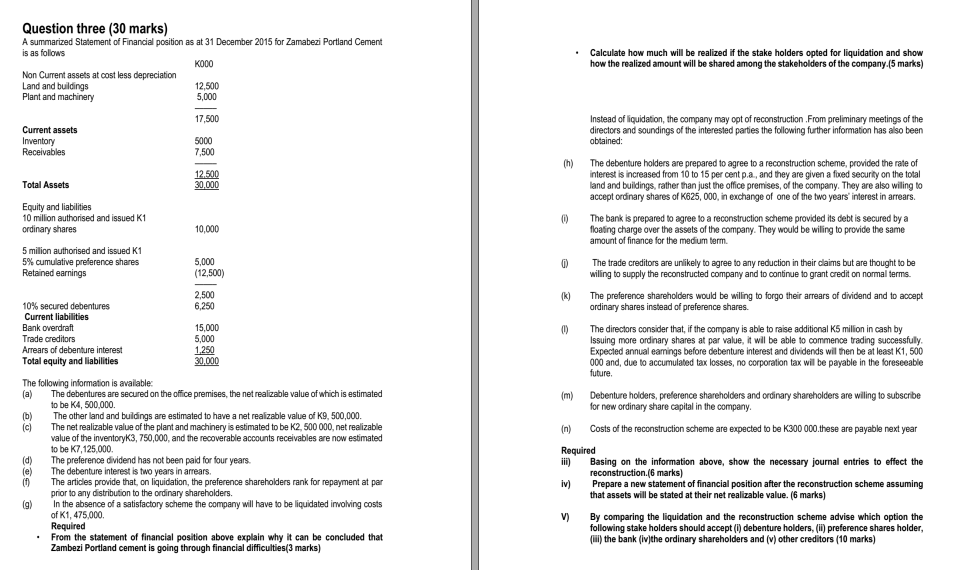

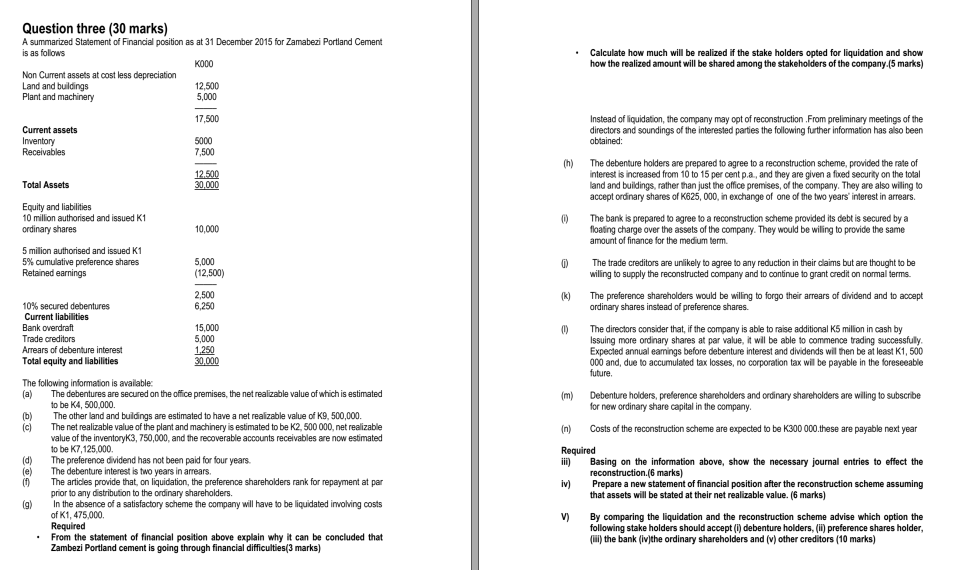

Question three (30 marks) A summarized Statement of Financial position as at 31 December 2015 for Zamabezi Portland Cement K000 12,500 is as folows Calculate how much will be realized if the stake holders opted for liquidation and show how the realized amount will be shared among the stakeholders of the company (5 marks) Non Current assets at cost less depreciation Land and buildings Plant and machinery 5,000 17,500 5000 Instead of liquidation, the company may opt of reconstruction From preliminary meetings of the Current assets directors and soundings of the interested parties the following further information has also been obtained: 7,500 (h) The debenture holders are prepared to agree to a reconstruction scheme, provided the rate of nterest is increased from 10 to 15 per cent p.a, and they are given a fxed security on the total and and buildings, rather than just the office premises, of the company. They are also wiling to accept ordinary shares of K625, 000, in exchange of one of the two years interest in arrears 12.500 Total Assets 30,000 Equity and liabilities 10 million authorised and issued K1 ordinary shares (i) The bank is prepared to agree to a reconstruction scheme provided its debt is secured by a floaing charge over the assets of the company. They would be wiling to provide the same amount of finance for the medium term 10,000 5 milion authorised and issued K1 5% cumulative preference shares Retained earnings 5,000 (12,500) (j) The trade creditors are unlikely to agree to any reduction in their dams but are thought to be (k) The preferenoa shareholders would be willing to forgo their arrears of dividand and to acpept (1) The directors consider that, if the company is able to raise additional K5 million in cash by willing to supply the reconstructed company and to contnue to grant credit on nomal terms. 2,500 6,250 10% secured debentures Current liabilities Bank overdraft Trade creditors Arrears of debenture interest Total equity and liabilities ordinary shares instead of preference shares. 15,000 5,000 1250 30,000 Issuing more ordinary shares at par value, it will be able to commence trading successfuly Expected annual eamings before debenture interest and dividends wil then be at least K1, 500 000 and, due to accumulated tax losses, no corporation tax will be payable in the foreseeable future The following information is available: (a) The debentures are secured on the office premises,the net realizable value ofwhich is estimated (m) Debenture holders, preference shareholders and ordinary shareholders are wiling to subscrbe (n) Costs of the reconstruction scheme are expected to be K300 000.these are payable next year i Basing on the information above, show the necessary journal entries to effect the to be K4, 500,000. for new ordinary share capital in the company. The other land and buildings are estimated to have a net realizable value of K9, 500,000 (c) b) The net realizable value of the plant and machinery is estimated to be K2, 500000, net realizable value of the inventoryK3, 750,000, and the recoverable accounts receivables are now estimated to be K7,125,000. (d) The preference dividend has not been paid for four years. (e) The debenture interest is two years in arrears. (i The articles provide that, on liquidation, the preference shareholders rank for repayment at par reconstruction.(6 marks) Prepare a new statement of financial position after the reconstruction scheme assuming that assets will be stated at their net realizable value. (6 marks) iv) prior to any distribution to the ordinary shareholders. (g) In the absence of a satisfactory scheme the company will have to be liquidated involving costs of K1, 475,000. Required V) By comparing the liquidation and the reconstruction scheme advise which option the following stake holders should accept (i) debenture holders, (ii) preference shares holder (i) the bank (ivthe ordinary shareholders and (v) other creditors (10 marks) From the statement of financial position above explain why it can be concluded that Zambezi Portland cement is