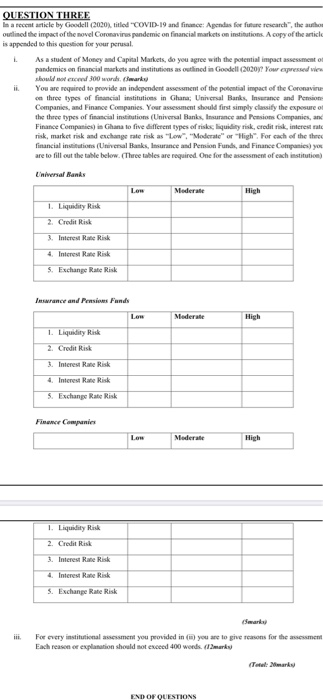

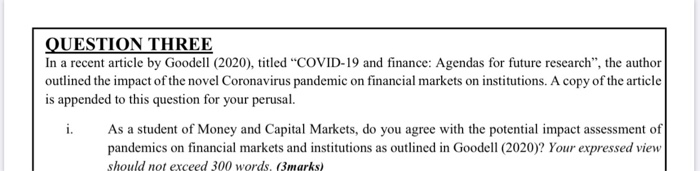

- QUESTION THREE In a recent article by Goodell (2020), titled "COVID-19 and finance Agendes for future research, the author outlined the impact of the novel Coronavirus pandemic on financial markets on institutions. A copy of the article is appended to this question for your perusal As a student of Money and Capital Markets, do you agree with the potential impact assessment of pandemics on financial markets and institutions as outlined in Goodell (202017 Your expressed in should not exceed 300 wordsmark You are required to provide an independent assessment of the potential impact of the Coronavina on three types of financial institutions in Ghana: Universal Banks, Insurance and Pensione Companies, and Finance Companies. Your assessment should first simply classify the exposure the three types of financial institutions (Universal Banks, Insurance and Pension Companies, and Finance Companies in Ghana to five different types of risk, liquidity risk, credit risk, interest rate risk, market risk and exchange rate risk as "how", "Moderate" or "High". For each of the three financial institutions (Universal Banks, Insurance and Pension Funds, and Finance Companies, you are to fill out the table below. (Three tables are required. One for the assessment of each institution) Universal Banks Low Moderate 1. Liquidity Risk 2. Credit Risk 3. Interest Rate Risk 4. Interest Rate Risk 5. Exchange Rate Risk Insurance and Pension Funds Lo Moderate High 1. Liquidity Risk 2. Credit Risk 3. Interest Rate Risk 4. Interest Rate Risk 5. Exchange Rate Risk Finance Companies Low Moderate High 1. Liquidity Risk 2. Credit Risk 3. Interest Rane Risk 4. Interest Rate Risk 5. Exchange Rate Risk For every institutional assessment you provided in you are to give reasons for the assessment Each reason or explanation should not exceed 400 words. (lmarks Tel: marks END OF QUESTIONS QUESTION THREE In a recent article by Goodell (2020), titled "COVID-19 and finance: Agendas for future research, the author outlined the impact of the novel Coronavirus pandemic on financial markets on institutions. A copy of the article is appended to this question for your perusal. i. As a student of Money and Capital Markets, do you agree with the potential impact assessment of pandemics on financial markets and institutions as outlined in Goodell (2020)? Your expressed view should not exceed 300 words. (3marks) - QUESTION THREE In a recent article by Goodell (2020), titled "COVID-19 and finance Agendes for future research, the author outlined the impact of the novel Coronavirus pandemic on financial markets on institutions. A copy of the article is appended to this question for your perusal As a student of Money and Capital Markets, do you agree with the potential impact assessment of pandemics on financial markets and institutions as outlined in Goodell (202017 Your expressed in should not exceed 300 wordsmark You are required to provide an independent assessment of the potential impact of the Coronavina on three types of financial institutions in Ghana: Universal Banks, Insurance and Pensione Companies, and Finance Companies. Your assessment should first simply classify the exposure the three types of financial institutions (Universal Banks, Insurance and Pension Companies, and Finance Companies in Ghana to five different types of risk, liquidity risk, credit risk, interest rate risk, market risk and exchange rate risk as "how", "Moderate" or "High". For each of the three financial institutions (Universal Banks, Insurance and Pension Funds, and Finance Companies, you are to fill out the table below. (Three tables are required. One for the assessment of each institution) Universal Banks Low Moderate 1. Liquidity Risk 2. Credit Risk 3. Interest Rate Risk 4. Interest Rate Risk 5. Exchange Rate Risk Insurance and Pension Funds Lo Moderate High 1. Liquidity Risk 2. Credit Risk 3. Interest Rate Risk 4. Interest Rate Risk 5. Exchange Rate Risk Finance Companies Low Moderate High 1. Liquidity Risk 2. Credit Risk 3. Interest Rane Risk 4. Interest Rate Risk 5. Exchange Rate Risk For every institutional assessment you provided in you are to give reasons for the assessment Each reason or explanation should not exceed 400 words. (lmarks Tel: marks END OF QUESTIONS QUESTION THREE In a recent article by Goodell (2020), titled "COVID-19 and finance: Agendas for future research, the author outlined the impact of the novel Coronavirus pandemic on financial markets on institutions. A copy of the article is appended to this question for your perusal. i. As a student of Money and Capital Markets, do you agree with the potential impact assessment of pandemics on financial markets and institutions as outlined in Goodell (2020)? Your expressed view should not exceed 300 words. (3marks)