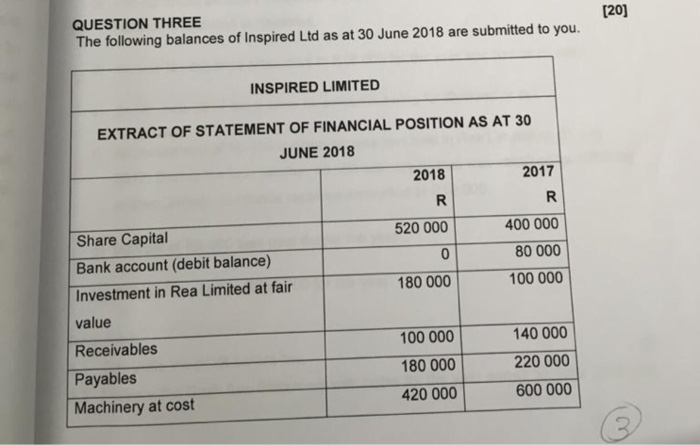

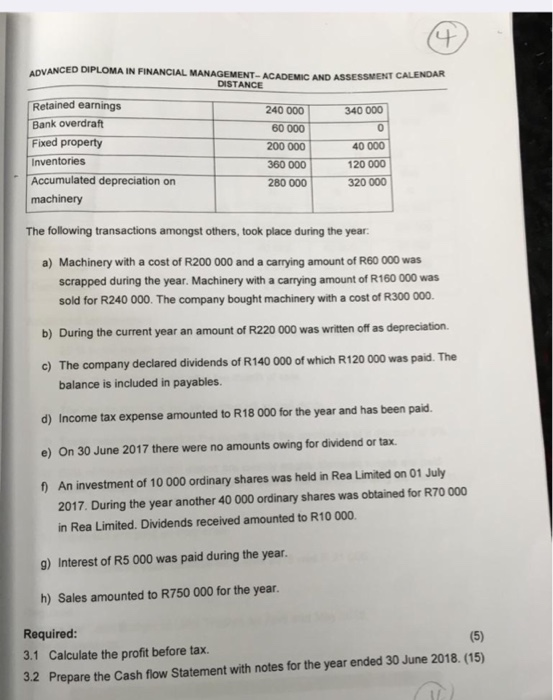

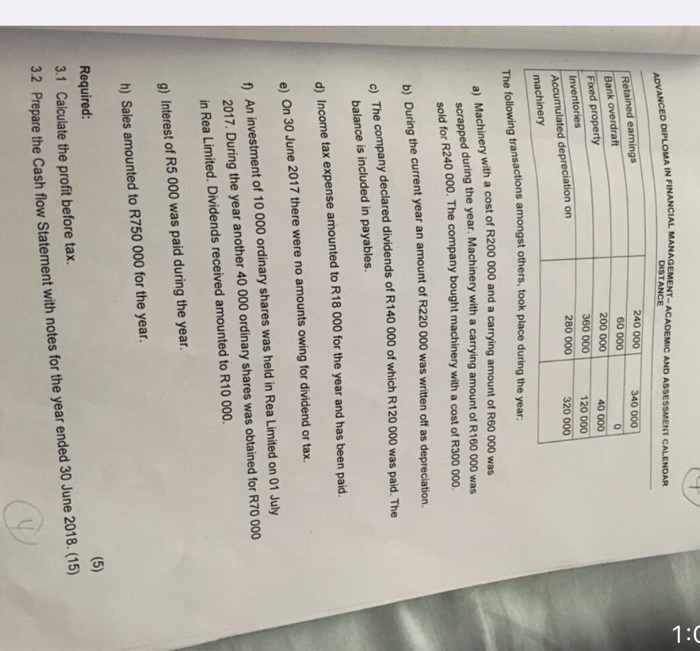

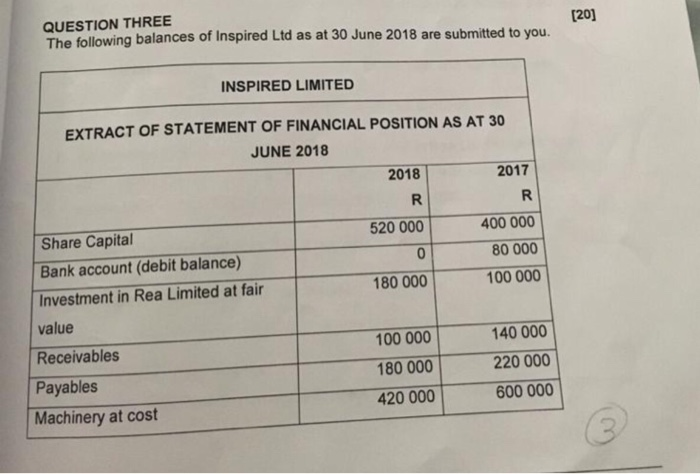

QUESTION THREE The following balances of Inspired Ltd as at 30 June 2018 are submitted to you. [20] INSPIRED LIMITED EXTRACT OF STATEMENT OF FINANCIAL POSITION AS AT 30 JUNE 2018 2018 2017 520 000 400 000 80 000 100 000 180 000 Share Capital Bank account (debit balance) Investment in Rea Limited at fair value Receivables Payables Machinery at cost 100 000 180 000 420 000 140 000 220 000 600 000 AVANCED DIPLOMA IN FINANCIAL MANAGEMENT - ACADEMIC AND ASSESSMENT CALENDAR DISTANCE 340 000 Retained earnings Bank overdraft Fixed property Inventories Accumulated depreciation on machinery 240 000 60 000 200 000 360 000 280 000 40 000 120 000 320 000 The following transactions amongst others, took place during the year a) Machinery with a cost of R200 000 and a carrying amount of R60 000 was scrapped during the year. Machinery with a carrying amount of R160 000 was sold for R240 000. The company bought machinery with a cost of R300 000 b) During the current year an amount of R220 000 was written off as depreciation. c) The company declared dividends of R140 000 of which R120 000 was paid. The balance is included in payables. d) Income tax expense amounted to R18 000 for the year and has been paid. e) On 30 June 2017 there were no amounts owing for dividend or tax. f) An investment of 10 000 ordinary shares was held in Rea Limited on 01 July 2017. During the year another 40 000 ordinary shares was obtained for R70 000 in Rea Limited. Dividends received amounted to R10 000. 