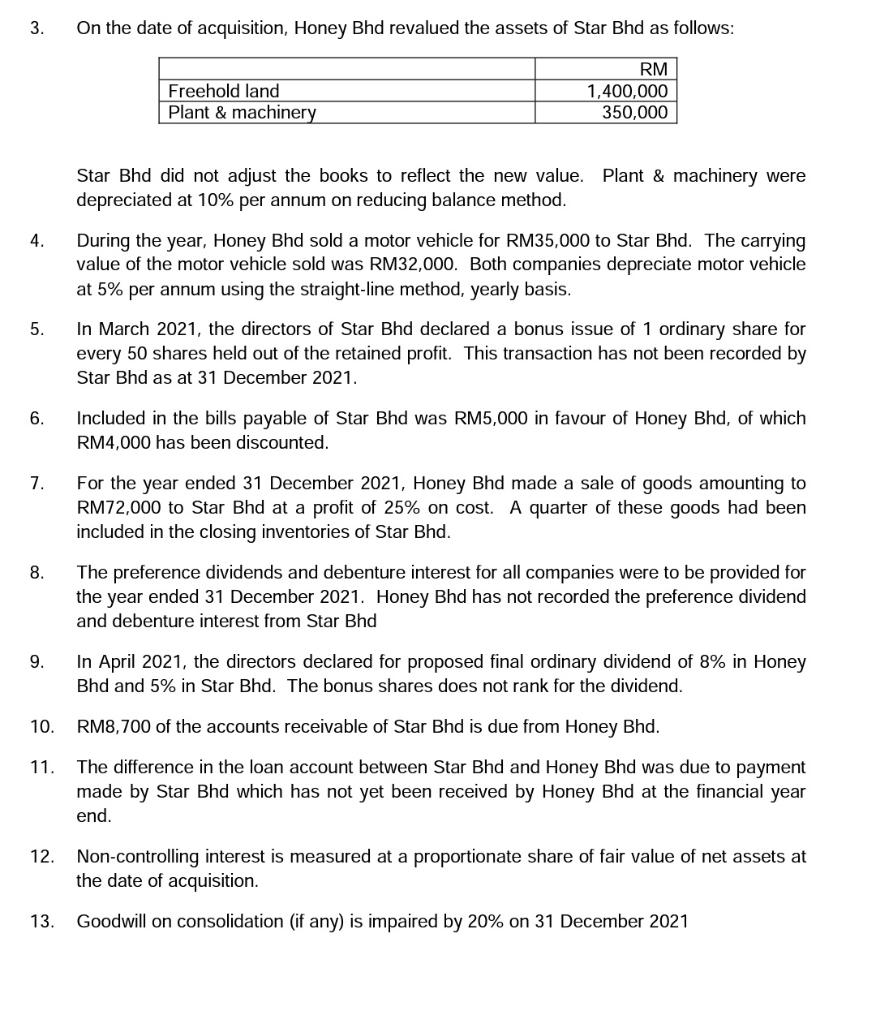

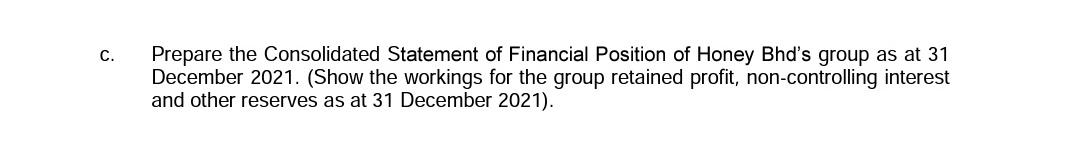

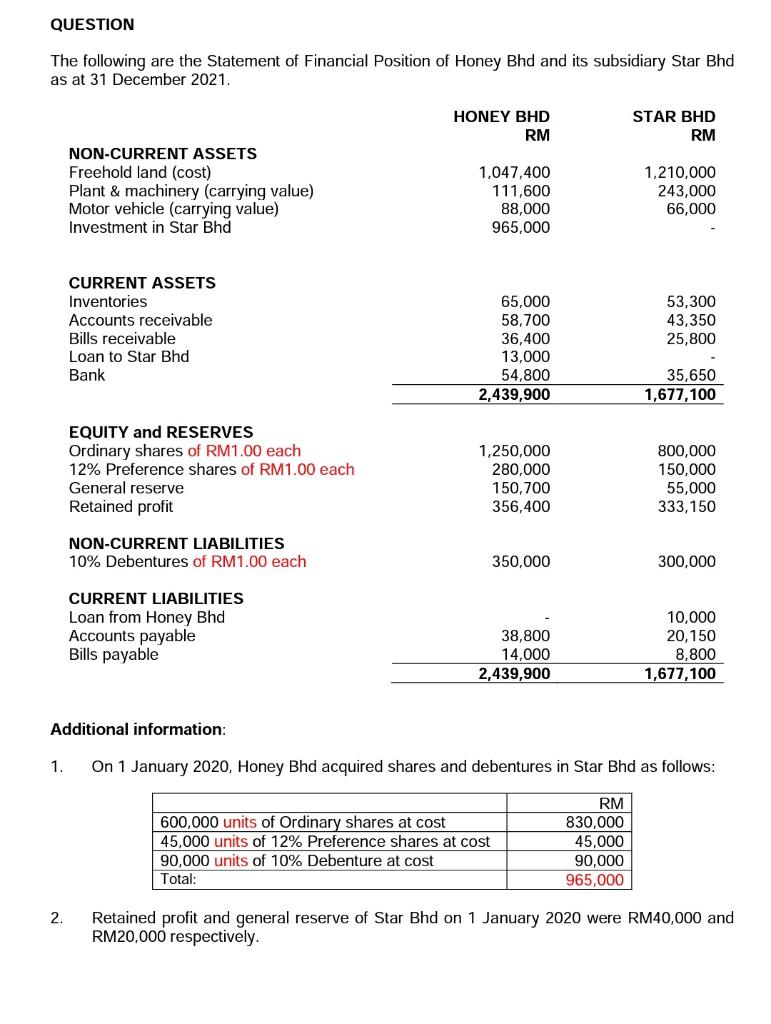

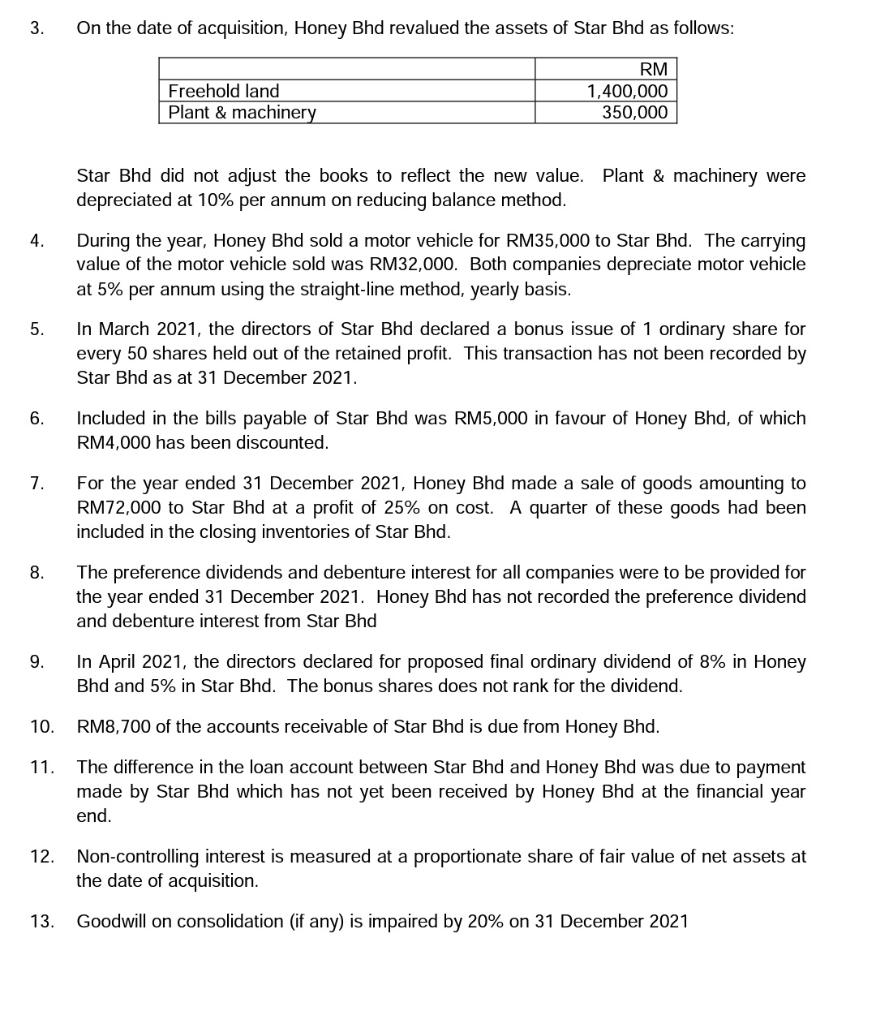

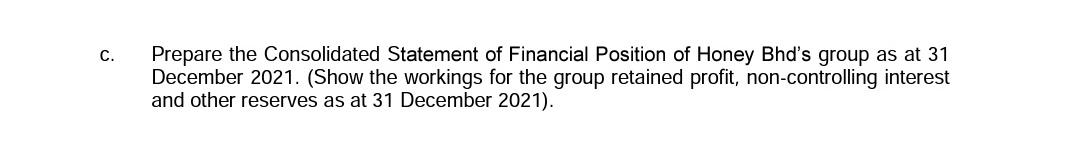

QUESTION The following are the Statement of Financial Position of Honey Bhd and its subsidiary Star Bhd as at 31 December 2021. Additional information: 1. On 1 January 2020, Honey Bhd acquired shares and debentures in Star Bhd as follows: 2. Retained profit and general reserve of Star Bhd on 1 January 2020 were RM40,000 and RM20,000 respectively. 3. On the date of acquisition, Honey Bhd revalued the assets of Star Bhd as follows: Star Bhd did not adjust the books to reflect the new value. Plant \& machinery were depreciated at 10% per annum on reducing balance method. 4. During the year, Honey Bhd sold a motor vehicle for RM35,000 to Star Bhd. The carrying value of the motor vehicle sold was RM32,000. Both companies depreciate motor vehicle at 5% per annum using the straight-line method, yearly basis. 5. In March 2021, the directors of Star Bhd declared a bonus issue of 1 ordinary share for every 50 shares held out of the retained profit. This transaction has not been recorded by Star Bhd as at 31 December 2021. 6. Included in the bills payable of Star Bhd was RM5,000 in favour of Honey Bhd, of which RM4,000 has been discounted. 7. For the year ended 31 December 2021, Honey Bhd made a sale of goods amounting to RM72,000 to Star Bhd at a profit of 25% on cost. A quarter of these goods had been included in the closing inventories of Star Bhd. 8. The preference dividends and debenture interest for all companies were to be provided for the year ended 