Answered step by step

Verified Expert Solution

Question

1 Approved Answer

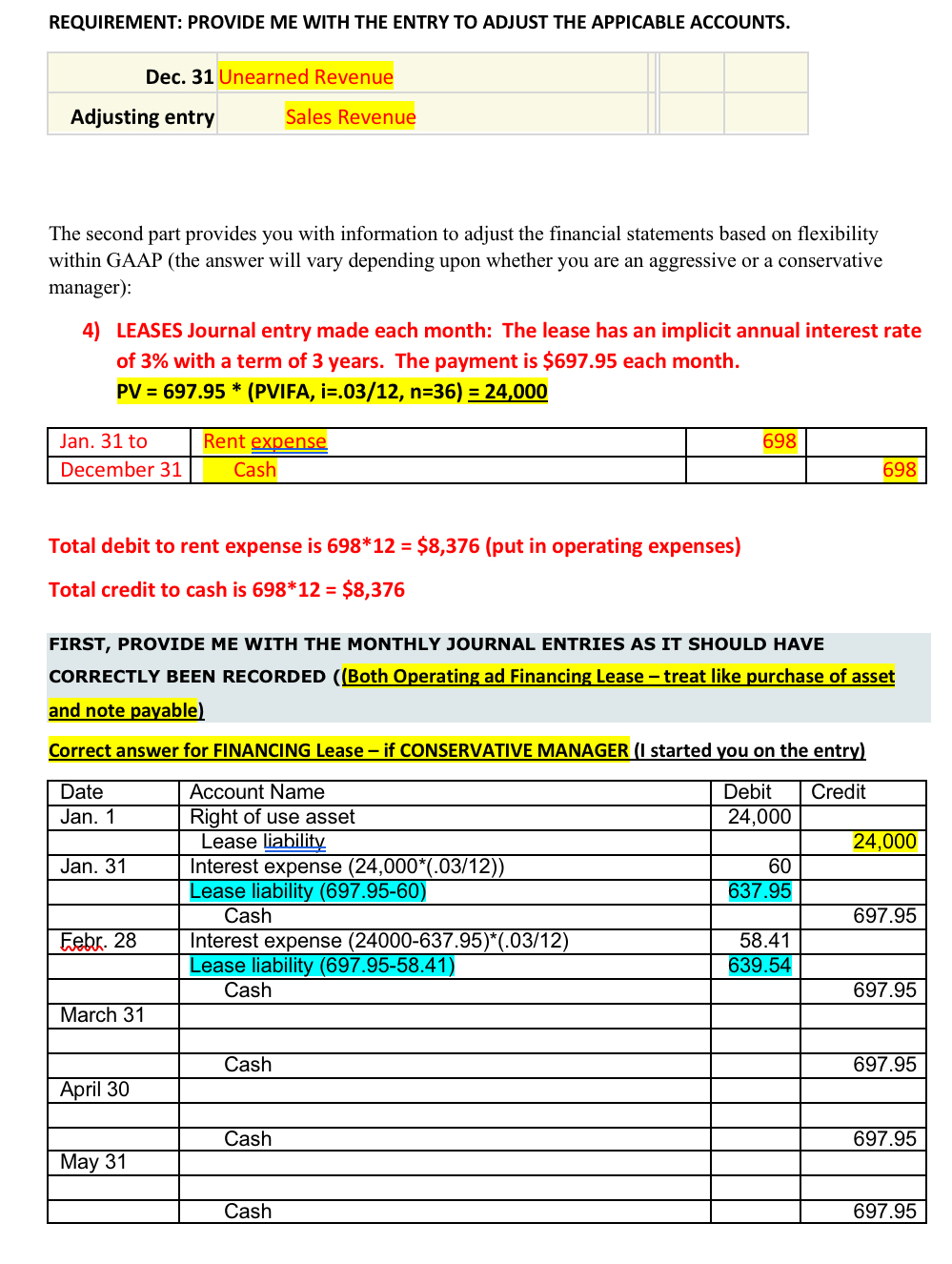

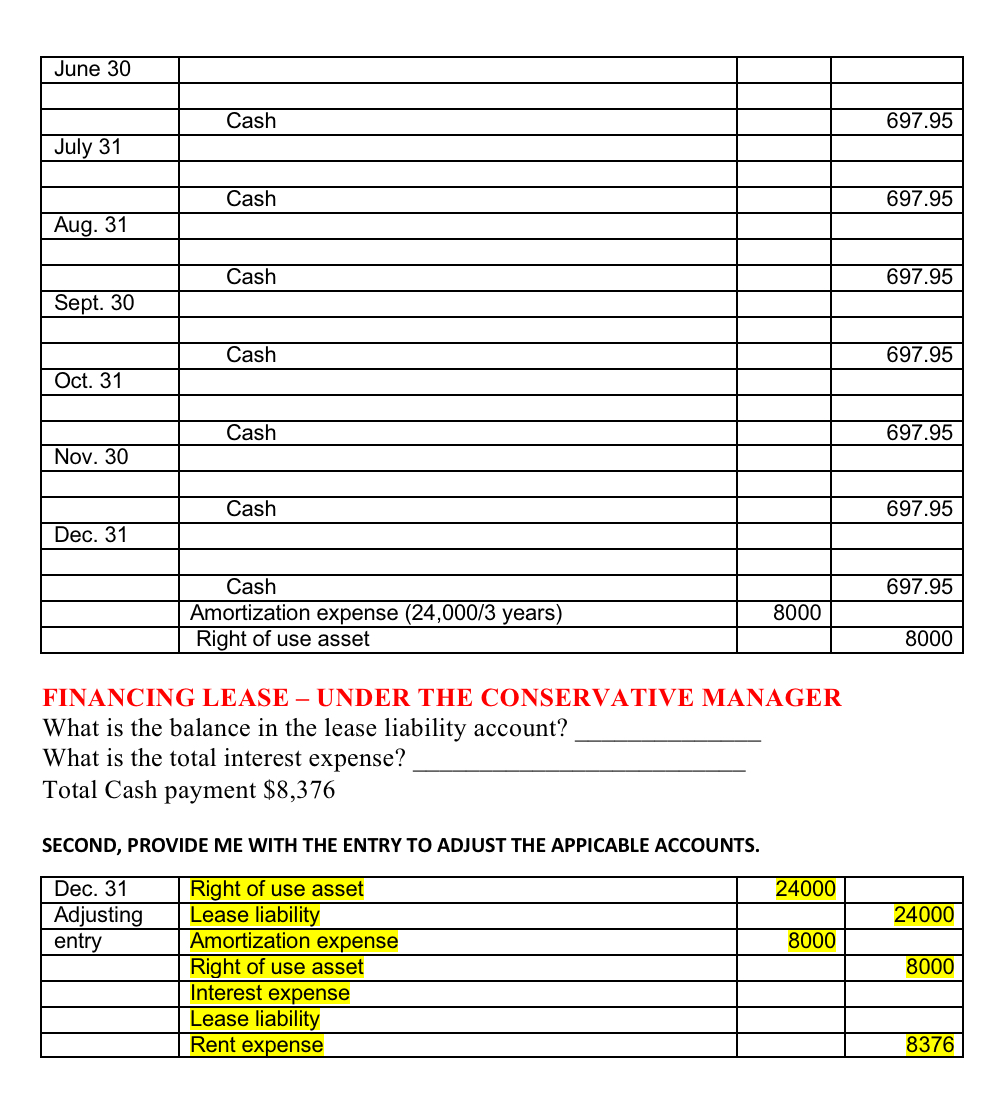

