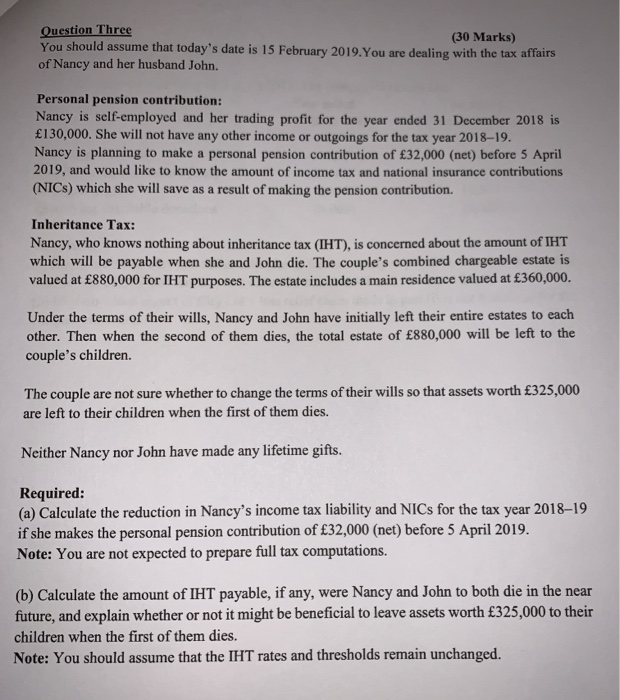

Question Three (30 Marks) You should assume that today's date is 15 February 2019. You are dealing with the tax affairs of Nancy and her husband John. Personal pension contribution: Nancy is self-employed and her trading profit for the year ended 31 December 2018 is 130,000. She will not have any other income or outgoings for the tax year 2018-19. Nancy is planning to make a personal pension contribution of 32,000 (net) before 5 April 2019, and would like to know the amount of income tax and national insurance contributions (NICS) which she will save as a result of making the pension contribution. Inheritance Tax: Nancy, who knows nothing about inheritance tax (IHT), is concerned about the amount of IHT which will be payable when she and John die. The couple's combined chargeable estate is valued at 880,000 for THT purposes. The estate includes a main residence valued at 360,000, Under the terms of their wills, Nancy and John have initially left their entire estates to each other. Then when the second of them dies, the total estate of 880,000 will be left to the couple's children. The couple are not sure whether to change the terms of their wills so that assets worth 325,000 are left to their children when the first of them dies. Neither Nancy nor John have made any lifetime gifts. Required: (a) Calculate the reduction in Nancy's income tax liability and NICs for the tax year 2018-19 if she makes the personal pension contribution of 32,000 (net) before 5 April 2019. Note: You are not expected to prepare full tax computations. (b) Calculate the amount of IHT payable, if any, were Nancy and John to both die in the near future, and explain whether or not it might be beneficial to leave assets worth 325,000 to their children when the first of them dies. Note: You should assume that the IHT rates and thresholds remain unchanged. Question Three (30 Marks) You should assume that today's date is 15 February 2019. You are dealing with the tax affairs of Nancy and her husband John. Personal pension contribution: Nancy is self-employed and her trading profit for the year ended 31 December 2018 is 130,000. She will not have any other income or outgoings for the tax year 2018-19. Nancy is planning to make a personal pension contribution of 32,000 (net) before 5 April 2019, and would like to know the amount of income tax and national insurance contributions (NICS) which she will save as a result of making the pension contribution. Inheritance Tax: Nancy, who knows nothing about inheritance tax (IHT), is concerned about the amount of IHT which will be payable when she and John die. The couple's combined chargeable estate is valued at 880,000 for THT purposes. The estate includes a main residence valued at 360,000, Under the terms of their wills, Nancy and John have initially left their entire estates to each other. Then when the second of them dies, the total estate of 880,000 will be left to the couple's children. The couple are not sure whether to change the terms of their wills so that assets worth 325,000 are left to their children when the first of them dies. Neither Nancy nor John have made any lifetime gifts. Required: (a) Calculate the reduction in Nancy's income tax liability and NICs for the tax year 2018-19 if she makes the personal pension contribution of 32,000 (net) before 5 April 2019. Note: You are not expected to prepare full tax computations. (b) Calculate the amount of IHT payable, if any, were Nancy and John to both die in the near future, and explain whether or not it might be beneficial to leave assets worth 325,000 to their children when the first of them dies. Note: You should assume that the IHT rates and thresholds remain unchanged