31 December 2021. Honey Bhd has not recorded the preference dividend and debenture interest from Star Bhd 9. In April 2021, the directors declared for proposed final ordinary dividend of 8% in Honey Bhd and 5% in Star Bhd. The bonus shares does not rank for the dividend. 10. RM8, 700 of the accounts receivable of Star Bhd is due from Honey Bhd. 11. The difference in the loan account between Star Bhd and Honey Bhd was due to payment made by Star Bhd which has not yet been received by Honey Bhd at the financial year end. 12. Non-controlling interest is measured at a proportionate share of fair value of net assets at the date of acquisition. 13. Goodwill on consolidation (if any) is impaired by 20% on 31 December 2021 Prepare the Consolidated Statement of Financial Position of Honey Bhd's group as at 31 December 2021. (Show the workings for the group retained profit, non-controlling interest and other reserves as at 31 December 2021). QUESTION The following are the Statement of Financial Position of Honey Bhd and its subsidiary Star Bhd as at 31 December 2021. Additional information: 1. On 1 January 2020, Honey Bhd acquired shares and debentures in Star Bhd as follows: 2. Retained profit and general reserve of Star Bhd on 1 January 2020 were RM40,000 and RM20,000 respectively. 3. On the date of acquisition, Honey Bhd revalued the assets of Star Bhd as follows: Star Bhd did not adjust the books to reflect the new value. Plant \& machinery were depreciated at 10% per annum on reducing balance method. 4. During the year, Honey Bhd sold a motor vehicle for RM35,000 to Star Bhd. The carrying value of the motor vehicle sold was RM32,000. Both companies depreciate motor vehicle at 5% per annum using the straight-line method, yearly basis. 