Answered step by step

Verified Expert Solution

Question

1 Approved Answer

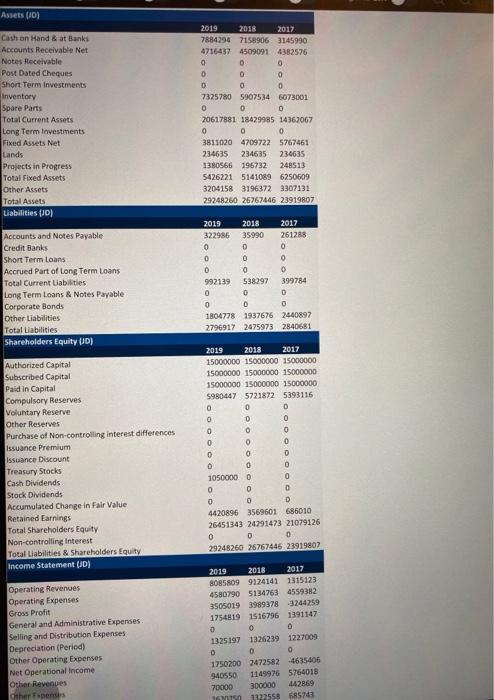

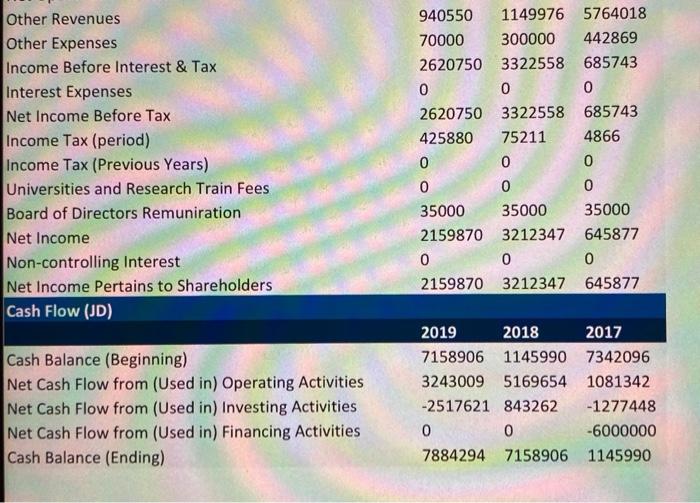

Question: The following attachments are the financial statements of two companies listed in Amman Stock Exchange (ASE) for the years of 2017 to 2019. Requirements:

Question:

The following attachments are the financial statements of two companies listed in Amman Stock Exchange (ASE) for the years of 2017 to 2019.

Requirements:

a.Compute the following ratios for both companies:

i. Working capital

ii. Current ratio

iii. Acid test ratio

iv. Cash flow from operations to current liabilities

v. Accounts receivable turnover ratio

vi. Days in receivables

vii. Inventory turnover ratio

viii. Average days in inventory

b.Based on the previous ratios discuss the working capital management and assess the relative working capital position for both companies.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started