Answered step by step

Verified Expert Solution

Question

1 Approved Answer

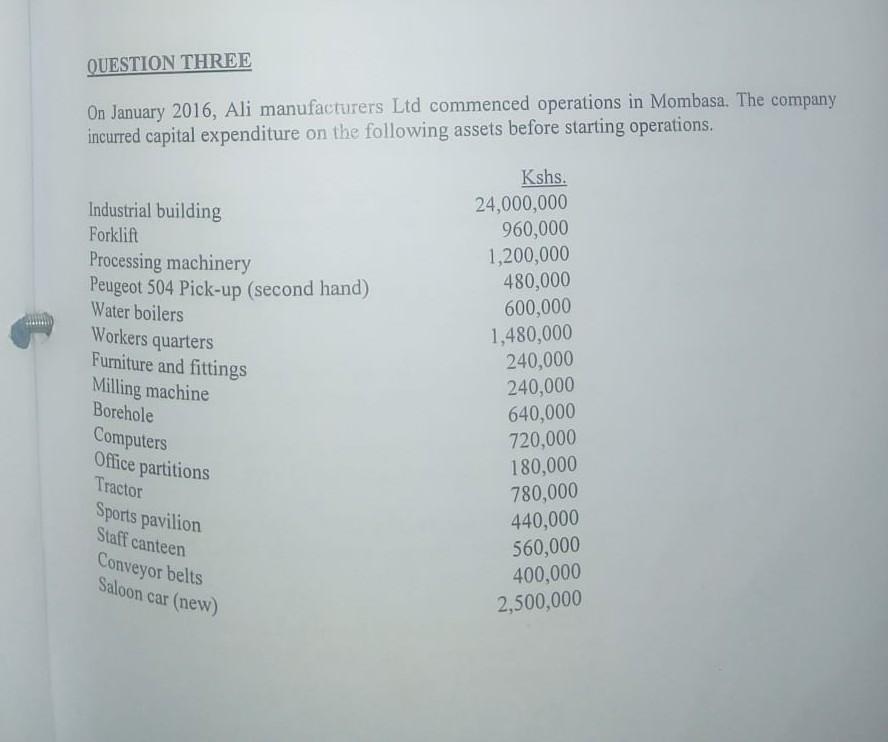

QUESTION THREE On January 2016, Ali manufacturers Ltd commenced operations in Mombasa. The company incurred capital expenditure on the following assets before starting operations. Industrial

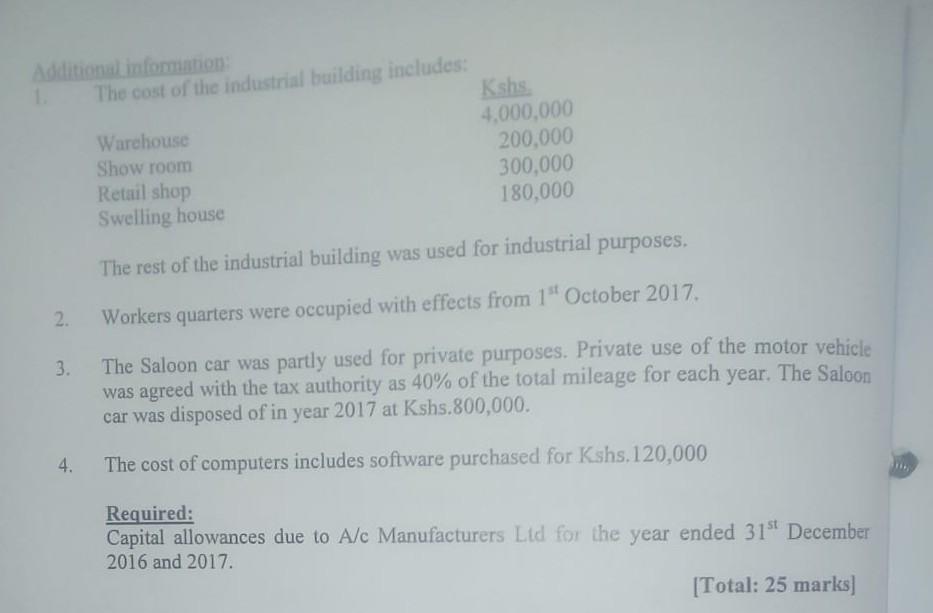

QUESTION THREE On January 2016, Ali manufacturers Ltd commenced operations in Mombasa. The company incurred capital expenditure on the following assets before starting operations. Industrial building Forklift Processing machinery Peugeot 504 Pick-up (second hand) Water boilers Workers quarters Furniture and fittings Milling machine Borehole Computers Office partitions Kshs. 24,000,000 960,000 1,200,000 480,000 600,000 1,480,000 240,000 240,000 640,000 720,000 180,000 780,000 440,000 560,000 400,000 2,500,000 Tractor Sports pavilion Staff canteen Conveyor belts Saloon car (new) Additional information The cost of the industrial building includes: Kshs. Warehouse 4,000,000 Showroom 200,000 Retail shop 300,000 Swelling house 180,000 The rest of the industrial building was used for industrial purposes. 2. Workers quarters were occupied with effects from 1" October 2017. 3. The Saloon car was partly used for private purposes. Private use of the motor vehicle was agreed with the tax authority as 40% of the total mileage for each year. The Saloon car was disposed of in year 2017 at Kshs.800,000. 4. The cost of computers includes software purchased for Kshs. 120,000 Required: Capital allowances due to A/c Manufacturers Ltd for the year ended 315 December 2016 and 2017 [Total: 25 marks) QUESTION THREE On January 2016, Ali manufacturers Ltd commenced operations in Mombasa. The company incurred capital expenditure on the following assets before starting operations. Industrial building Forklift Processing machinery Peugeot 504 Pick-up (second hand) Water boilers Workers quarters Furniture and fittings Milling machine Borehole Computers Office partitions Kshs. 24,000,000 960,000 1,200,000 480,000 600,000 1,480,000 240,000 240,000 640,000 720,000 180,000 780,000 440,000 560,000 400,000 2,500,000 Tractor Sports pavilion Staff canteen Conveyor belts Saloon car (new) Additional information The cost of the industrial building includes: Kshs. Warehouse 4,000,000 Showroom 200,000 Retail shop 300,000 Swelling house 180,000 The rest of the industrial building was used for industrial purposes. 2. Workers quarters were occupied with effects from 1" October 2017. 3. The Saloon car was partly used for private purposes. Private use of the motor vehicle was agreed with the tax authority as 40% of the total mileage for each year. The Saloon car was disposed of in year 2017 at Kshs.800,000. 4. The cost of computers includes software purchased for Kshs. 120,000 Required: Capital allowances due to A/c Manufacturers Ltd for the year ended 315 December 2016 and 2017 [Total: 25 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started