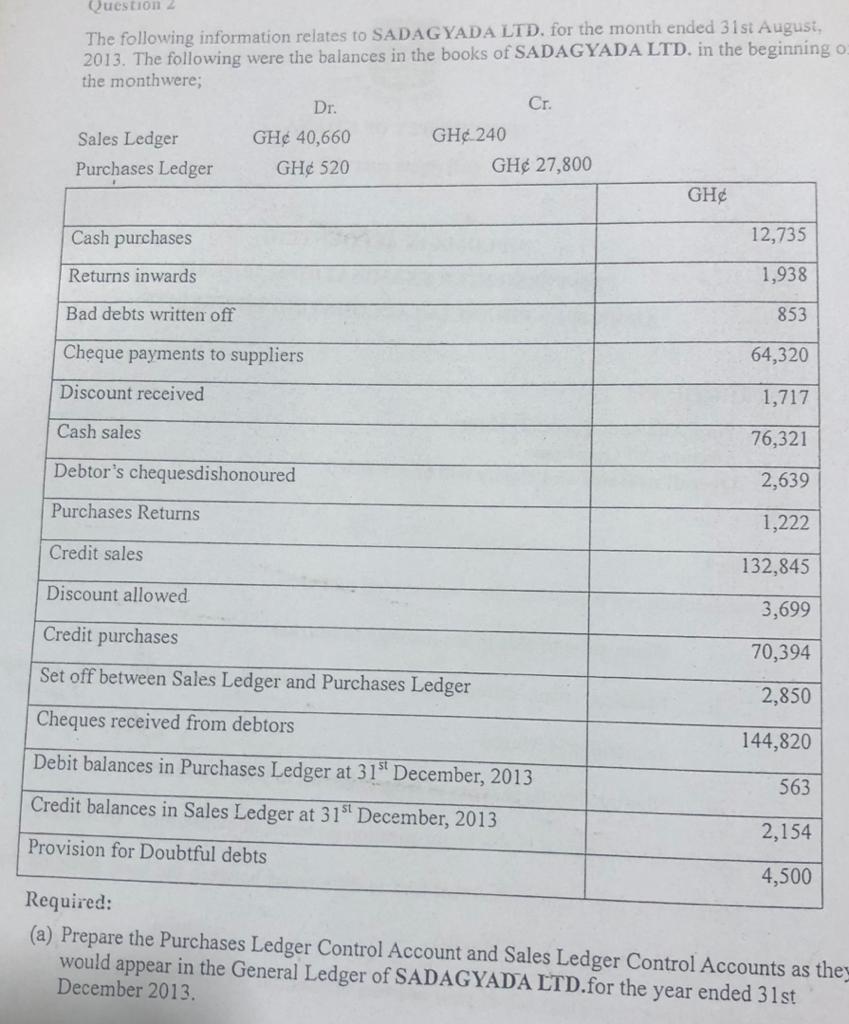

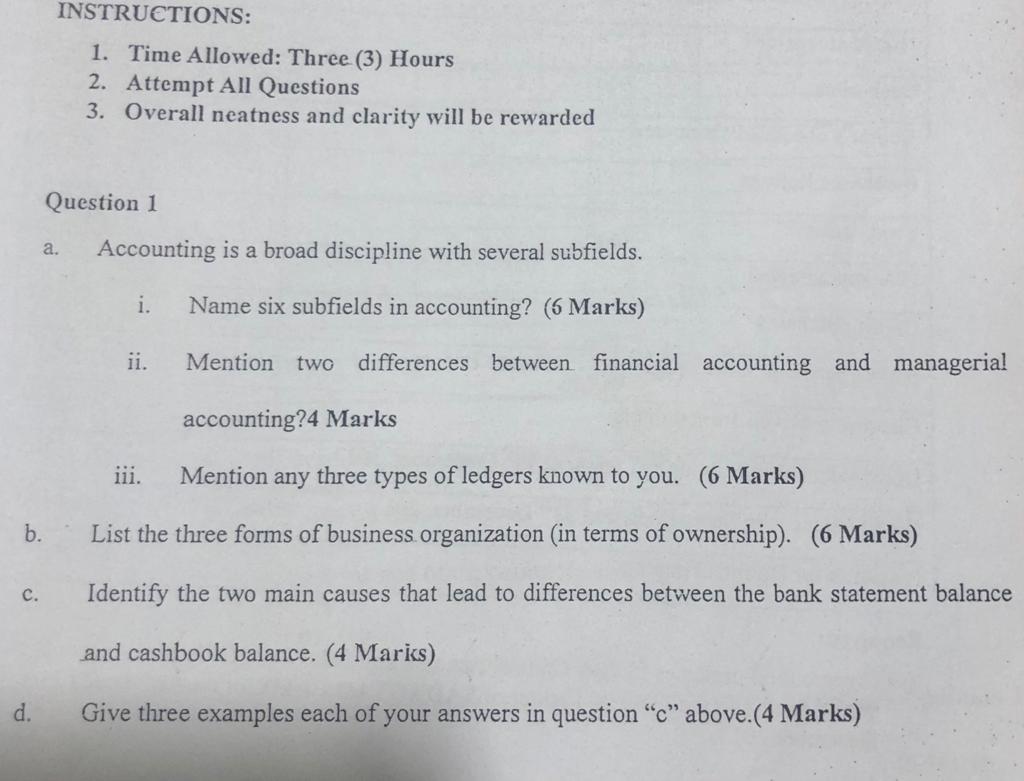

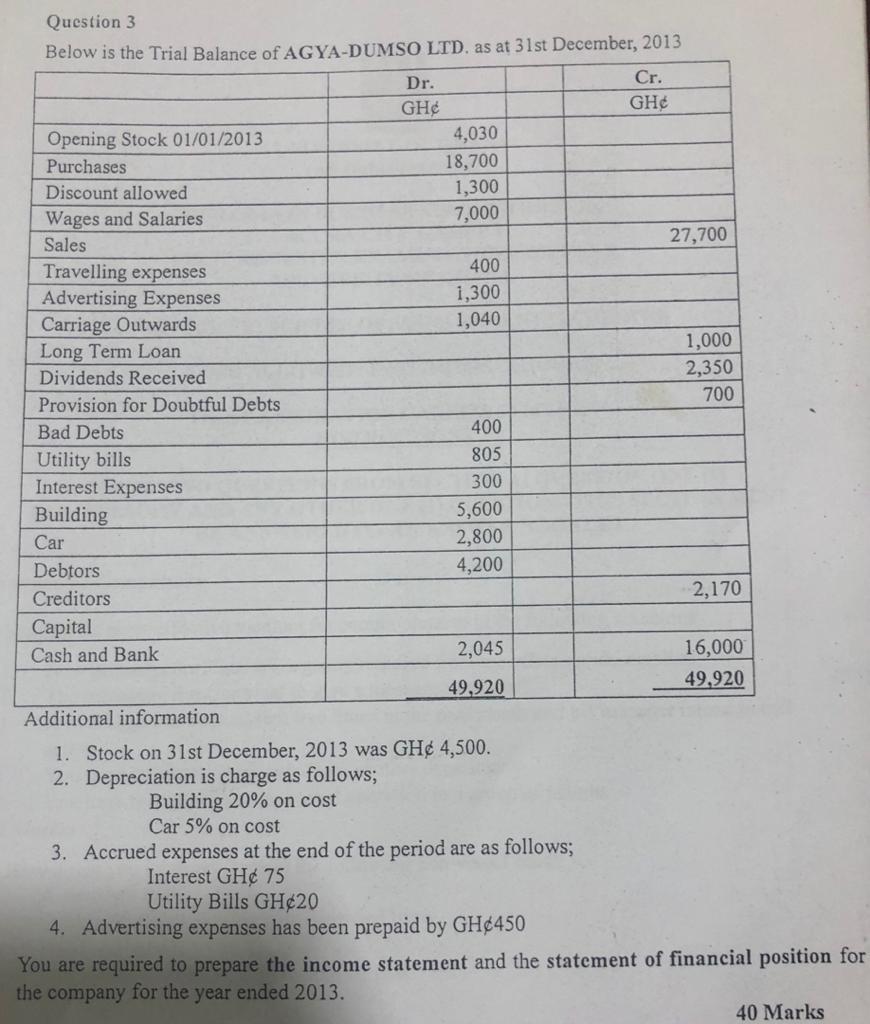

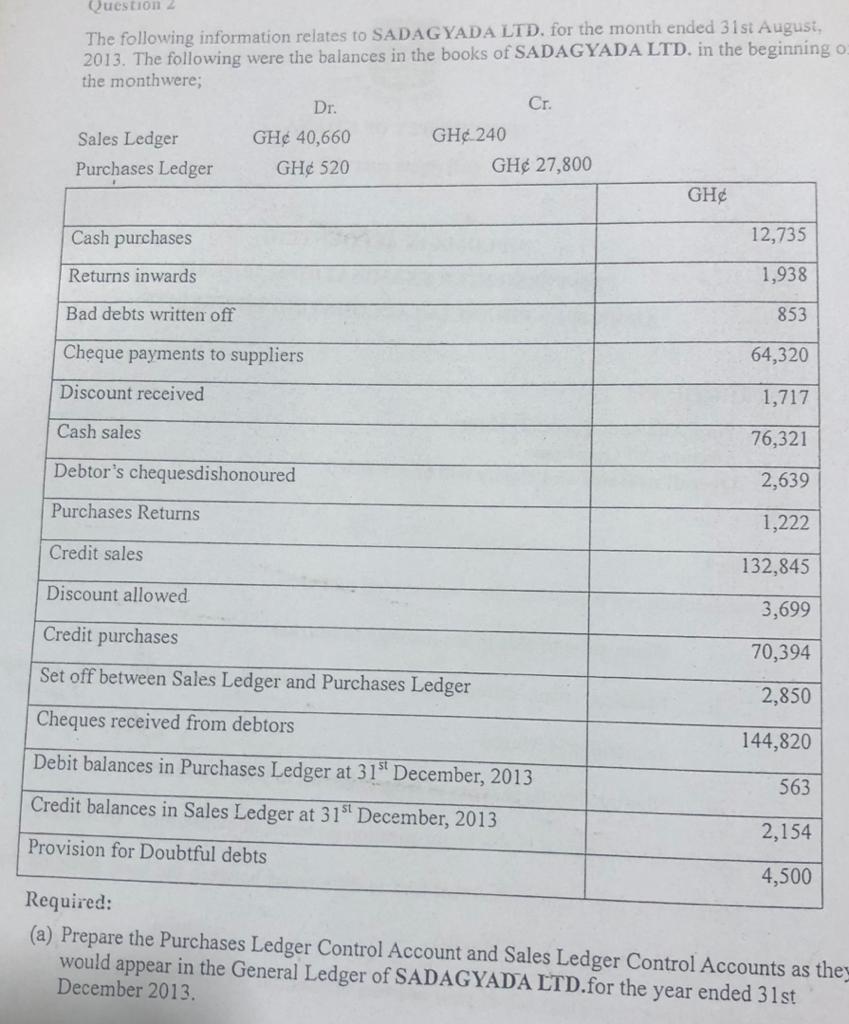

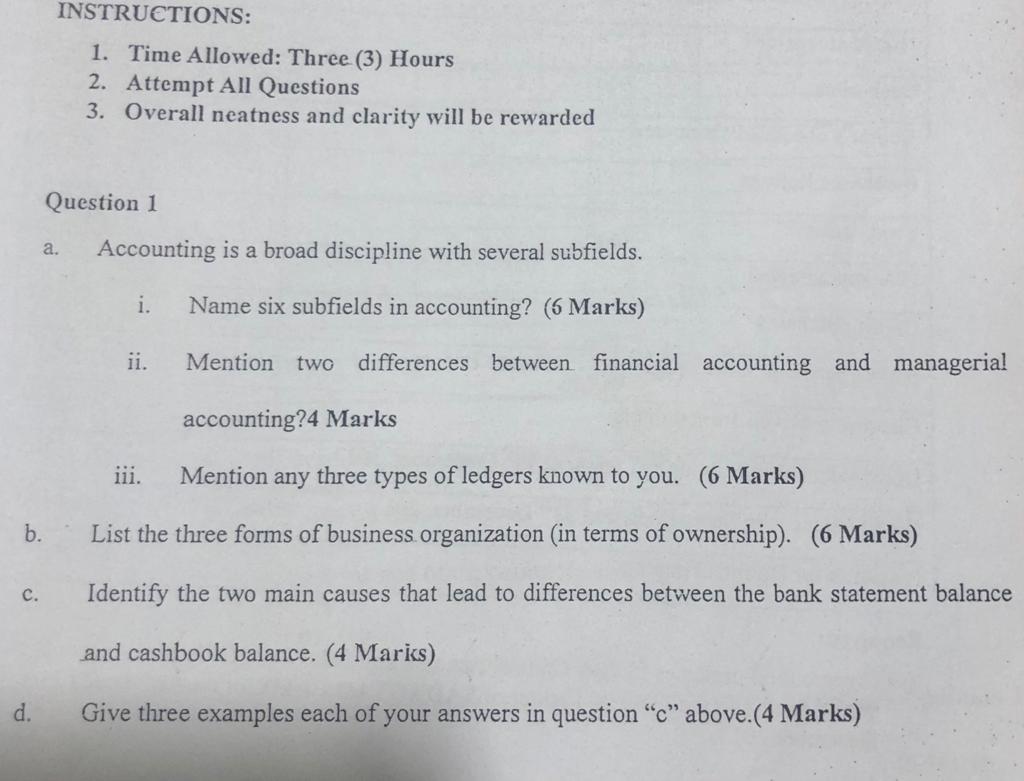

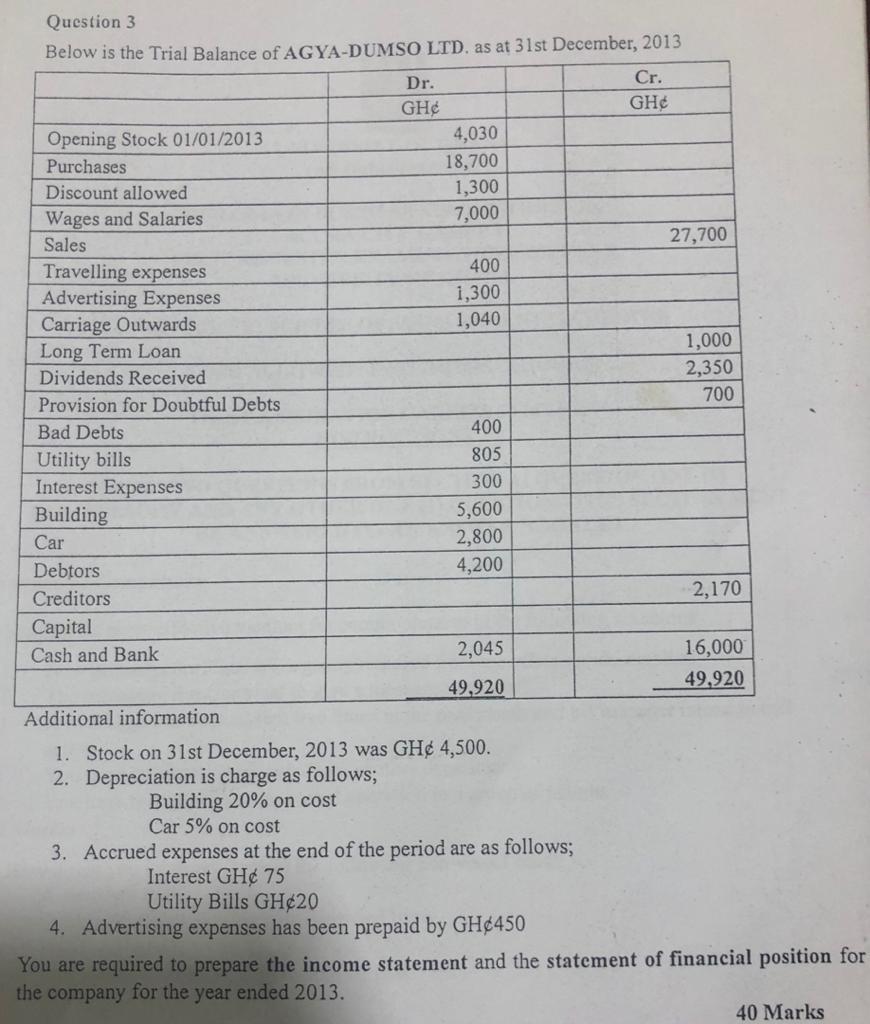

Question The following information relates to SADAGYADA LTD. for the month ended 31st August, 2013. The following were the balances in the books of SADAGYADA LTD. in the beginning o the monthwere; Dr. Cr. Sales Ledger GH 40,660 GH 240 Purchases Ledger GH 520 GH 27,800 GH Cash purchases 12,735 Returns inwards 1,938 Bad