Question

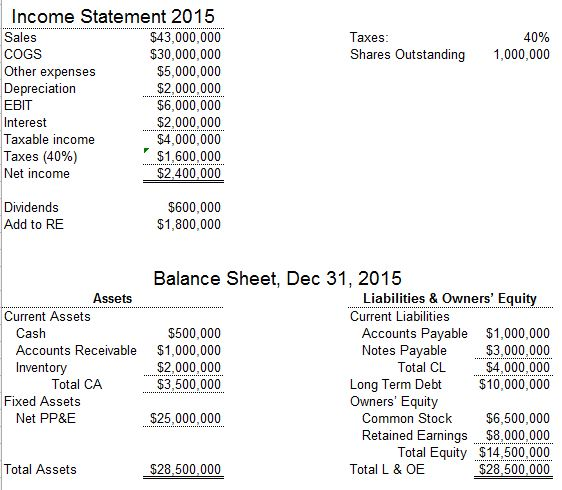

Question: The quarterly investors call is approaching and you were asked to comment on the EPS and projected EPS based on the growth forecast of

Question: The quarterly investors call is approaching and you were asked to comment on the EPS and projected EPS based on the growth forecast of 10%.

(a) Compute the EPS for the calendar year of 2015

(b) What is the projected EPS with the same assumptions as in Question 1? You are a bit skeptical of the projected 10% growth in sales and decided to look at a much less aggressive long-run growth scenario of 3.5% growth in sales.

(c) What is the projected EPS for a 3.5% growth in sales? If the dividend payout ratio remains the same, how much is paid per share? As some external financing will be needed to accommodate any growth, you started looking into raising debt and/or equity. Since your company would be mostly described as a smallcap US company, you looked at market data to help you determine your costs of equity and debt.

(d) Using the information on slide 8 on the deck from Week 5, what should be the risk premium for appropriate market for your company? Assume the risk free is given by 1mo Treasury Bills.

(e) Looking at historical stock market data, you determined that your beta is roughly 1.4 with respect to the market benchmark you used above to compute the risk premium. What should your cost of equity be?

(f) In order to get a little more comfortable with the number computed above, you decided to look at the cost of equity using the dividend growth corresponding to the 3.5% growth scenario from (c). What is the cost of equity using this approach? In order to determine your cost of debt, you decided to look at your long term debt, which is structured as a single 20yr bond with semi-annual coupons, a coupon rate of 10%, and is currently trading at 105%.

(g) What is your cost of debt?

(h) What is your after-tax cost of debt? Your CEO is interested in knowing what is the minimum return the company should generate to make sure investors are satisfied, but is not sure which number to focus on.

(i) What measure should you propose and how would you explain it to your CEO?

(j) What is the value for the proposed measure?

Market-to-book Ratio is 1.25

Income Statement 2015 $43,000,000 Taxes: Sales 40% $30,000,000 COGS Shares outstanding 1,000,000 $5,000,000 Other expenses Depreciation $2,000,000 $6,000,000 EBIT $2,000,000 nterest $4,000,000 Taxable income Taxes (40%) $1,600,000 Net income $2,400,000 Dividends $600,000 Add to RE $1,800,000 Balance Sheet, Dec 31, 2015 Liabilities & Owners' Equity Assets Current Assets Current Liabilities ash $500,000 Accounts Payable $1,000,000 Notes Payable $3,000,000 Accounts Receivable $1,000,000 Inventory $2,000,000 Total CL $4,000,000 Total CA Long Term Debt $10,000,000 $3,500,000 Fixed Assets Owners' Equity Common Stock $6,500,000 Net PP&E $25,000,000 Retained Earnings $8.000,000 Total Equity $141500,000 Total L & O $28.500.000 Total Assets $28.500.000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started