Answered step by step

Verified Expert Solution

Question

1 Approved Answer

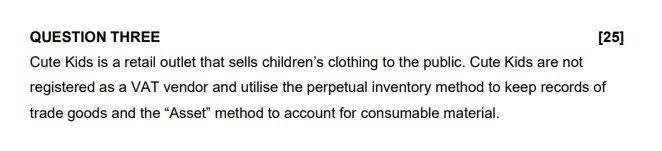

QUESTION THREE Cute Kids is a retail outlet that sells children's clothing to the public. Cute Kids are not registered as a VAT vendor and

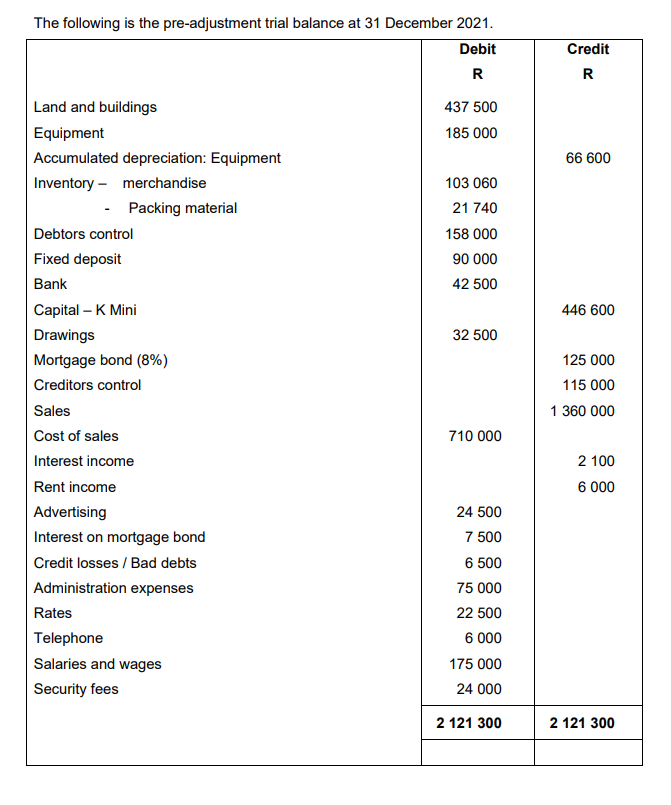

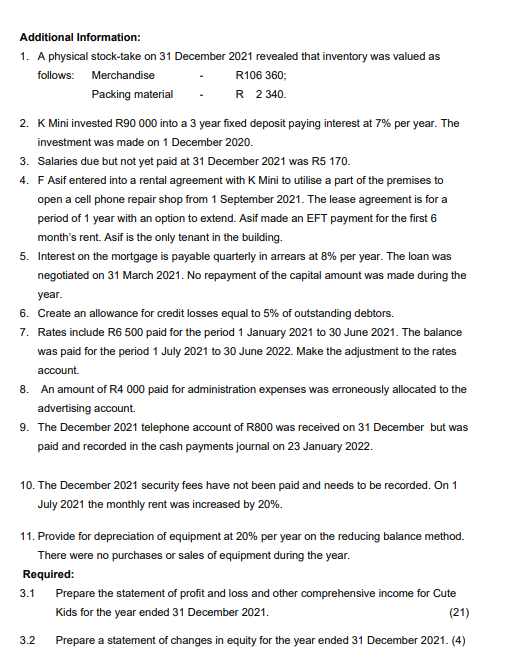

QUESTION THREE Cute Kids is a retail outlet that sells children's clothing to the public. Cute Kids are not registered as a VAT vendor and utilise the perpetual inventory method to keep records of trade goods and the "Asset" method to account for consumable material. Additional Information: 1. A physical stock-take on 31 December 2021 revealed that inventory was valued as follows: Merchandise R106 360; Packing material R 2340 . 2. K Mini invested R90000 into a 3 year fixed deposit paying interest at 7% per year. The investment was made on 1 December 2020. 3. Salaries due but not yet paid at 31 December 2021 was R5 170. 4. F Asif entered into a rental agreement with K Mini to utilise a part of the premises to open a cell phone repair shop from 1 September 2021. The lease agreement is for a period of 1 year with an option to extend. Asif made an EFT payment for the first 6 month's rent. Asif is the only tenant in the building. 5. Interest on the mortgage is payable quarterly in arrears at 8% per year. The loan was negotiated on 31 March 2021. No repayment of the capital amount was made during the year. 6. Create an allowance for credit losses equal to 5% of outstanding debtors. 7. Rates include R6 500 paid for the period 1 January 2021 to 30 June 2021 . The balance was paid for the period 1 July 2021 to 30 June 2022. Make the adjustment to the rates account. 8. An amount of R4 000 paid for administration expenses was erroneously allocated to the advertising account. 9. The December 2021 telephone account of R800 was received on 31 December but was paid and recorded in the cash payments journal on 23 January 2022. 10. The December 2021 security fees have not been paid and needs to be recorded. On 1 July 2021 the monthly rent was increased by 20%. 11. Provide for depreciation of equipment at 20% per year on the reducing balance method. There were no purchases or sales of equipment during the year. Required: 3.1 Prepare the statement of profit and loss and other comprehensive income for Cute Kids for the year ended 31 December 2021. 3.2 Prepare a statement of changes in equity for the year ended 31 December 2021. (4) The following is the pre-adjustment trial balance at 31 December 2021. QUESTION THREE Cute Kids is a retail outlet that sells children's clothing to the public. Cute Kids are not registered as a VAT vendor and utilise the perpetual inventory method to keep records of trade goods and the "Asset" method to account for consumable material. Additional Information: 1. A physical stock-take on 31 December 2021 revealed that inventory was valued as follows: Merchandise R106 360; Packing material R 2340 . 2. K Mini invested R90000 into a 3 year fixed deposit paying interest at 7% per year. The investment was made on 1 December 2020. 3. Salaries due but not yet paid at 31 December 2021 was R5 170. 4. F Asif entered into a rental agreement with K Mini to utilise a part of the premises to open a cell phone repair shop from 1 September 2021. The lease agreement is for a period of 1 year with an option to extend. Asif made an EFT payment for the first 6 month's rent. Asif is the only tenant in the building. 5. Interest on the mortgage is payable quarterly in arrears at 8% per year. The loan was negotiated on 31 March 2021. No repayment of the capital amount was made during the year. 6. Create an allowance for credit losses equal to 5% of outstanding debtors. 7. Rates include R6 500 paid for the period 1 January 2021 to 30 June 2021 . The balance was paid for the period 1 July 2021 to 30 June 2022. Make the adjustment to the rates account. 8. An amount of R4 000 paid for administration expenses was erroneously allocated to the advertising account. 9. The December 2021 telephone account of R800 was received on 31 December but was paid and recorded in the cash payments journal on 23 January 2022. 10. The December 2021 security fees have not been paid and needs to be recorded. On 1 July 2021 the monthly rent was increased by 20%. 11. Provide for depreciation of equipment at 20% per year on the reducing balance method. There were no purchases or sales of equipment during the year. Required: 3.1 Prepare the statement of profit and loss and other comprehensive income for Cute Kids for the year ended 31 December 2021. 3.2 Prepare a statement of changes in equity for the year ended 31 December 2021. (4) The following is the pre-adjustment trial balance at 31 December 2021