going through financial difficulties(3 marks) Question three (30 marks) A summarized Statement of Financial position as at 31 December 2015 for Zamabezi Portland Cement K000 12,500 is as folows Calculate how much will be realized if the stake holders opted for liquidation and show how the realized amount will be shared among the stakeholders of the company (5 marks) Non Current assets at cost less depreciation Land and buildings Plant and machinery 5,000 17,500 5000 Instead of liquidation, the company may opt of reconstruction From preliminary meetings of the Current assets directors and soundings of the interested parties the following further information has also been obtained: 7,500 (h) The debenture holders are prepared to agree to a reconstruction scheme, provided the rate of nterest is increased from 10 to 15 per cent p.a, and they are given a fxed security on the total and and buildings, rather than just the office premises, of the company. They are also wiling to accept ordinary shares of K625, 000, in exchange of one of the two years interest in arrears 12.500 Total Assets 30,000 Equity and liabilities 10 million authorised and issued K1 ordinary shares (i) The bank is prepared to agree to a reconstruction scheme provided its debt is secured by a floaing charge over the assets of the company. They would be wiling to provide the same amount of finance for the medium term 10,000 5 milion authorised and issued K1 5% cumulative preference shares Retained earnings 5,000 (12,500) (j) The trade creditors are unlikely to agree to any reduction in their dams but are thought to be (k) The preferenoa shareholders would be willing to forgo their arrears of dividand and to acpept (1) The directors consider that, if the company is able to raise additional K5 million in cash by willing to supply the reconstructed company and to contnue to grant credit on nomal terms. 2,500 6,250 10% secured debentures Current liabilities Bank overdraft Trade creditors Arrears of debenture interest Total equity and liabilities ordinary shares instead of preference shares. 15,000 5,000 1250 30,000 Issuing more ordinary shares at par value, it will be able to commence trading successfuly Expected annual eamings before debenture interest and dividends wil then be at least K1, 500 000 and, due to accumulated tax losses, no corporation tax will be payable in the foreseeable future The following information is available: (a) The debentures are secured on the office premises,the net realizable value ofwhich is estimated (m) Debenture holders, preference shareholders and ordinary shareholders are wiling to subscrbe (n) Costs of the reconstruction scheme are expected to be K300 000.these are payable next year i Basing on the information above, show the necessary journal entries to effect the to be K4, 500,000. for new ordinary share capital in the company. The other land and buildings are estimated to have a net realizable value of K9, 500,000 (c) b) The net realizable value of the plant and machinery is estimated to be K2, 500000, net realizable value of the inventoryK3, 750,000, and the recoverable accounts receivables are now estimated to be K7,125,000. (d) The preference dividend has not been paid for four years. (e) The debenture interest is two years in arrears. (i The articles provide that, on liquidation, the preference shareholders rank for repayment at par reconstruction.(6 marks) Prepare a new statement of financial position after the reconstruction scheme assuming that assets will be stated at their net realizable value. (6 marks) iv) prior to any distribution to the ordinary shareholders. (g) In the absence of a satisfactory scheme the company will have to be liquidated involving costs of K1, 475,000. Required V) By comparing the liquidation and the reconstruction scheme advise which option the following stake holders should accept (i) debenture holders, (ii) preference shares holder (i) the bank (ivthe ordinary shareholders and (v) other creditors (10 marks) From the statement of financial position above explain why it can be concluded that Zambezi Portland cement is going through financial difficulties