debts written off 853 Cheque payments to suppliers 64,320 Discount received 1,717 Cash sales 76,321 Debtor's chequesdishonoured 2,639 Purchases Returns 1,222 Credit sales 132,845 Discount allowed 3,699 Credit purchases 70,394 Set off between Sales Ledger and Purchases Ledger 2,850 Cheques received from debtors 144,820 Debit balances in Purchases Ledger at 31" December, 2013 563 Credit balances in Sales Ledger at 31 December, 2013 2,154 Provision for Doubtful debts 4,500 Required: (a) Prepare the Purchases Ledger Control Account and Sales Ledger Control Accounts as they would appear in the General Ledger of SADAGYADA LTD.for the year ended 31st December 2013 INSTRUCTIONS: 1. Time Allowed: Three (3) Hours 2. Attempt All Questions 3. Overall neatness and clarity will be rewarded Question 1 a. Accounting is a broad discipline with several subfields. i. Name six subfields in accounting? (6 Marks) ii. Mention two differences between financial accounting and managerial accounting?4 Marks iii. Mention any three types of ledgers known to you. (6 Marks) b. List the three forms of business organization (in terms of ownership). (6 Marks) c. Identify the two main causes that lead to differences between the bank statement balance and cashbook balance. (4 Marks) d. Give three examples each of your answers in question "c" above.(4 Marks) Question 3 Below is the Trial Balance of AGYA-DUMSO LTD. as at 31st December, 2013 Dr. Cr. GH GH Opening Stock 01/01/2013 4,030 Purchases 18,700 Discount allowed 1,300 Wages and Salaries 7,000 Sales 27,700 Travelling expenses 400 Advertising Expenses 1,300 Carriage Outwards 1,040 Long Term Loan 1,000 Dividends Received 2,350 Provision for Doubtful Debts 700 Bad Debts 400 Utility bills 805 Interest Expenses 300 Building 5,600 Car 2,800 Debtors 4,200 Creditors 2,170 Capital Cash and Bank 2,045 16,000 49,920 49,920 Additional information 1. Stock on 31st December, 2013 was GH 4,500. 2. Depreciation is charge as follows; Building 20% on cost Car 5% on cost 3. Accrued expenses at the end of the period are as follows; Interest GH 75 Utility Bills GH20 4. Advertising expenses has been prepaid by GH450 You are required to prepare the income statement and the statement of financial position for the company for the year ended 2013. 40 Marks