QUESTION THREE Cute Kids is a retail outlet that sells children's clothing to the public. Cute Kids are not registered as a VAT vendor and utilise the perpetual inventory method to keep records of trade goods and the "Asset" method to account for consumable material. Additional Information: 1. A physical stock-take on 31 December 2021 revealed that inventory was valued as follows: Merchandise R106 360; Packing material R 2340 . 2. K Mini invested R90000 into a 3 year fixed deposit paying interest at 7% per year. The investment was made on 1 December 2020. 3. Salaries due but not yet paid at 31 December 2021 was R5 170. 4. F Asif entered into a rental agreement with K Mini to utilise a part of the premises to open a cell phone repair shop from 1 September 2021. The lease agreement is for a period of 1 year with an option to extend. Asif made an EFT payment for the first 6 month's rent. Asif is the only tenant in the building. 5. Interest on the mortgage is payable quarterly in arrears at 8% per year. The loan was negotiated on 31 March 2021. No repayment of the capital amount was made during the year. 6. Create an allowance for credit losses equal to 5% of outstanding debtors. 7. Rates include R6 500 paid for the period 1 January 2021 to 30 June 2021 . The balance was paid for the period 1 July 2021 to 30 June 2022. Make the adjustment to the rates account. 8. An amount of R4 000 paid for administration expenses was erroneously allocated to the advertising account. 9. The December 2021 telephone account of R800 was received on 31 December but was paid and recorded in the cash payments journal on 23 January 2022. 10. The December 2021 security fees have not been paid and needs to be recorded. On 1 July 2021 the monthly rent was increased by 20%. 11. Provide for depreciation of equipment at 20% per year on the reducing balance method. There were no purchases or sales of equipment during the year. Required: 3.1 Prepare the statement of profit and loss and other comprehensive income for Cute Kids for the year ended 31 December 2021. 3.2 Prepare a statement of changes in equity for the year ended 31 December 2021. (4) The following is the pre-adjustment trial balance at 31 December 2021. QUESTION THREE Cute Kids is a retail outlet that sells children's clothing to the public. Cute Kids are not registered as a VAT vendor and utilise the perpetual inventory method to keep records of trade goods and the "Asset" method to account for consumable material. Additional Information: 1. A physical stock-take on 31 December 2021 revealed that inventory was valued as follows: Merchandise R106 360; Packing material R 2340 . 2. K Mini invested R90000 into a 3 year fixed deposit paying interest at 7% per year. The investment was made on 1 December 2020. 3. Salaries due but not yet paid at 31 December 2021 was R5 170. 4. F Asif entered into a rental agreement with K Mini to utilise a part of the premises to open a cell phone repair shop from 1 September 2021. The lease agreement is for a period of 1 year with an option to extend. Asif made an EFT payment for the first 6 month's rent. Asif is the only tenant in the building. 5. Interest on the mortgage is payable quarterly in arrears at 8% per year. The loan was negotiated on 31 March 2021. No repayment of the capital amount was made during the year. 6. Create an allowance for credit losses equal to 5% of outstanding debtors. 7. Rates include R6 500 paid for the period 1 January 2021 to 30 June 2021 . The balance was paid for the period 1 July 2021 to 30 June 2022. Make the adjustment to the rates account. 8. An amount of R4 000 paid for administration expenses was erroneously allocated to the advertising account. 9. The December 2021 telephone account of R800 was received on 31 December but was paid and recorded in the cash payments journal on 23 January 2022. 10. The December 2021 security fees have not been paid and needs to be recorded. On 1 July 2021 the monthly rent was increased by 20%. 11. Provide for depreciation of equipment at 20% per year on the reducing balance method. There were no purchases or sales of equipment during the year. Required: 3.1 Prepare the statement of profit and loss and other comprehensive income for Cute Kids for the year ended 31 December 2021. 3.2 Prepare a statement of changes in equity for the year ended 31 December 2021. (4) The following is the pre-adjustment trial balance at 31 December 2021 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started