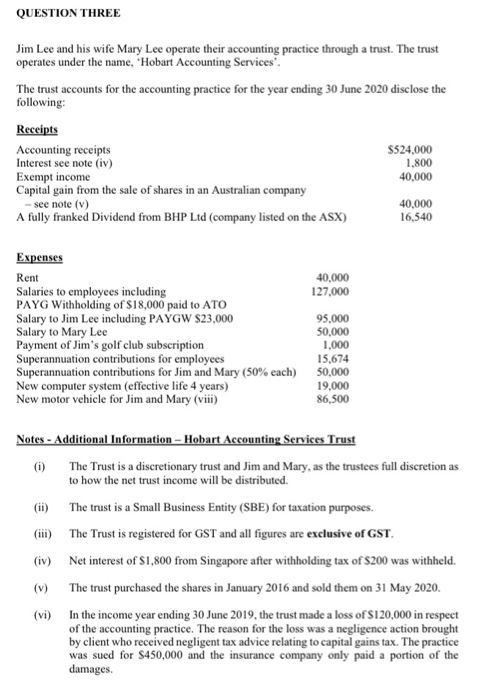

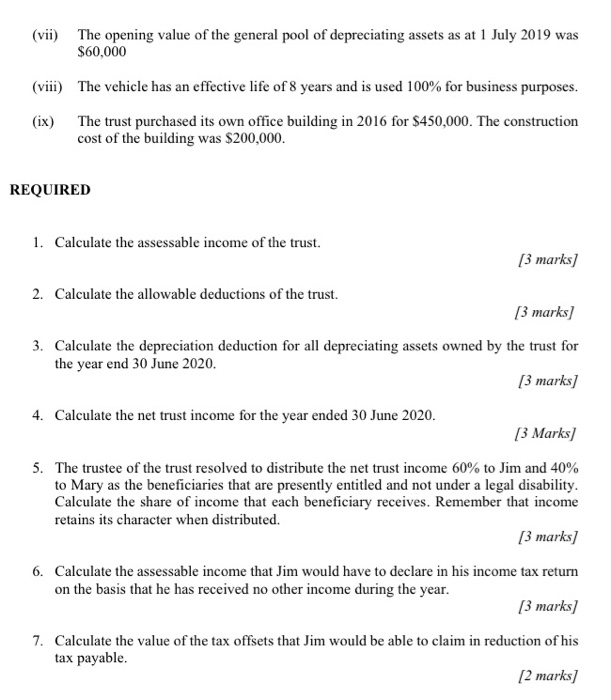

QUESTION THREE Jim Lee and his wife Mary Lee operate their accounting practice through a trust. The trust operates under the name, "Hobart Accounting Services'. The trust accounts for the accounting practice for the year ending 30 June 2020 disclose the following: Receipts Accounting receipts $524,000 Interest see note (iv) 1,800 Exempt income 40,000 Capital gain from the sale of shares in an Australian company - see note (v) 40,000 A fully franked Dividend from BHP Ltd (company listed on the ASX) 16,540 Expenses Rent 40,000 Salaries to employees including 127,000 PAYG Withholding of $18,000 paid to ATO Salary to Jim Lee including PAYGW $23,000 95,000 Salary to Mary Lee 50,000 Payment of Jim's golf club subscription 1,000 Superannuation contributions for employees 15,674 Superannuation contributions for Jim and Mary (50% each) 50,000 New computer system (effective life 4 years) 19,000 New motor vehicle for Jim and Mary (viii) 86,500 Notes - Additional Information - Hobart Accounting Services Trust The Trust is a discretionary trust and Jim and Mary, as the trustees full discretion as to how the net trust income will be distributed. The trust is a Small Business Entity (SBE) for taxation purposes. (ii) The Trust is registered for GST and all figures are exclusive of GST. (iv) Net interest of S1,800 from Singapore after withholding tax of S200 was withheld. The trust purchased the shares in January 2016 and sold them on 31 May 2020. (vi) In the income year ending 30 June 2019, the trust made a loss of S120,000 in respect of the accounting practice. The reason for the loss was a negligence action brought by client who received negligent tax advice relating to capital gains tax. The practice was sued for $450,000 and the insurance company only paid a portion of the damages (vii) The opening value of the general pool of depreciating assets as at 1 July 2019 was $60,000 (viii) The vehicle has an effective life of 8 years and is used 100% for business purposes. (ix) The trust purchased its own office building in 2016 for $450,000. The construction cost of the building was $200,000. REQUIRED 1. Calculate the assessable income of the trust. [3 marks] 2. Calculate the allowable deductions of the trust. [3 marks] 3. Calculate the depreciation deduction for all depreciating assets owned by the trust for the year end 30 June 2020. [3 marks] 4. Calculate the net trust income for the year ended 30 June 2020. 13 Marks) 5. The trustee of the trust resolved to distribute the net trust income 60% to Jim and 40% to Mary as the beneficiaries that are presently entitled and not under a legal disability. Calculate the share of income that each beneficiary receives. Remember that income retains its character when distributed. [3 marks] 6. Calculate the assessable income that Jim would have to declare in his income tax return on the basis that he has received no other income during the year. [3 marks] 7. Calculate the value of the tax offsets that Jim would be able to claim