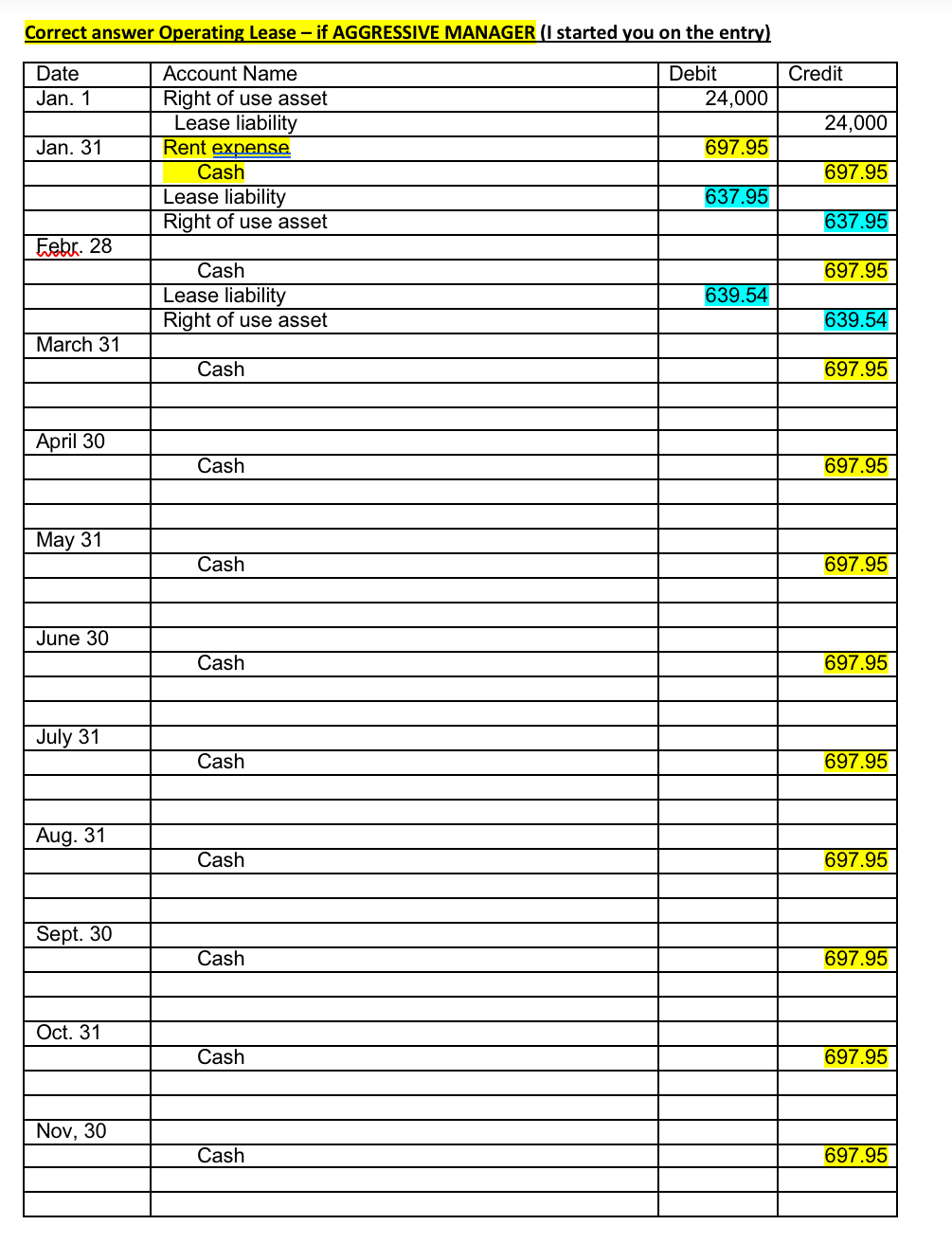

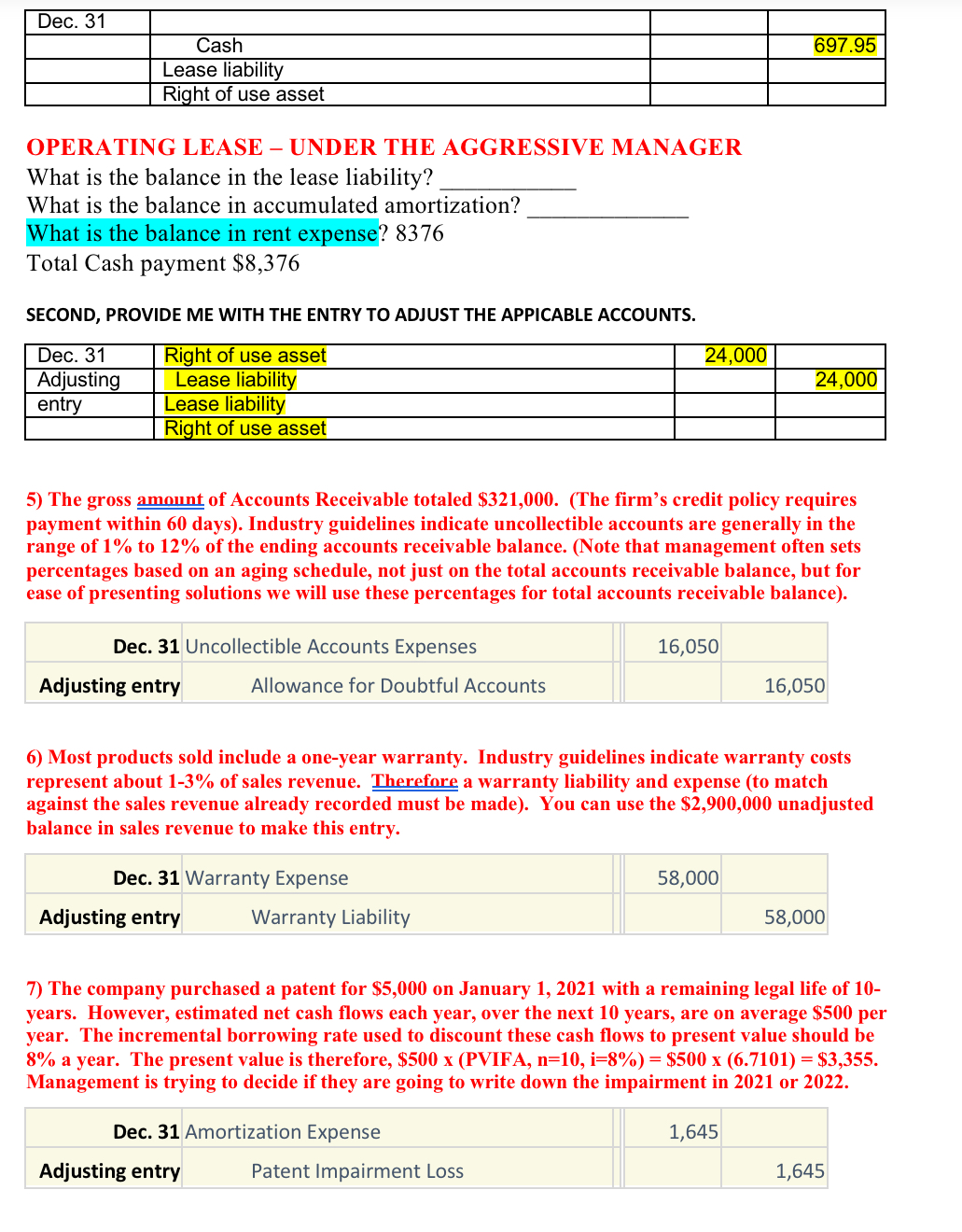

QUESTION: This case demonstrates the flexibility management has in determining Net Income under Generally Accepted Accounting Principles (GAAP). Most courses dealing with Financial Accounting present

QUESTION:

