Answered step by step

Verified Expert Solution

Question

1 Approved Answer

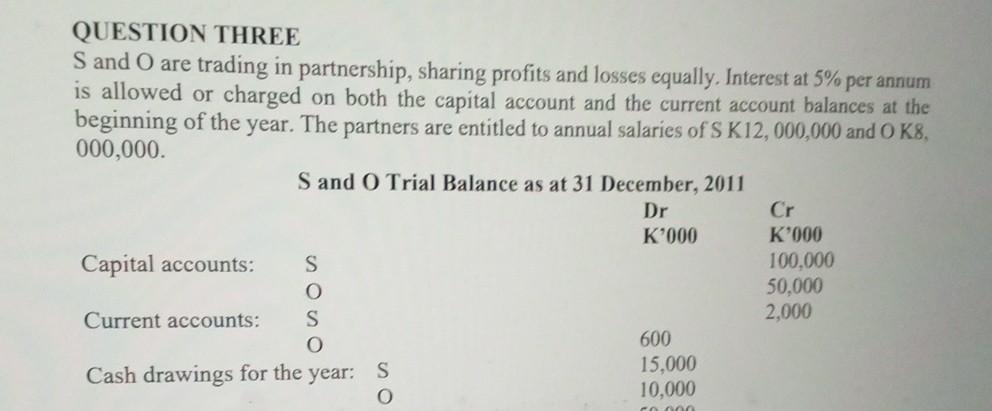

QUESTION THREE S and O are trading in partnership, sharing profits and losses equally. Interest at 5% per annum is allowed or charged on both

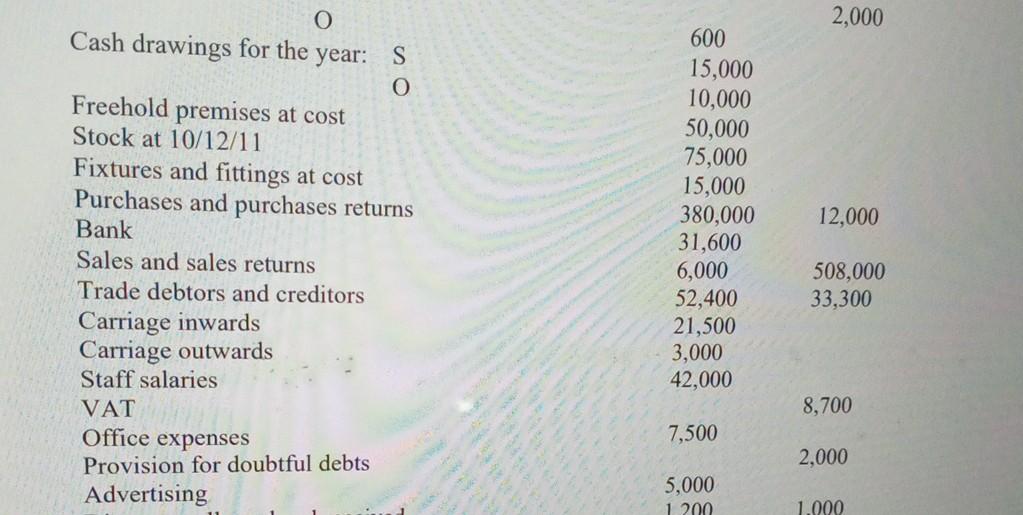

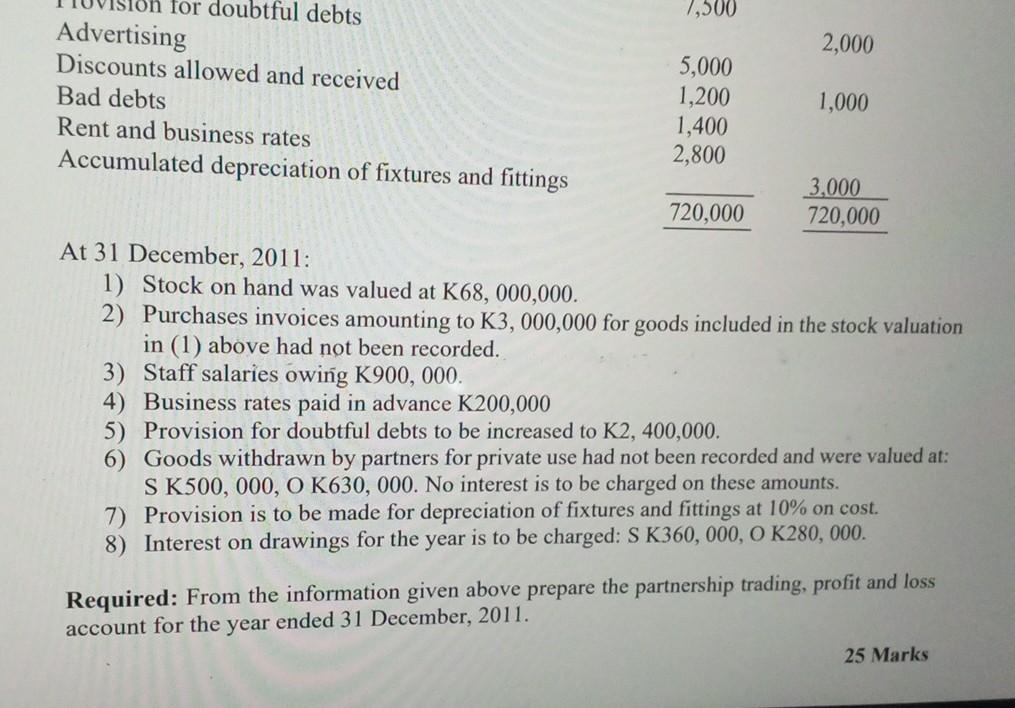

QUESTION THREE S and O are trading in partnership, sharing profits and losses equally. Interest at 5% per annum is allowed or charged on both the capital account and the current account balances at the beginning of the year. The partners are entitled to annual salaries of S K 12,000,000 and OK8, 000,000 . \begin{tabular}{lllc} \multicolumn{1}{c}{O} & & 2,000 \\ Cash drawings for the year: & S & 600 & \\ & O & 15,000 & \\ Freehold premises at cost & 10,000 & \\ Stock at 10/12/11 & 50,000 & \\ Fixtures and fittings at cost & 75,000 & \\ Purchases and purchases returns & 15,000 & \\ Bank & 380,000 & 12,000 \\ Sales and sales returns & 31,600 & \\ Trade debtors and creditors & 6,000 & 508,000 \\ Carriage inwards & 52,400 & 33,300 \\ Carriage outwards & 21,500 & \\ Staff salaries & 3,000 & \\ VAT & 42,000 & 8,700 \\ Office expenses & & \\ Provision for doubtful debts & 7,500 & 2,000 \\ Advertising & 5,000 & \\ \hline \end{tabular} At 51 Vecember, 2011: 1) Stock on hand was valued at K68,000,000. 2) Purchases invoices amounting to K3,000,000 for goods included in the stock valuation in (1) above had not been recorded. 3) Staff salaries owing K 900,000. 4) Business rates paid in advance K200,000 5) Provision for doubtful debts to be increased to K2,400,000. 6) Goods withdrawn by partners for private use had not been recorded and were valued at: S K500, 000, O K630, 000. No interest is to be charged on these amounts. 7) Provision is to be made for depreciation of fixtures and fittings at 10% on cost. 8) Interest on drawings for the year is to be charged: S K 360,000,OK280,000. Required: From the information given above prepare the partnership trading, profit and loss account for the year ended 31 December, 2011

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started