in reduction of his tax payable. [2 marks] QUESTION THREE Jim Lee and his wife Mary Lee operate their accounting practice through a trust. The trust operates under the name, "Hobart Accounting Services'. The trust accounts for the accounting practice for the year ending 30 June 2020 disclose the following: Receipts Accounting receipts $524,000 Interest see note (iv) 1,800 Exempt income 40,000 Capital gain from the sale of shares in an Australian company - see note (v) 40,000 A fully franked Dividend from BHP Ltd (company listed on the ASX) 16,540 Expenses Rent 40,000 Salaries to employees including 127,000 PAYG Withholding of $18,000 paid to ATO Salary to Jim Lee including PAYGW $23,000 95,000 Salary to Mary Lee 50,000 Payment of Jim's golf club subscription 1,000 Superannuation contributions for employees 15,674 Superannuation contributions for Jim and Mary (50% each) 50,000 New computer system (effective life 4 years) 19,000 New motor vehicle for Jim and Mary (viii) 86,500 Notes - Additional Information - Hobart Accounting Services Trust The Trust is a discretionary trust and Jim and Mary, as the trustees full discretion as to how the net trust income will be distributed. The trust is a Small Business Entity (SBE) for taxation purposes. (ii) The Trust is registered for GST and all figures are exclusive of GST. (iv) Net interest of S1,800 from Singapore after withholding tax of S200 was withheld. The trust purchased the shares in January 2016 and sold them on 31 May 2020. (vi) In the income year ending 30 June 2019, the trust made a loss of S120,000 in respect of the accounting practice. The reason for the loss was a negligence action brought by client who received negligent tax advice relating to capital gains tax. The practice was sued for $450,000 and the insurance company only paid a portion of the damages (vii) The opening value of the general pool of depreciating assets as at 1 July 2019 was $60,000 (viii) The vehicle has an effective life of 8 years and is used 100% for business purposes. (ix) The trust purchased its own office building in 2016 for $450,000. The construction cost of the building was $200,000. REQUIRED 1. Calculate the assessable income of the trust. [3 marks] 2. Calculate the allowable deductions of the trust. [3 marks] 3. Calculate the depreciation deduction for all depreciating assets owned by the trust for the year end 30 June 2020. [3 marks] 4. Calculate the net trust income for the year ended 30 June 2020. 13 Marks) 5. The trustee of the trust resolved to distribute the net trust income 60% to Jim and 40% to Mary as the beneficiaries that are presently entitled and not under a legal disability. Calculate the share of income that each beneficiary receives. Remember that income retains its character when distributed. [3 marks] 6. Calculate the assessable income that Jim would have to declare in his income tax return on the basis that he has received no other income during the year. [3 marks] 7. Calculate the value of the tax offsets that Jim would be able to claim in reduction of his tax payable. [2 marks]