Answered step by step

Verified Expert Solution

Question

1 Approved Answer

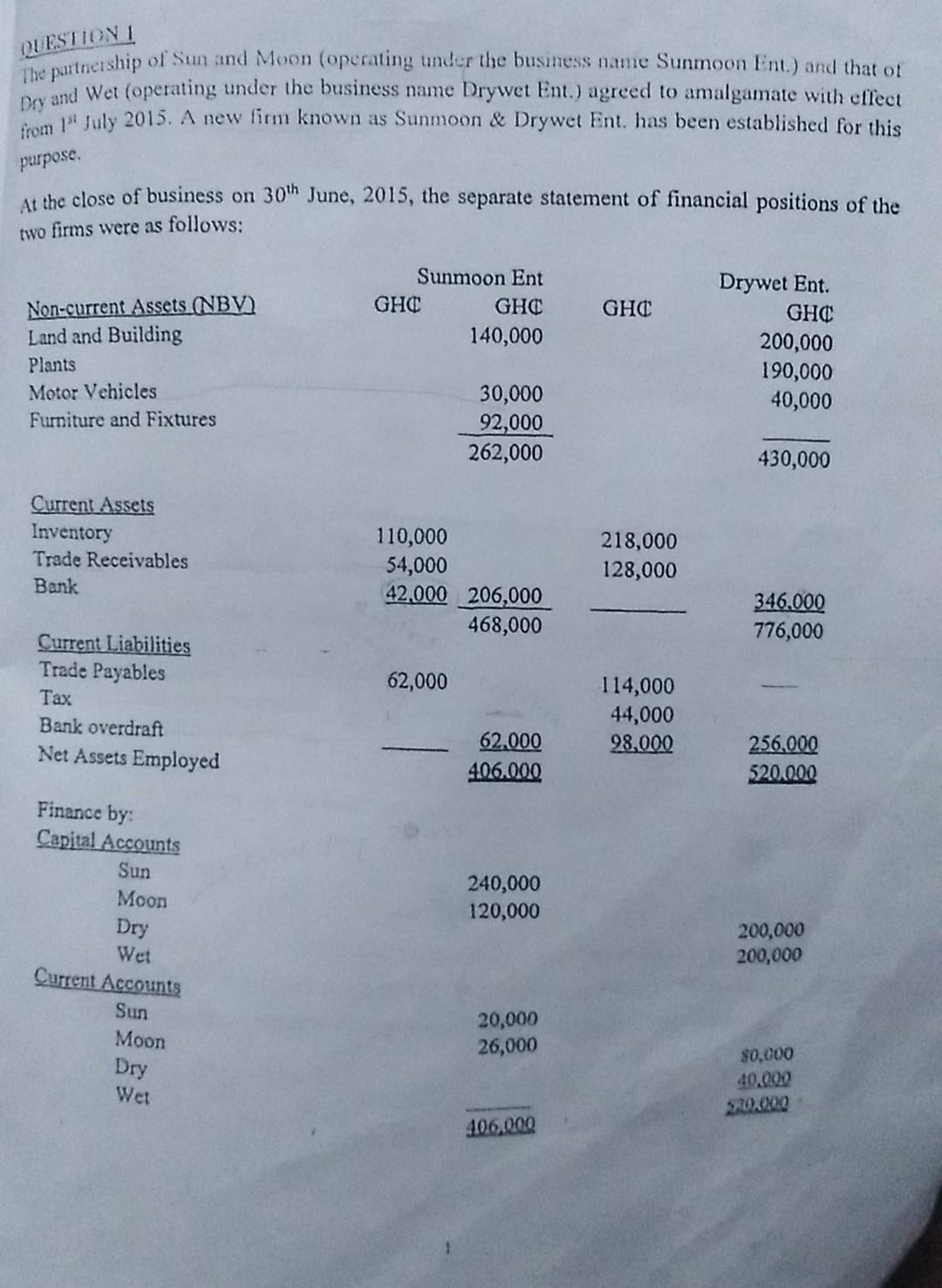

QUESTION the partnership of Sun and Moon (operating under the business name Sunmoon Ent.) and that of Dry and Wet (operating under the business name

QUESTION the partnership of Sun and Moon (operating under the business name Sunmoon Ent.) and that of Dry and Wet (operating under the business name Drywet Ent.) agreed to amalgamate with effect from 1 July 2015. A new firm known as Sunmoon & Drywet Ent has been established for this purpose. At the close of business on 30th June, 2015, the separate statement of financial positions of the two firms were as follows: Sunmoon Ent GHC GHC 140,000 GHC Non-current Assets (NBV) Land and Building Plants Motor Vehicles Furniture and Fixtures Drywet Ent. GHC 200,000 190,000 40,000 30,000 92,000 262,000 430,000 Current Assets Inventory Trade Receivables Bank 110,000 54,000 42.000 206,000 468,000 218,000 128,000 346.000 776,000 62,000 Current Liabilities Trade Payables Tax Bank overdraft Net Assets Employed 114,000 44,000 98,000 62.000 406.000 256,000 520.000 240,000 120,000 Finance by: Capital Accounts Sun Moon Dry Wet Current Accounts Sun Moon Dry 200,000 200,000 20,000 26,000 80,000 40.000 $10.000 Wet 406.000 QUESTION the partnership of Sun and Moon (operating under the business name Sunmoon Ent.) and that of Dry and Wet (operating under the business name Drywet Ent.) agreed to amalgamate with effect from 1 July 2015. A new firm known as Sunmoon & Drywet Ent has been established for this purpose. At the close of business on 30th June, 2015, the separate statement of financial positions of the two firms were as follows: Sunmoon Ent GHC GHC 140,000 GHC Non-current Assets (NBV) Land and Building Plants Motor Vehicles Furniture and Fixtures Drywet Ent. GHC 200,000 190,000 40,000 30,000 92,000 262,000 430,000 Current Assets Inventory Trade Receivables Bank 110,000 54,000 42.000 206,000 468,000 218,000 128,000 346.000 776,000 62,000 Current Liabilities Trade Payables Tax Bank overdraft Net Assets Employed 114,000 44,000 98,000 62.000 406.000 256,000 520.000 240,000 120,000 Finance by: Capital Accounts Sun Moon Dry Wet Current Accounts Sun Moon Dry 200,000 200,000 20,000 26,000 80,000 40.000 $10.000 Wet 406.000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started