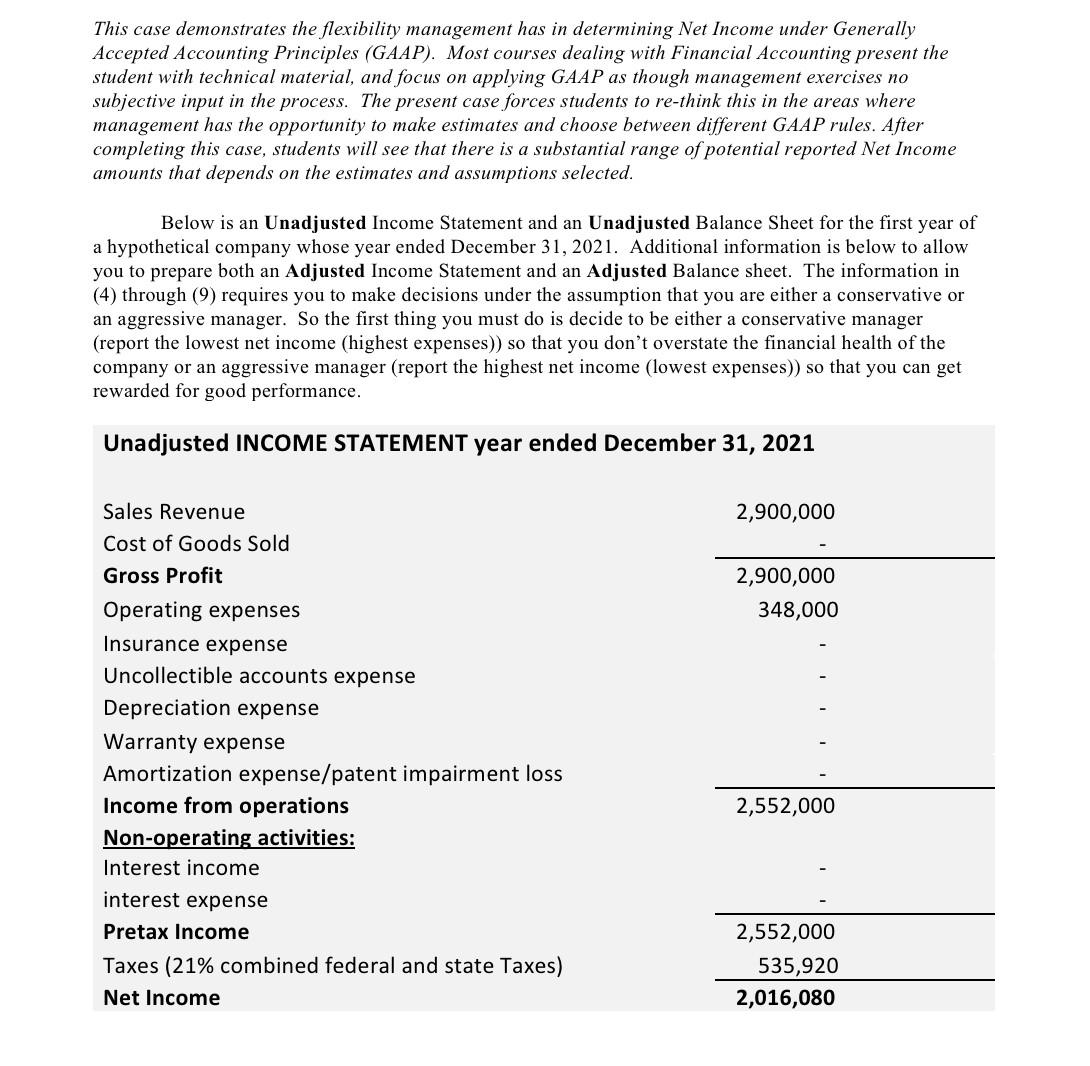

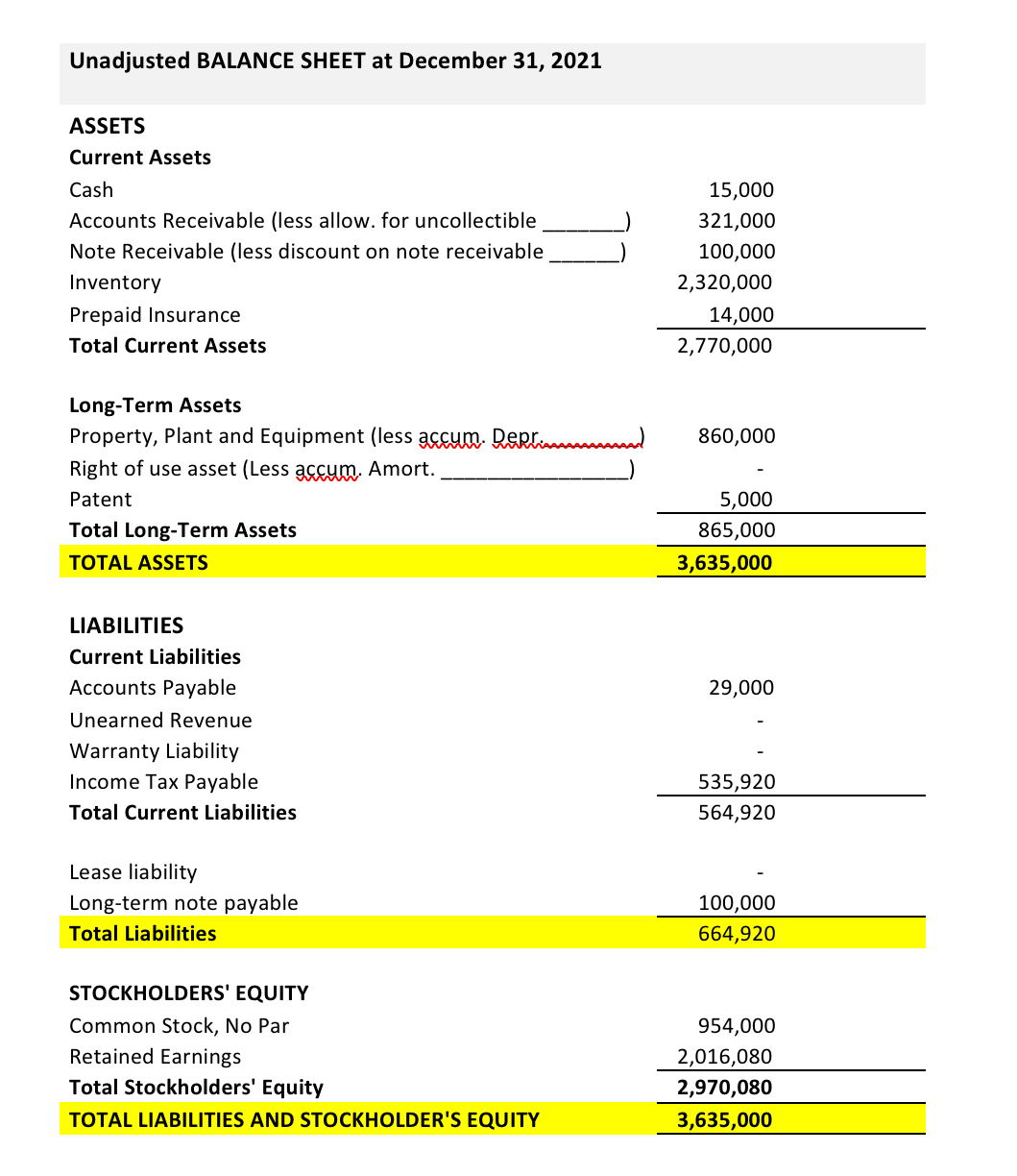

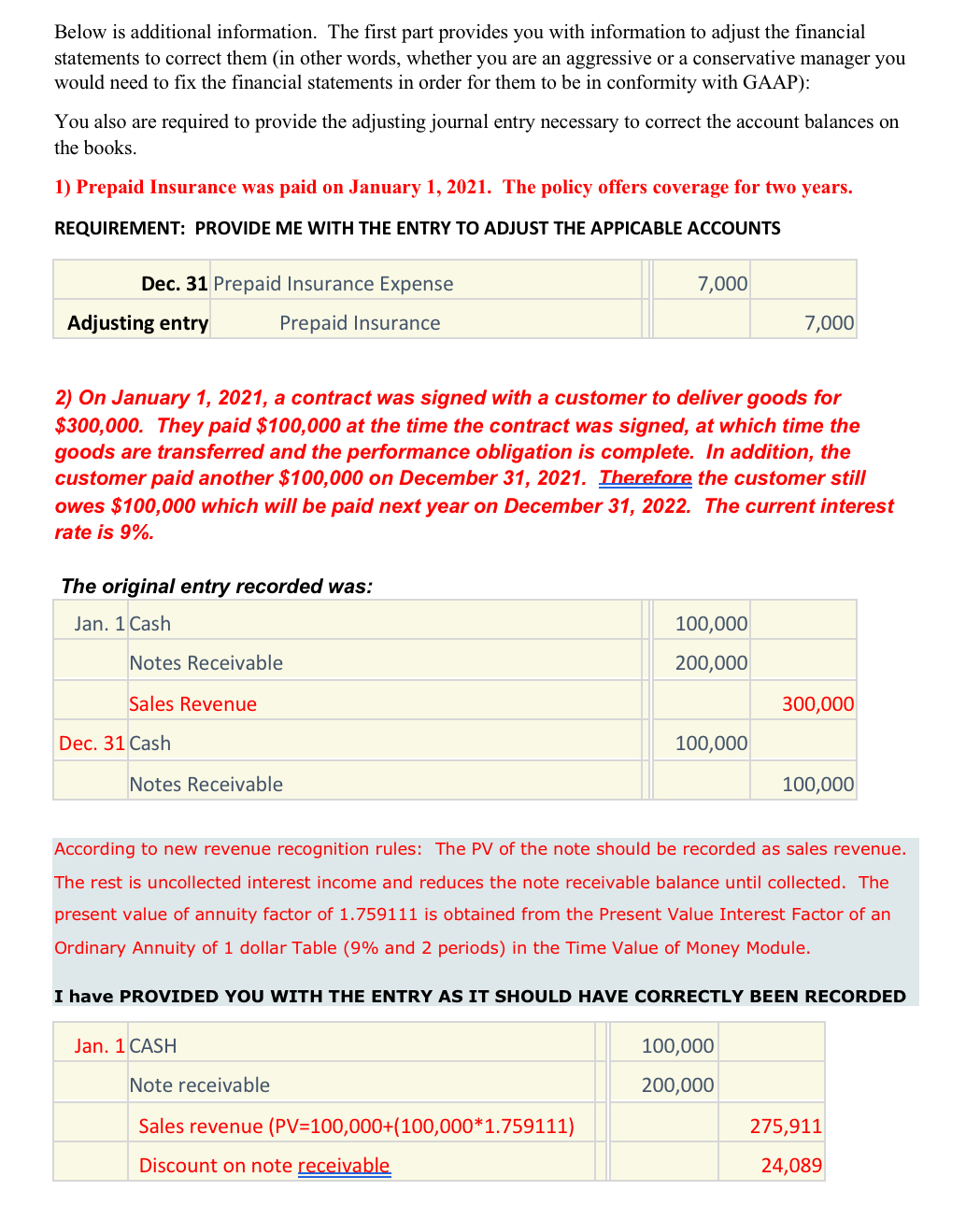

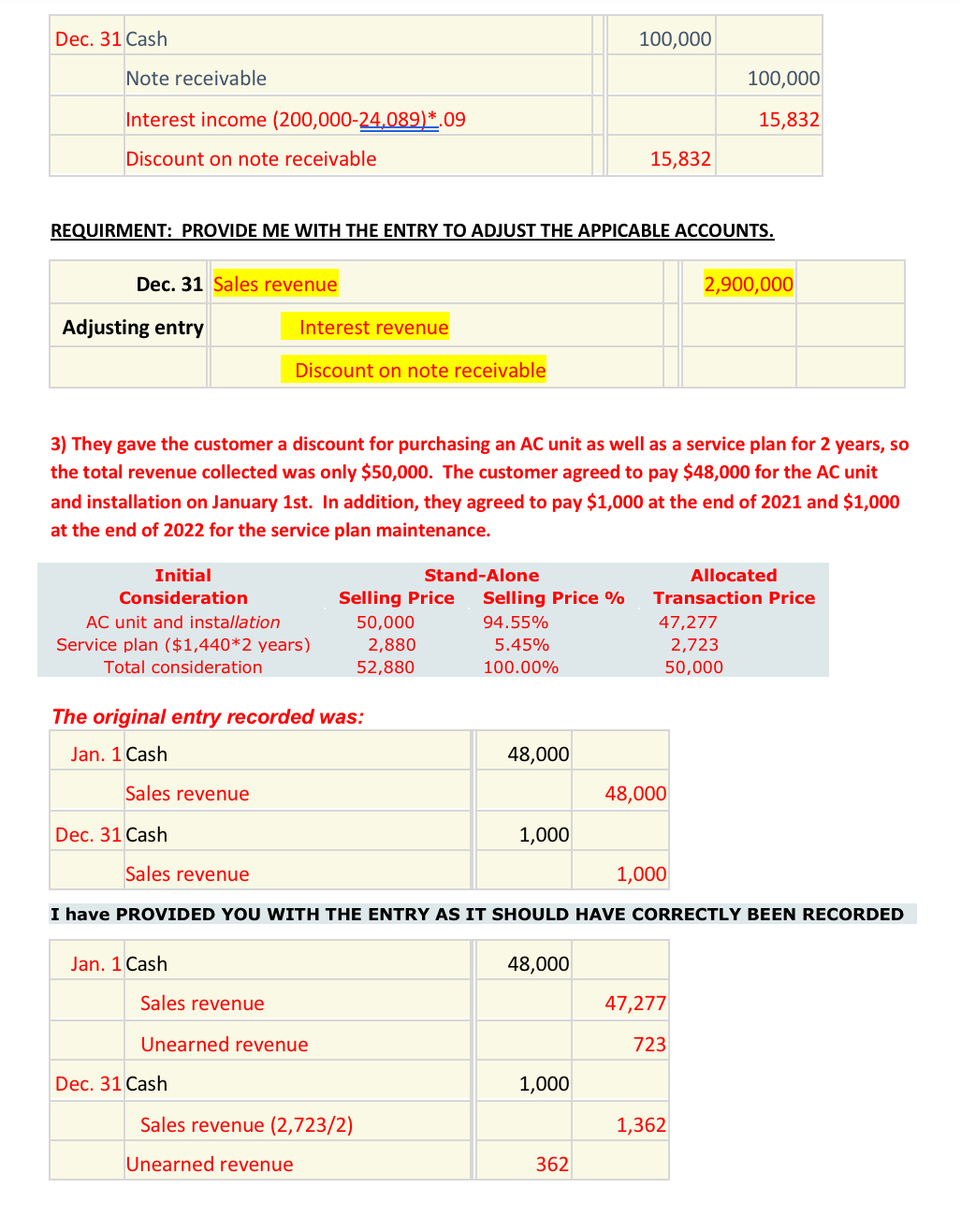

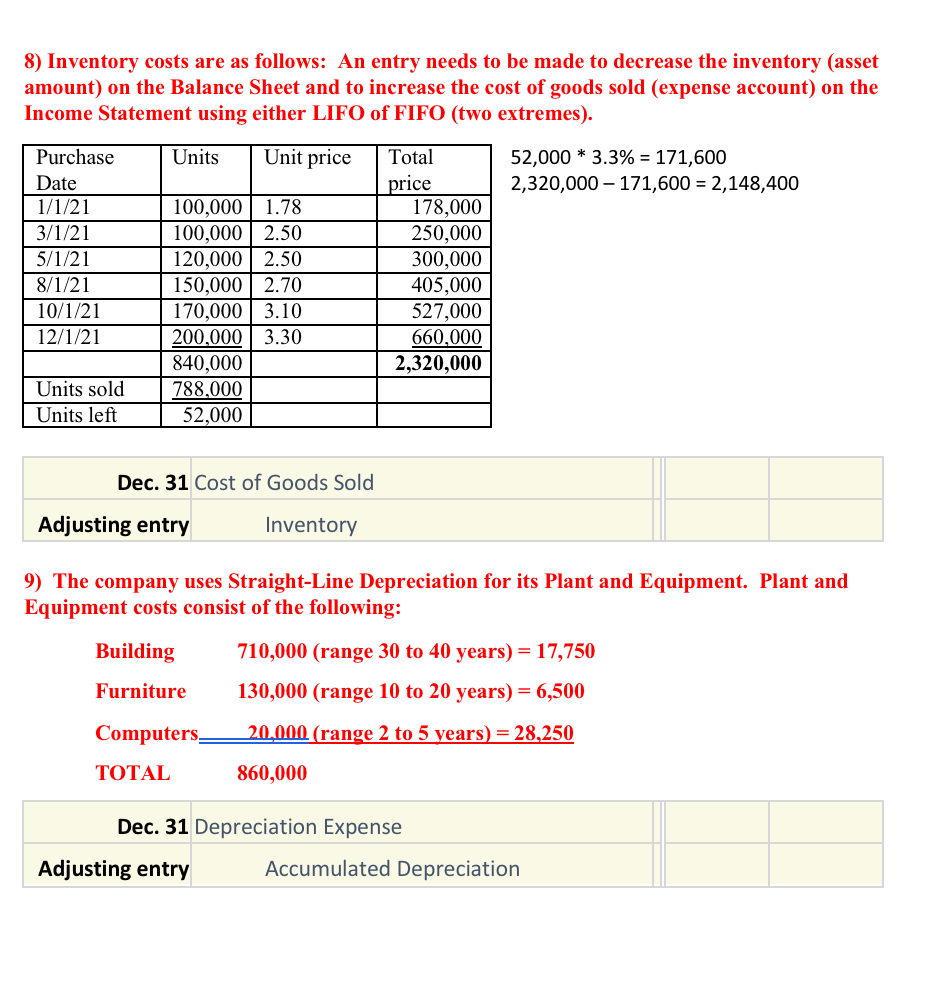

This case demonstrates the flexibility management has in determining Net Income under Generally Accepted Accounting Principles (GAAP). Most courses dealing with Financial Accounting present the student with technical