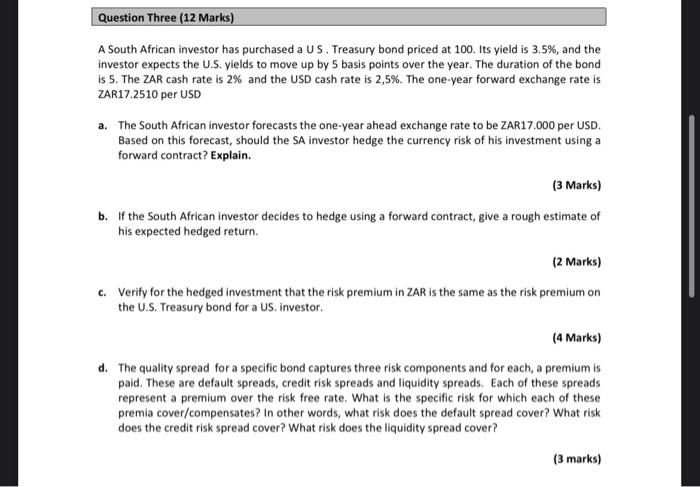

Question Three (12 Marks) A South African investor has purchased a US Treasury bond priced at 100. Its yield is 3.5%, and the investor expects the U.S. yields to move up by 5 basis points over the year. The duration of the bond is 5. The ZAR cash rate is 2% and the USD cash rate is 2,5%. The one-year forward exchange rate is ZAR17.2510 per USD a. The South African investor forecasts the one-year ahead exchange rate to be ZAR17.000 per USD. Based on this forecast, should the SA investor hedge the currency risk of his investment using a forward contract? Explain. (3 Marks) b. If the South African investor decides to hedge using a forward contract, give a rough estimate of his expected hedged return. (2 Marks) c. Verify for the hedged investment that the risk premium in ZAR is the same as the risk premium on the U.S. Treasury bond for a US, investor. (4 Marks) d. The quality spread for a specific bond captures three risk components and for each, a premium is paid. These are default spreads, credit risk spreads and liquidity spreads. Each of these spreads represent a premium over the risk free rate. What is the specific risk for which each of these premia cover/compensates? In other words, what risk does the default spread cover? What risk does the credit risk spread cover? What risk does the liquidity spread cover? (3 marks) Question Three (12 Marks) A South African investor has purchased a US Treasury bond priced at 100. Its yield is 3.5%, and the investor expects the U.S. yields to move up by 5 basis points over the year. The duration of the bond is 5. The ZAR cash rate is 2% and the USD cash rate is 2,5%. The one-year forward exchange rate is ZAR17.2510 per USD a. The South African investor forecasts the one-year ahead exchange rate to be ZAR17.000 per USD. Based on this forecast, should the SA investor hedge the currency risk of his investment using a forward contract? Explain. (3 Marks) b. If the South African investor decides to hedge using a forward contract, give a rough estimate of his expected hedged return. (2 Marks) c. Verify for the hedged investment that the risk premium in ZAR is the same as the risk premium on the U.S. Treasury bond for a US, investor. (4 Marks) d. The quality spread for a specific bond captures three risk components and for each, a premium is paid. These are default spreads, credit risk spreads and liquidity spreads. Each of these spreads represent a premium over the risk free rate. What is the specific risk for which each of these premia cover/compensates? In other words, what risk does the default spread cover? What risk does the credit risk spread cover? What risk does the liquidity spread cover