Answered step by step

Verified Expert Solution

Question

1 Approved Answer

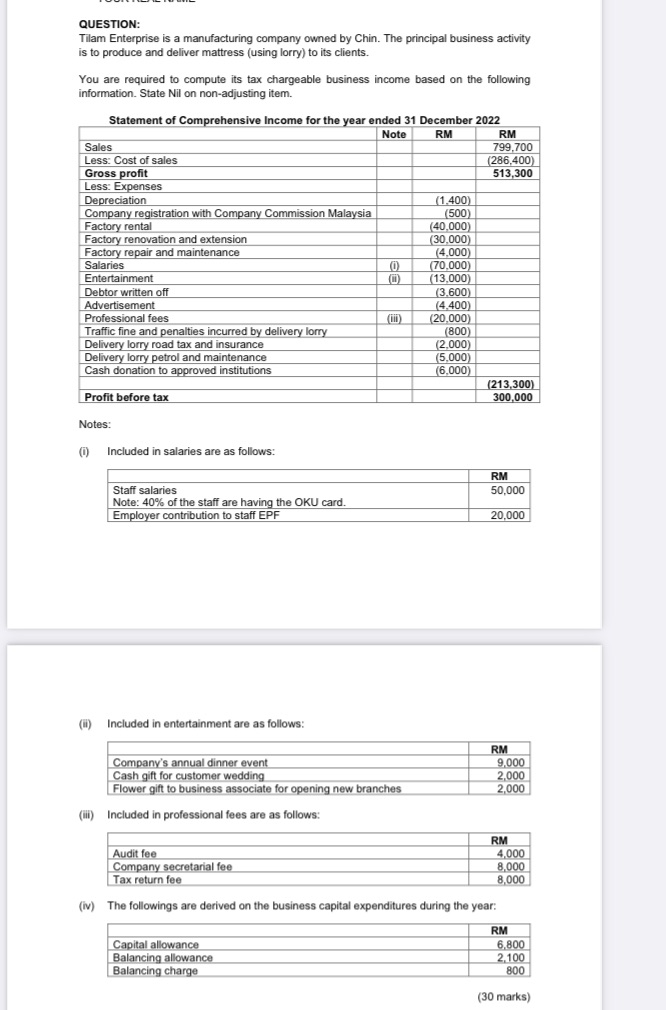

QUESTION: Tilam Enterprise is a manufacturing company owned by Chin. The principal business activity is to produce and deliver mattress (using lorry) to its

QUESTION: Tilam Enterprise is a manufacturing company owned by Chin. The principal business activity is to produce and deliver mattress (using lorry) to its clients. You are required to compute its tax chargeable business income based on the following information. State Nil on non-adjusting item. Statement of Comprehensive Income for the year ended 31 December 2022 Note RM Sales Less: Cost of sales Gross profit Less: Expenses Depreciation Company registration with Company Commission Malaysia Factory rental Factory renovation and extension Factory repair and maintenance Salaries Entertainment Debtor written off Advertisement Professional fees Traffic fine and penalties incurred by delivery lorry Delivery lorry road tax and insurance Delivery lorry petrol and maintenance Cash donation to approved institutions Profit before tax Notes: (1) Included in salaries are as follows: Staff salaries Note: 40% of the staff are having the OKU card. Employer contribution to staff EPF (ii) Included in entertainment are as follows: (iii) Included in professional fees are as follows: (0) (0) Company's annual dinner event Cash gift for customer wedding Flower gift to business associate for opening new branches (iii) Capital allowance Balancing allowance Balancing charge (1,400) (500) (40,000) (30,000) (4,000) (70,000) (13,000) (3.600) (4.400) (20,000) (800) (2.000) (5,000) (6,000) RM 799,700 (286,400) 513,300 (213,300) 300,000 RM 50,000 20,000 RM 9,000 2,000 2,000 RM Audit fee Company secretarial fee Tax return fee (iv) The followings are derived on the business capital expenditures during the year: 4,000 8,000 8,000 RM 6,800 2,100 800 (30 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To compute the tax chargeable business income for Tilam Enterprise based on the provided information ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started