Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION THREE Publix Ltd is a publicly listed supermarket chain. During the current year, it started the construction of a new store. Details relating to

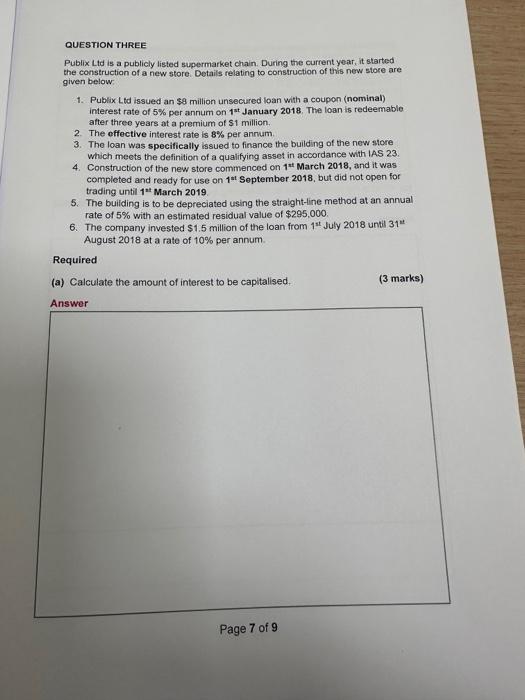

QUESTION THREE Publix Ltd is a publicly listed supermarket chain. During the current year, it started the construction of a new store. Details relating to construction of this new store are given below: 1. Publix Ltd issued an $8 million unsecured loan with a coupon (nominal) interest rate of 5% per annum on 1st January 2018. The loan is redeemable after three years at a premium of $1 million. 2. The effective interest rate is 8% per annum. 3. The loan was specifically issued to finance the building of the new store which meets the definition of a qualifying asset in accordance with IAS 23. 4. Construction of the new store commenced on 1st March 2018, and it was completed and ready for use on 1st September 2018, but did not open for trading until 1st March 2019. 5. The building is to be depreciated using the straight-line method at an annual rate of 5% with an estimated residual value of $295,000. 6. The company invested $1.5 million of the loan from 1st July 2018 until 31st August 2018 at a rate of 10% per annum. Required (a) Calculate the amount of interest to be capitalised. (b) What is the carrying value of the building on 31st december 2018? (c) What is the carrying value of the building as of 31st december 2019 to the nearest $?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started