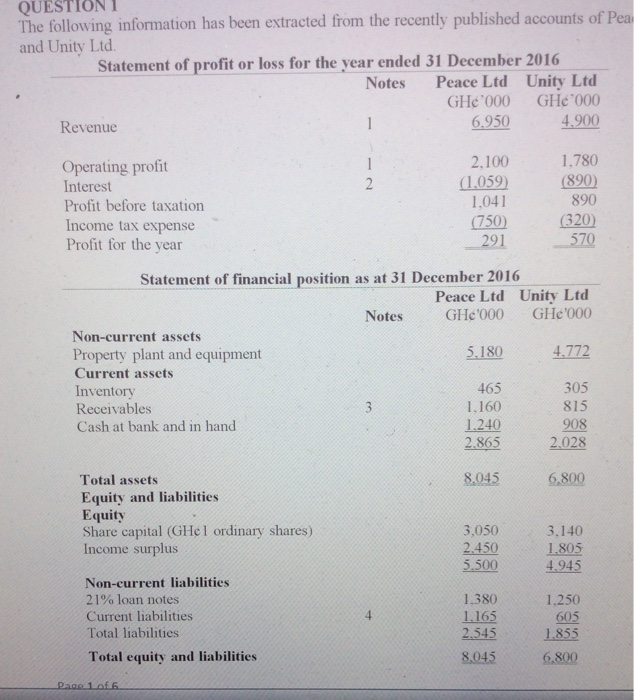

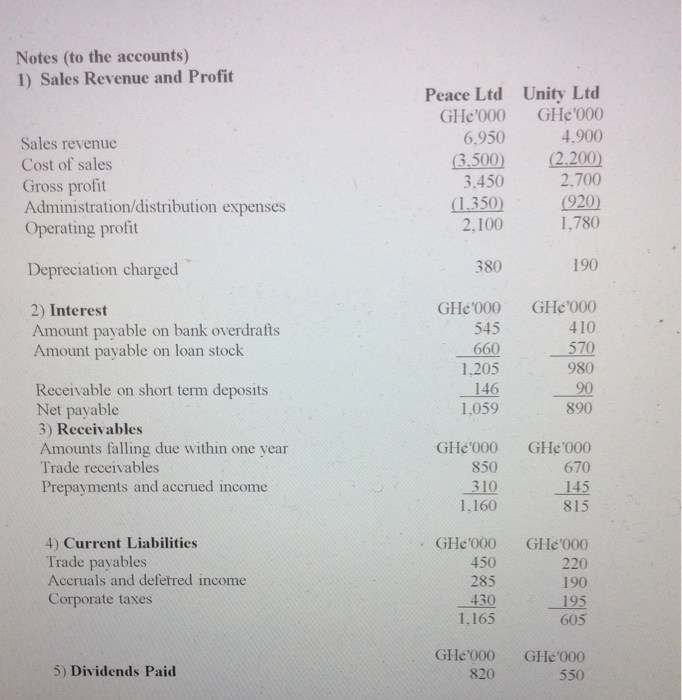

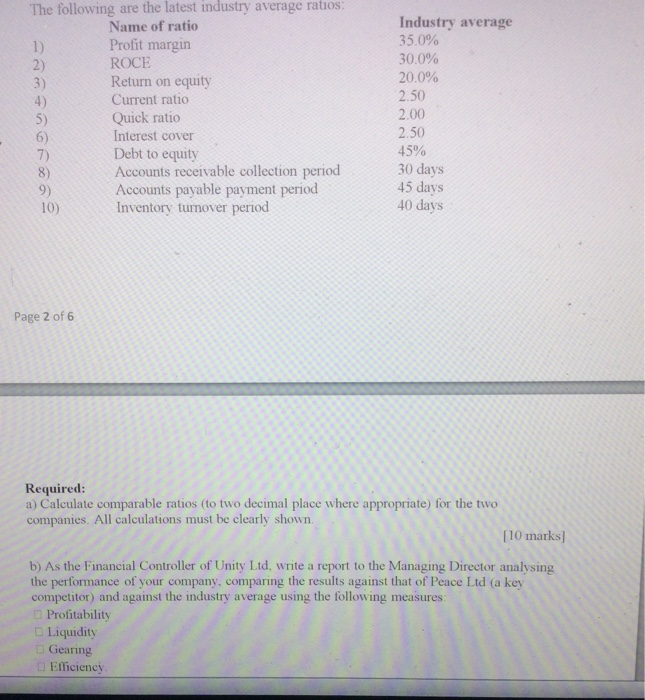

QUESTION The following information has been extracted from the recently published accounts of Pear and Unity Ltd Statement of profit or loss for the year ended 31 December 2016 Notes Peace Ltd Unity Ltd GHc 000 GH 000 Revenue 6.950 4.900 1 2 Operating profit Interest Profit before taxation Income tax expense Profit for the year 2.100 (1.059) 1.041 (750) 291 1.780 (890) 890 (320) 570 Statement of financial position as at 31 December 2016 Peace Ltd Unity Ltd Notes GH'000 GHc'000 Non-current assets Property plant and equipment 5.180 4.772 Current assets Inventory 465 305 Receivables 3 1,160 815 Cash at bank and in hand 1.240 908 2.865 2.028 8.045 6.800 Total assets Equity and liabilities Equity Share capital (GHel ordinary shares) Income surplus 3.050 2.450 5.500 3.140 1.805 4.945 4 Non-current liabilities 21% loan notes Current liabilities Total liabilities Total equity and liabilities 1.380 1.165 2.545 8.045 1.250 605 1.855 6.800 Page 1 of 6 Notes (to the accounts) 1) Sales Revenue and Profit Sales revenue Cost of sales Gross profit Administration/distribution expenses Operating profit Peace Ltd Unity Ltd GH'000 GH'000 6.950 4,900 (3.500) (2.200) 3.450 2.700 (1.350) (920) 2.100 1,780 Depreciation charged 380 190 2) Interest Amount payable on bank overdrafts Amount payable on loan stock GHe'000 545 660 1.205 146 1,059 GHe'000 410 570 980 90 890 Receivable on short term deposits Net payable 3) Receivables Amounts falling due within one year Trade receivables Prepayments and accrued income GH'000 850 310 1.160 GHe'000 670 145 815 4) Current Liabilities Trade payables Accruals and deferred income Corporate taxes GHc'000 450 285 430 1,165 GH.000 220 190 195 605 5) Dividends Paid GHc'000 820 GH000 550 The following are the latest industry average ratios: Name of ratio 1) Profit margin 2) ROCE 3) Return on equity 4) Current ratio 5) Quick ratio Interest cover 7) Debt to equity 8) Accounts receivable collection period 9) Accounts payable payment period Inventory turnover period Industry average 35.0% 30.0% 20.0% 2.50 2.00 2.50 45% 30 days 45 days 40 days 10) Page 2 of 6 Required: a) Calculate comparable ratios (to two decimal place where appropriate) for the two companies. All calculations must be clearly shown [10 marks b) As the Financial Controller of Unity Ltd, write a report to the Managing Director analysing the performance of your company, comparing the results against that of Peace Ltd (a key competitor) and against the industry average using the following measures: Profitability Liquidity Gearing Efficiency