material, and focus on applying GAAP as though management exercises no subjective input in the process. The present case forces students to re-think this in the areas where management has the opportunity to make estimates and choose between different GAAP rules. After completing this case, students will see that there is a substantial range of potential reported Net Income amounts that depends on the estimates and assumptions selected. Below is an Unadjusted Income Statement and an Unadjusted Balance Sheet for the first year of a hypothetical company whose year ended December 31, 2021. Additional information is below to allow you to prepare both an Adjusted Income Statement and an Adjusted Balance sheet. The information in (4) through (9) requires you to make decisions under the assumption that you are either a conservative or an aggressive manager. So the first thing you must do is decide to be either a conservative manager (report the lowest net income (highest expenses)) so that you don't overstate the financial health of the company or an aggressive manager (report the highest net income (lowest expenses)) so that you can get rewarded for good performance. Unadjusted INCOME STATEMENT year ended December 31, 2021 Sales Revenue Cost of Goods Sold Gross Profit Operating expenses Insurance expense 2,900,000 2,900,000 348,000 Uncollectible accounts expense Depreciation expense Warranty expense Amortization expense/patent impairment loss Income from operations 2,552,000 Non-operating activities: Interest income interest expense Pretax Income 2,552,000 Taxes (21% combined federal and state Taxes) 535,920 Net Income 2,016,080

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started