Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION: ? THIS IS THE CORRECT ANSWERS FROM THE QUESTIONS ABOVE HOW TO GET THE ANNUAL ADDITION? Common-law Partner Information Prior to July 2021 ,

QUESTION:

?

THIS IS THE CORRECT ANSWERS FROM THE QUESTIONS ABOVE

HOW TO GET THE ANNUAL ADDITION?

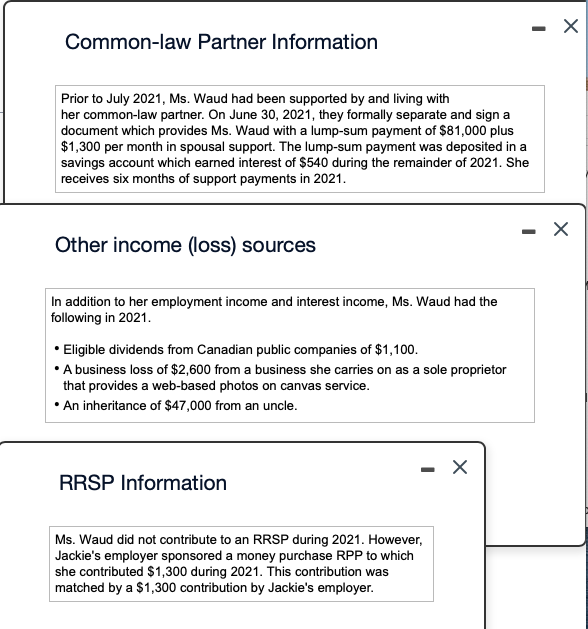

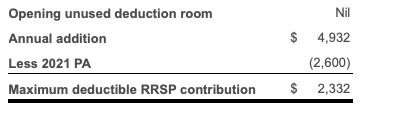

Common-law Partner Information Prior to July 2021 , Ms. Waud had been supported by and living with her common-law partner. On June 30, 2021, they formally separate and sign a document which provides Ms. Waud with a lump-sum payment of $81,000 plus $1,300 per month in spousal support. The lump-sum payment was deposited in a savings account which earned interest of $540 during the remainder of 2021 . She receives six months of support payments in 2021. Other income (loss) sources In addition to her employment income and interest income, Ms. Waud had the following in 2021. - Eligible dividends from Canadian public companies of $1,100. - A business loss of $2,600 from a business she carries on as a sole proprietor that provides a web-based photos on canvas service. - An inheritance of $47,000 from an uncle. RRSP Information Ms. Waud did not contribute to an RRSP during 2021. However, Jackie's employer sponsored a money purchase RPP to which she contributed $1,300 during 2021 . This contribution was matched by a $1,300 contribution by Jackie's employer. \begin{tabular}{lrr} Opening unused deduction room & Nil \\ Annual addition & $ & 4,932 \\ Less 2021 PA & (2,600) \\ \hline Maximum deductible RRSP contribution & $ & 2,332 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started