Question

QUESTION: The following texts is from my textbook and I don't understand how PV resulted in $45,945 on the financial calculator. It mentions nowhere about

QUESTION: The following texts is from my textbook and I don't understand how PV resulted in $45,945 on the financial calculator. It mentions nowhere about what to input for P/Y or C/Y (which I have at 2) and I think that's why I'm getting different answers. I tried to just do the calculations myself with the formulas but I'm not getting the same answer. Could someone please help clarify??

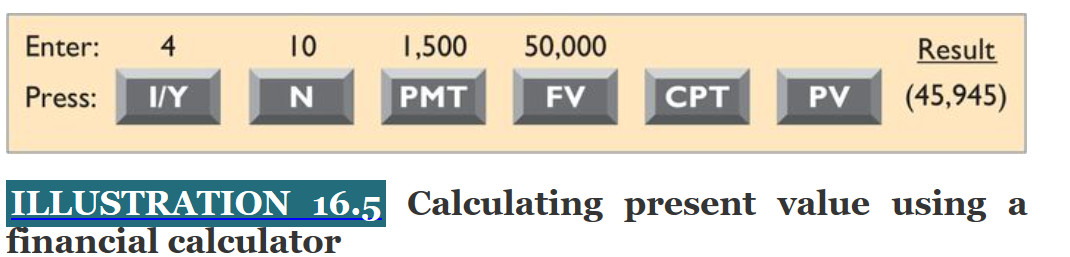

To illustrate the investor's accounting, assume that Lionheart Properties Inc. acquires Doan Inc.'s $50,000, 5-year, 6% bonds on January 1, 2021. The bonds pay interest on January 1 and July 1 each year. The bonds were issued to yield 8%.

The Doan Inc. bonds will be issued at a discount because the market interest rate is higher than the contract rate. Using a financial calculator, Lionheart Properties Inc. will calculate the price of the bond using a market interest rate per semi-annual payment period of 4% (8% 6/12), number of periods of 10 (5 years 2 payments per year), payment of $1,500 ($50,000 6% 6/12), and a future value of $50,000. The present value of the bond using these inputs is $45,945 (result rounded to nearest dollar) as demonstrated in Illustration 16.5.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started