Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION THREE (Groups 4 and 9) A company has three production cost centres (P1, P2 and P3) and two service cost centres (S1 and S2)

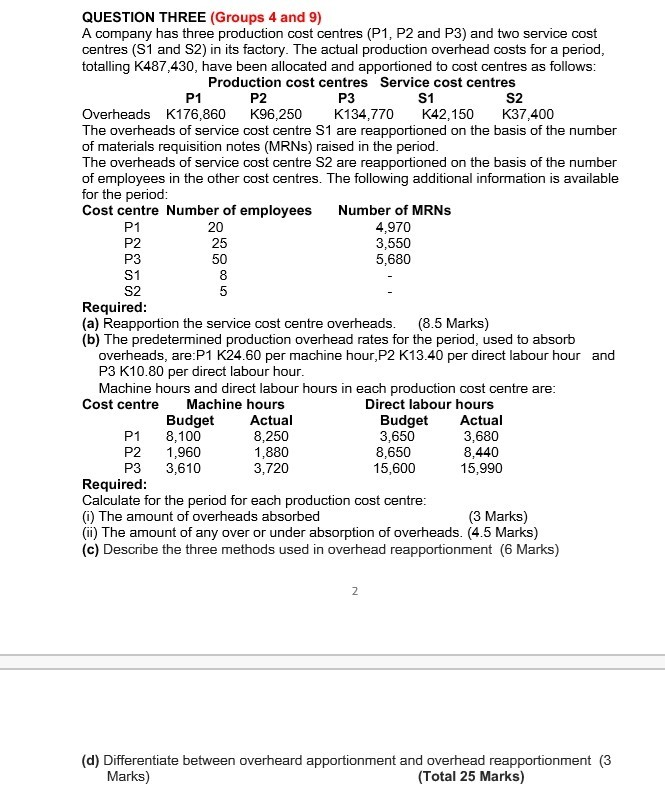

QUESTION THREE (Groups 4 and 9) A company has three production cost centres (P1, P2 and P3) and two service cost centres (S1 and S2) in its factory. The actual production overhead costs for a period totalling K487,430, have been allocated and apportioned to cost centres as follows Production cost centres Service cost centres P1 P2 P3 S1 S2 Overheads K176,860 K96,250 K134,770 K42,150 K37,400 The overheads of service cost centre S1 are reapportioned on the basis of the number of materials requisition notes (MRNs) raised in the period The overheads of service cost centre S2 are reapportioned on the basis of the number of employees in the other cost centres. The following additional information is available for the period Cost centre Number of employees Number of MRNs 20 25 50 4,970 3,550 5,680 P2 P3 S1 S2 Required (a) Reapportion the service cost centre overheads. (8.5 Marks) (b) The predetermined production overhead rates for the period, used to absorb overheads, are P1 K24.60 per machine hour,P2 K13.40 per direct labour hour and P3 K10.80 per direct labour hour. Machine hours and direct labour hours in each production cost centre are Cost centre Machine hours Actual 8,250 1,880 3,720 Direct labour hours Budget Actual 3,680 8,440 15,990 Budget P1 8,100 P2 1,960 P3 3,610 3,650 8,650 15,600 Required Calculate for the period for each production cost centre (i) The amount of overheads absorbed (ii) The amount of any over or under absorption of overheads. (4.5 Marks) (c) Describe the three methods used in overhead reapportionment (6 Marks) (3 Marks) (d) Differentiate between overheard apportionment and overhead reapportionment (3 Marks) (Total 25 Marks) QUESTION THREE (Groups 4 and 9) A company has three production cost centres (P1, P2 and P3) and two service cost centres (S1 and S2) in its factory. The actual production overhead costs for a period totalling K487,430, have been allocated and apportioned to cost centres as follows Production cost centres Service cost centres P1 P2 P3 S1 S2 Overheads K176,860 K96,250 K134,770 K42,150 K37,400 The overheads of service cost centre S1 are reapportioned on the basis of the number of materials requisition notes (MRNs) raised in the period The overheads of service cost centre S2 are reapportioned on the basis of the number of employees in the other cost centres. The following additional information is available for the period Cost centre Number of employees Number of MRNs 20 25 50 4,970 3,550 5,680 P2 P3 S1 S2 Required (a) Reapportion the service cost centre overheads. (8.5 Marks) (b) The predetermined production overhead rates for the period, used to absorb overheads, are P1 K24.60 per machine hour,P2 K13.40 per direct labour hour and P3 K10.80 per direct labour hour. Machine hours and direct labour hours in each production cost centre are Cost centre Machine hours Actual 8,250 1,880 3,720 Direct labour hours Budget Actual 3,680 8,440 15,990 Budget P1 8,100 P2 1,960 P3 3,610 3,650 8,650 15,600 Required Calculate for the period for each production cost centre (i) The amount of overheads absorbed (ii) The amount of any over or under absorption of overheads. (4.5 Marks) (c) Describe the three methods used in overhead reapportionment (6 Marks) (3 Marks) (d) Differentiate between overheard apportionment and overhead reapportionment (3 Marks) (Total 25 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started