Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION THREE The following draft financial statements are available for Danvers plc for the year ended 30 September 2021: Summarised Statement of Comprehensive Income

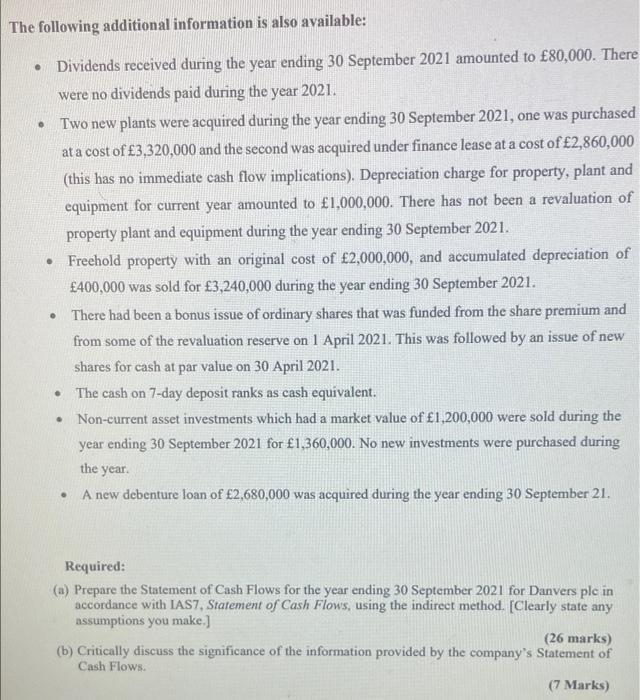

QUESTION THREE The following draft financial statements are available for Danvers plc for the year ended 30 September 2021: Summarised Statement of Comprehensive Income for the year ended 30 September: Turnover Cost of Sales Gross Profit Investment income Distribution and administration expenses Operating profit Finance costs Profit before tax Taxation Profit for the year 2020 ' 000 16,400 -12,000 4,400 280 -1,800 2,880 -160 2,720 -720 2,000 2021 '000 23,400 -18,600 4,800 440 -3,480 1,760 -200 1,560 -400 1,160 Statement of Financial Position as of 30 September: Assets: Non-current assets: Property, plant and equipment at cost Less: Accumulated Depreciation Investment at cost Current Assets: Inventories Trade receivables Cash on 7-day deposit Cash at Bank Total Assets Equity and Liabilities Equity Issued share capital at 1 each Share premium Revaluation reserve Retained earnings Liabilities Non-Current liabilities Debenture loan payable Deferred Tax Current Liabilities: Trade Payables Other payables Current tax payable Bank overdraft Debenture loan payable ' 000 13,440 3.800 2,880 1,480 160 400 3,200 800 1,440 4.040 2,760 360 1,840 1,600 480 840 2020 '000 000 9,640 2,800 12,440 4,920 17.360 3,120 17,440 4.400 4,080 1,400 17,360 5,600 800 9,480 5.200 : 1,280 640 400 1,160 4,760 1.920 - 2,800 520 2021 ' 000 13,040 1,800 14,840 5.480 20,320 11,600 3,320 5.400 20,320 The following additional information is also available: Dividends received during the year ending 30 September 2021 amounted to 80,000. There were no dividends paid during the year 2021. Two new plants were acquired during the year ending 30 September 2021, one was purchased at a cost of 3,320,000 and the second was acquired under finance lease at a cost of 2,860,000 (this has no immediate cash flow implications). Depreciation charge for property, plant and equipment for current year amounted to 1,000,000. There has not been a revaluation of property plant and equipment during the year ending 30 September 2021. Freehold property with an original cost of 2,000,000, and accumulated depreciation of 400,000 was sold for 3,240,000 during the year ending 30 September 2021. There had been a bonus issue of ordinary shares that was funded from the share premium and from some of the revaluation reserve on 1 April 2021. This was followed by an issue of new shares for cash at par value on 30 April 2021. . The cash on 7-day deposit ranks as cash equivalent. Non-current asset investments which had a market value of 1,200,000 were sold during the year ending 30 September 2021 for 1,360,000. No new investments were purchased during the year. A new debenture loan of 2,680,000 was acquired during the year ending 30 September 21. Required: (a) Prepare the Statement of Cash Flows for the year ending 30 September 2021 for Danvers plc in accordance with IAS7, Statement of Cash Flows, using the indirect method. [Clearly state any assumptions you make.] (26 marks) (b) Critically discuss the significance of the information provided by the company's Statement of Cash Flows. (7 Marks)

Step by Step Solution

★★★★★

3.48 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

aStatement of Cash Flows for the Year Ended 30 September 2021 Cash Flows from Operating Activities E000 Cash receipts from customers 16400 Cash payments to suppliers and employees 23400 Interest recei...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started