5. In March 2021, the directors of Star Bhd declared a bonus issue of 1 ordinary share for every 50 shares held out of the retained profit. This transaction has not been recorded by Star Bhd as at 31 December 2021. 6. Included in the bills payable of Star Bhd was RM5,000 in favour of Honey Bhd, of which RM4,000 has been discounted. 7. For the year ended 31 December 2021, Honey Bhd made a sale of goods amounting to RM72,000 to Star Bhd at a profit of 25% on cost. A quarter of these goods had been included in the closing inventories of Star Bhd. 8. The preference dividends and debenture interest for all companies were to be provided for the year ended 31 December 2021. Honey Bhd has not recorded the preference dividend and debenture interest from Star Bhd 9. In April 2021, the directors declared for proposed final ordinary dividend of 8% in Honey Bhd and 5% in Star Bhd. The bonus shares does not rank for the dividend. 10. RM8, 700 of the accounts receivable of Star Bhd is due from Honey Bhd. 11. The difference in the loan account between Star Bhd and Honey Bhd was due to payment made by Star Bhd which has not yet been received by Honey Bhd at the financial year end. 12. Non-controlling interest is measured at a proportionate share of fair value of net assets at the date of acquisition. 13. Goodwill on consolidation (if any) is impaired by 20% on 31 December 2021 Prepare the Consolidated Statement of Financial Position of Honey Bhd's group as at 31 December 2021. (Show the workings for the group retained profit, non-controlling interest and other reserves as at 31 December 2021)