Question

Question: The Phone Company has received an offer by a contract supplier to make and ship the Phone Companys cell phone (100,000 units) directly to

Question:

The Phone Company has received an offer by a contract supplier to make and ship the Phone Companys cell phone (100,000 units) directly to the Phone Companys customers. The Phone Company will continue to do some product design and marketing but will no longer manufacture the phones itself. If the Phone Company accepts this offer, its variable manufacturing costs would be $0 and its fixed manufacturing cost would be reduced by 75% of its current level. In addition, its variable selling cost would decrease by one-third and its fixed selling cost would not change. How much per cell phone could the Phone Company pay the contract supplier if it wants to maintain its present level of operating income?

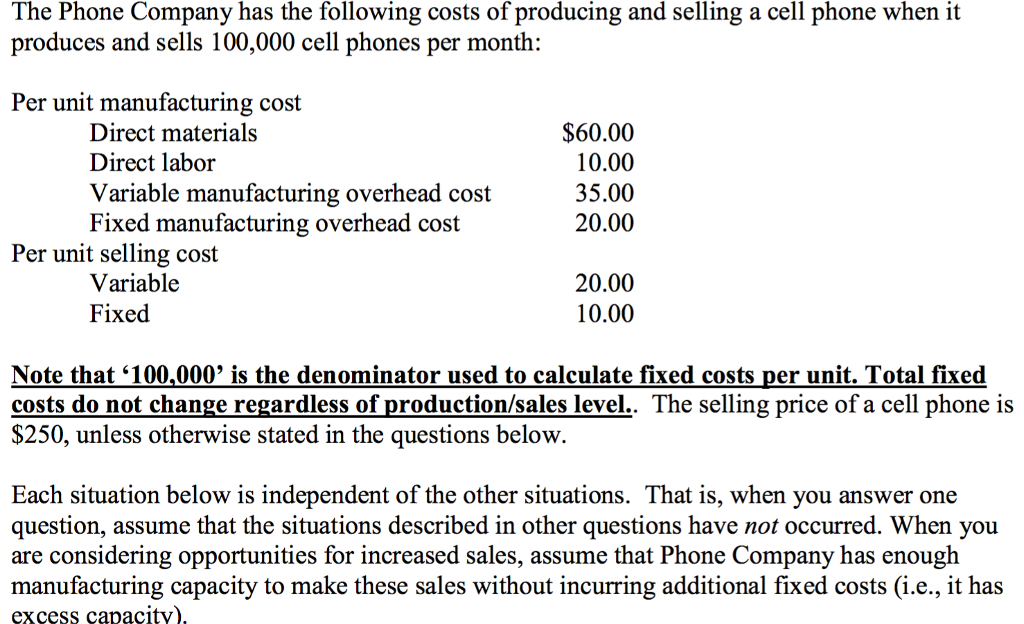

The Phone Company has the following costs of producing and selling a cell phone when it produces and sells 100,000 cell phones per month: Per unit manufacturing cost Direct materials Direct labor Variable manufacturing overhead cost Fixed manufacturing overhead cost $60.00 10.00 35.00 20.00 Per unit selling cost Variable Fixed 20.00 10.00 Note that 100.000, is the denominator used to calculate fixed costs per unit. Total fixed costs do not change regardless of production/sales level.. The selling price of a cell phone is $250, unless otherwise stated in the questions belovw Each situation below is independent of the other situations. That is, when you answer one question, assume that the situations described in other questions have not occurred. When you are considering opportunities for increased sales, assume that Phone Company has enough manufacturing capacity to make these sales without incurring additional fixed costs (i.e., it has excess capacitv)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started