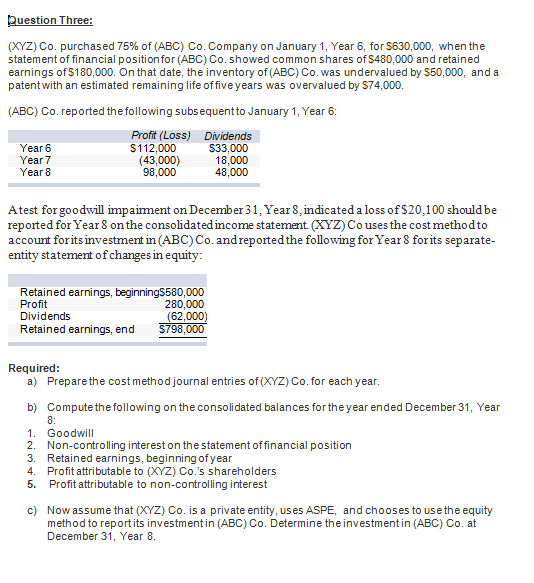

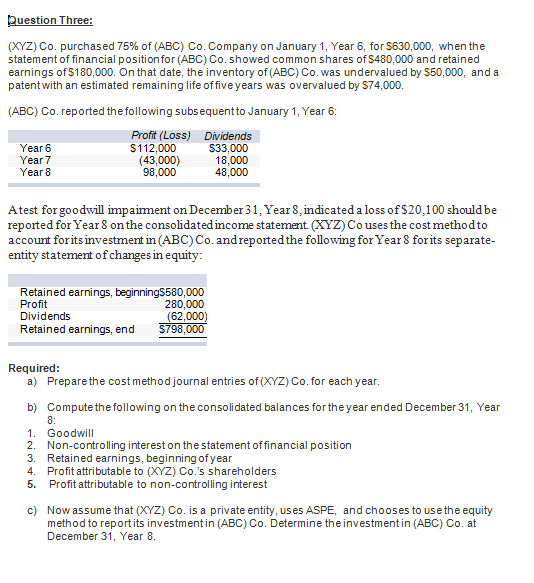

Question Three: (XYZ) Co. purchased 75% of (ABC) Co. Company on January 1, Year 6, for $630,000, when the statement of financial position for (ABC) Co. showed common shares of 480,000 and retained earnings of $180,000. On that date, the inventory of (ABC) Co. was undervalued by S50,000, and a patent with an estimated remaining life of five years was overvalued by $74,000. (ABC) Co. reported the following subsequent to January 1, Year 6: Profit (Loss) Dividends Year 6 $112,000 $33,000 Year 7 (43,000) 18,000 Year 8 98,000 48,000 Atest for goodwill impaiment on December 31, Year 8, indicated a loss of $20,100 should be reported for Year 8 on the consolidated income statement (XYZ) Co uses the cost method to account forits investment in (ABC) Co. and reported the following for Year 8 forits separate- entity statement of changes in equity: Retained earnings, beginnings580,000 Profit 280,000 Dividends (62,000) Retained earnings, end $798,000 Required: a) Prepare the cost method journal entries of (XYZ) Co. for each year. b) Compute the following on the consolidated balances for the year ended December 31, Year 8: 1. Goodwill 2. Non-controlling interest on the statement of financial position 3. Retained earnings, beginning of year 4. Profit attributable to (XYZ) Co.'s shareholders 5. Profit attributable to non-controlling interest c) Now assume that (XYZ) Co. is a private entity, uses ASPE, and chooses to use the equity method to report its investmentin (ABC) Co. Determine the investment in (ABC) Co. at December 31, Year 8. Question Three: (XYZ) Co. purchased 75% of (ABC) Co. Company on January 1, Year 6, for $630,000, when the statement of financial position for (ABC) Co. showed common shares of 480,000 and retained earnings of $180,000. On that date, the inventory of (ABC) Co. was undervalued by S50,000, and a patent with an estimated remaining life of five years was overvalued by $74,000. (ABC) Co. reported the following subsequent to January 1, Year 6: Profit (Loss) Dividends Year 6 $112,000 $33,000 Year 7 (43,000) 18,000 Year 8 98,000 48,000 Atest for goodwill impaiment on December 31, Year 8, indicated a loss of $20,100 should be reported for Year 8 on the consolidated income statement (XYZ) Co uses the cost method to account forits investment in (ABC) Co. and reported the following for Year 8 forits separate- entity statement of changes in equity: Retained earnings, beginnings580,000 Profit 280,000 Dividends (62,000) Retained earnings, end $798,000 Required: a) Prepare the cost method journal entries of (XYZ) Co. for each year. b) Compute the following on the consolidated balances for the year ended December 31, Year 8: 1. Goodwill 2. Non-controlling interest on the statement of financial position 3. Retained earnings, beginning of year 4. Profit attributable to (XYZ) Co.'s shareholders 5. Profit attributable to non-controlling interest c) Now assume that (XYZ) Co. is a private entity, uses ASPE, and chooses to use the equity method to report its investmentin (ABC) Co. Determine the investment in (ABC) Co. at December 31, Year 8