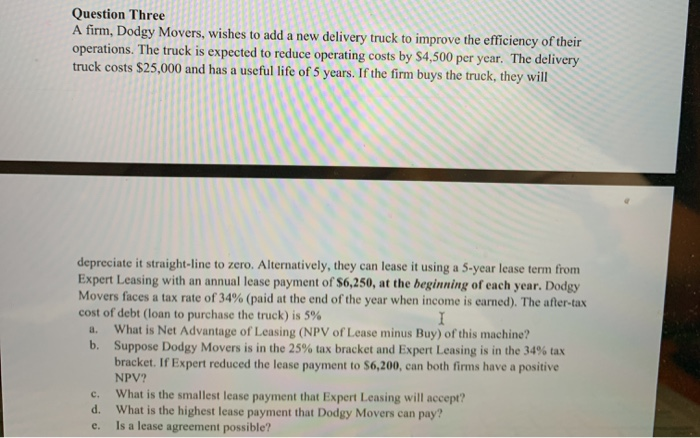

Question Three A firm, Dodgy Movers, wishes to add a new delivery truck to improve the efficiency of their operations. The truck is expected to reduce operating costs by S4,500 per year. The delivery truck costs $25,000 and has a useful life of 5 years. If the firm buys the truck, they will I depreciate it straight-line to zero. Alternatively, they can lease it using a 5-year lease term from Expert Leasing with an annual lease payment of $6,250, at the beginning of each year. Dodgy Movers faces a tax rate of 34% (paid at the end of the year when income is earned). The after-tax cost of debt (loan to purchase the truck) is 5% What is Net Advantage of Leasing (NPV of Lease minus Buy) of this machine? b. Suppose Dodgy Movers is in the 25% tax bracket and Expert Leasing is in the 34% tax bracket. If Expert reduced the lease payment to S6,200, can both firms have a positive NPV? What is the smallest lease payment that Expert Leasing will accept? d. What is the highest lease payment that Dodgy Movers can pay? Is a lease agreement possible? c. e. Question Three A firm, Dodgy Movers, wishes to add a new delivery truck to improve the efficiency of their operations. The truck is expected to reduce operating costs by S4,500 per year. The delivery truck costs $25,000 and has a useful life of 5 years. If the firm buys the truck, they will I depreciate it straight-line to zero. Alternatively, they can lease it using a 5-year lease term from Expert Leasing with an annual lease payment of $6,250, at the beginning of each year. Dodgy Movers faces a tax rate of 34% (paid at the end of the year when income is earned). The after-tax cost of debt (loan to purchase the truck) is 5% What is Net Advantage of Leasing (NPV of Lease minus Buy) of this machine? b. Suppose Dodgy Movers is in the 25% tax bracket and Expert Leasing is in the 34% tax bracket. If Expert reduced the lease payment to S6,200, can both firms have a positive NPV? What is the smallest lease payment that Expert Leasing will accept? d. What is the highest lease payment that Dodgy Movers can pay? Is a lease agreement possible? c. e