Answered step by step

Verified Expert Solution

Question

1 Approved Answer

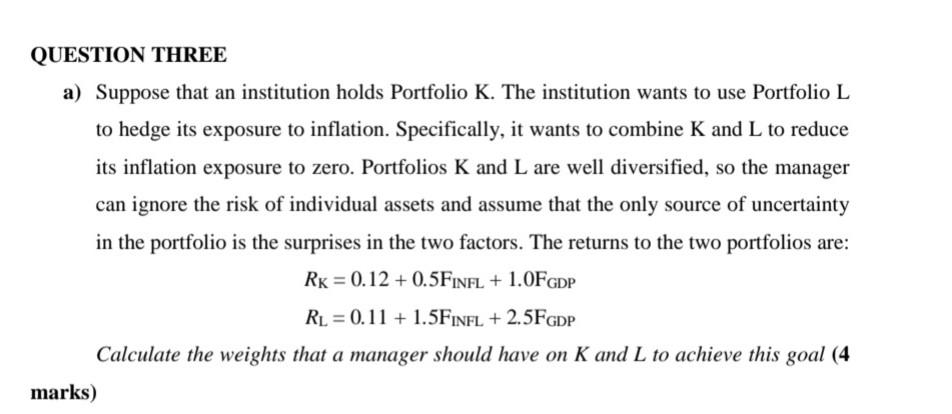

QUESTION THREE a) Suppose that an institution holds Portfolio K. The institution wants to use Portfolio L to hedge its exposure to inflation. Specifically, it

QUESTION THREE a) Suppose that an institution holds Portfolio K. The institution wants to use Portfolio L to hedge its exposure to inflation. Specifically, it wants to combine K and L to reduce K L its inflation exposure to zero. Portfolios K and L are well diversified, so the manager can ignore the risk of individual assets and assume that the only source of uncertainty in the portfolio is the surprises in the two factors. The returns to the two portfolios are: RK = 0.12 +0.5FINFL + 1.0FGDP RL = 0.11 + 1.5FINFL + 2.5FGDP Calculate the weights that a manager should have on K and L to achieve this goal (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started