Answered step by step

Verified Expert Solution

Question

1 Approved Answer

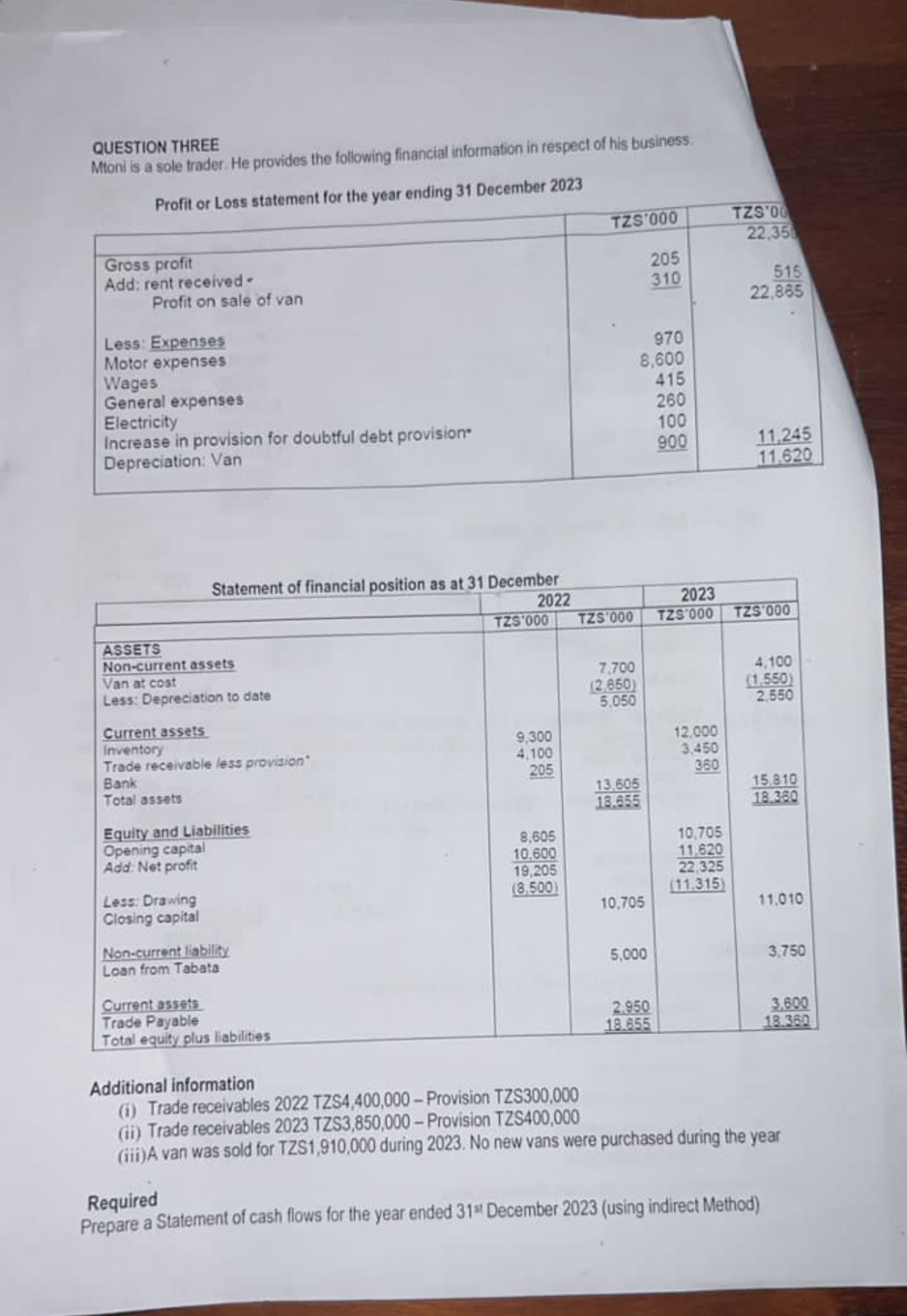

QUESTION THREE Mtoni is a sole trader. He provides the following financial information in respect of his business. Profit or Loss statement for the

QUESTION THREE Mtoni is a sole trader. He provides the following financial information in respect of his business. Profit or Loss statement for the year ending 31 December 2023 TZS'000 Gross profit TZS'000 22,35 Add: rent received- 205 Profit on sale of van 310 515 22,865 Less: Expenses Motor expenses 970 Wages 8,600 General expenses 415 Electricity 260 Increase in provision for doubtful debt provision Depreciation: Van 100 900 11.245 11.620 ASSETS Statement of financial position as at 31 December 2022 TZS'000 TZS'000 2023 TZS'000 TZS 000 Non-current assets Van at cost Less: Depreciation to date 7,700 (2.850) 4,100 (1.550) 5,050 2.550 Current assets Inventory 9,300 12.000 Trade receivable less provision" 4,100 3.450 Bank 205 360 Total assets 13.605 15.810 18.655 18.360 Equity and Liabilities Opening capital 8,605 10,705 Add: Net profit 10,600 11,620 19,205 22,325 Less: Drawing (8,500) (11.315) Closing capital 10.705 11,010 Non-current liability Loan from Tabata 5,000 3,750 Current assets Trade Payable Total equity plus liabilities 2.950 3,600 18.655 18.360 Additional information (i) Trade receivables 2022 TZS4,400,000-Provision TZS300,000 (ii) Trade receivables 2023 TZS3,850,000-Provision TZS400,000 (iii) A van was sold for TZS1,910,000 during 2023. No new vans were purchased during the year Required Prepare a Statement of cash flows for the year ended 31st December 2023 (using indirect Method)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started