9) Interest of R5 000 was paid during the year. h) Sales amounted to R750 000 for the year. (5) Required: 3.1 Calculate the profit before tax. 3.2 Prepare the cash flow Statement with notes for the year ended 30 June 2018. (15) Dil OMA IN FINANCIAL MANAGEMENT - ACADEMIC AND ASSESSMENT CALENDAR DISTANCE ADVANCED DIPLOMA IN FINANCIAL Retained earnings Bank overdraft Ficed property Inventories Accumulated depreciation on machinery 240 000 60 000 200 000 360 000 280 000 340 000 0 40 000 120 000 320 000 The following transicum amyotuens, took place during the Winery with a cost of R200 000 and a carrying amount of R60 000 was ved during the year. Machinery with a carrying amount of R160 000 was FR240 000. The company bought machinery with a cost of R300 000. scrapped during the year. M the current year an amount of R220 000 was written off as depreciation. b) During the current year an amount of company declared dividends of R140 000 of which R120 000 was paid. The balance is included in payables. d) Income tax expense amounted to R18 000 for the year and has been paid e) On 30 June 2017 there were no amounts owing for dividend or tax. An investment of 10 000 ordinary shares was held in Rea Limited on 01 July 2017. During the year another 40 000 ordinary shares was obtained for R70 000 in Rea Limited. Dividends received amounted to R10 000. 9) Interest of R5 000 was paid during the year. h) Sales amounted to R750 000 for the year. (5) Required: 3.1 Calculate the profit before tax. 3.2 Prepare the Cash flow Statement with notes for the year ended 30 June 2018. (15) [20] QUESTION THREE The following balances of Inspired Ltd as at 30 June 2018 are submitted to you. INSPIRED LIMITED EXTRACT OF STATEMENT OF FINANCIAL POSITION AS AT 30 JUNE 2018 2018 2017 520 000 400 000 80 000 100 000 180 000 Share Capital Bank account (debit balance) Investment in Rea Limited at fair value Receivables Payables Machinery at cost 100 000 180 000 420 000 140 000 220 000 600 000