Answered step by step

Verified Expert Solution

Question

1 Approved Answer

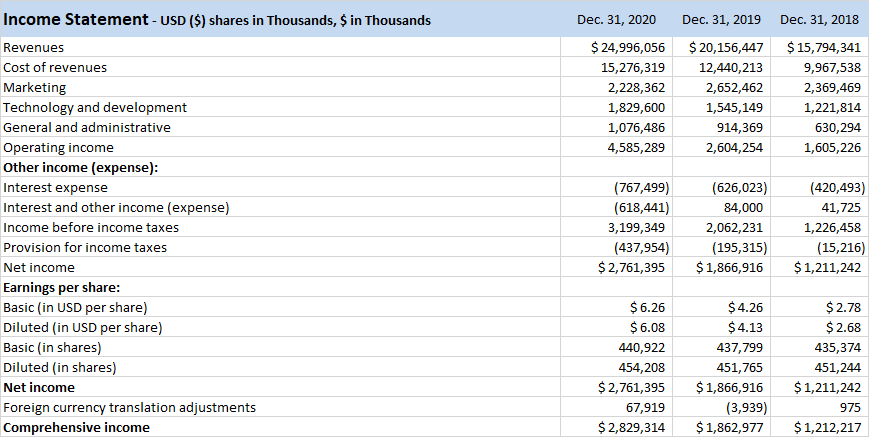

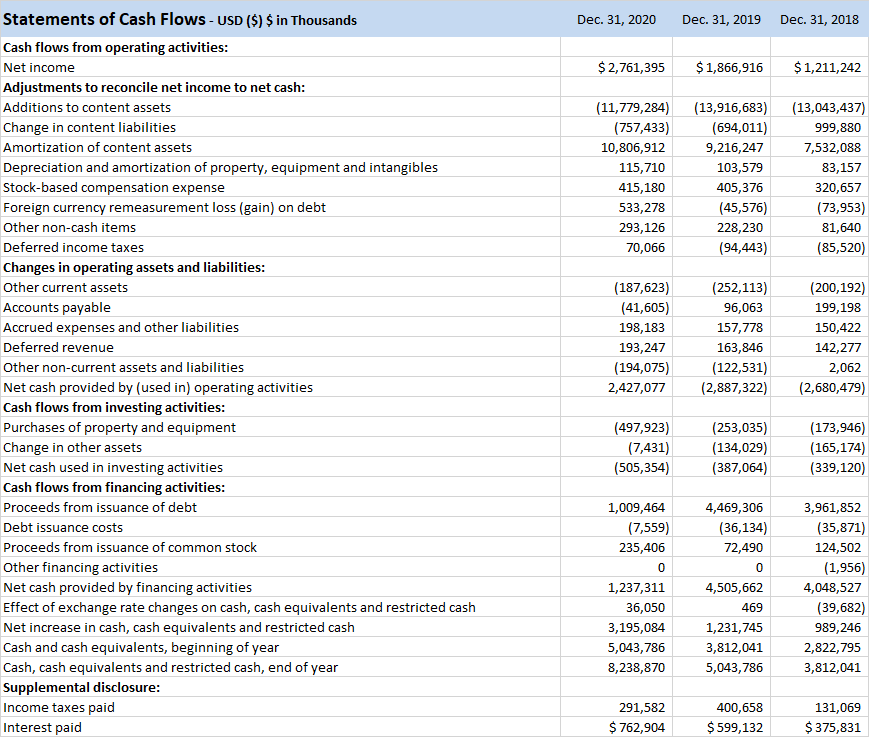

Question: To the income statement, balance sheet and statement of cash flow, ADD horizontal analysis (shown between the years) and vertical analysis (shown to the

Question: To the income statement, balance sheet and statement of cash flow, ADD horizontal analysis (shown between the years) and vertical analysis (shown to the right of the last year of historical data).

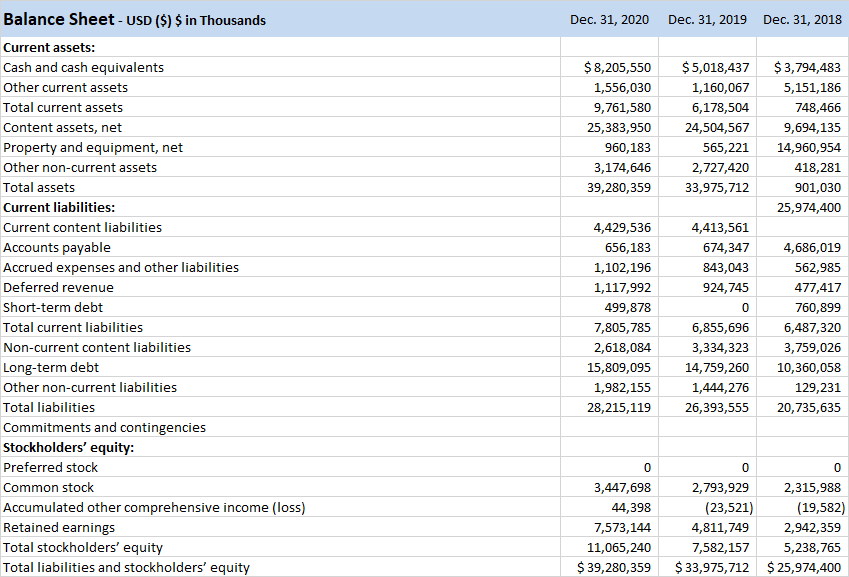

Balance Sheet - USD ($) $ in Thousands Current assets: Cash and cash equivalents Other current assets Total current assets Dec. 31, 2020 Dec. 31, 2019 Dec. 31, 2018 $5,018,437 $3,794,483 $8,205,550 1,556,030 1,160,067 5,151,186 9,761,580 6,178,504 Content assets, net Property and equipment, net 25,383,950 24,504,567 748,466 9,694,135 960,183 565,221 14,960,954 Other non-current assets Total assets 3,174,646 2,727,420 418,281 39,280,359 33,975,712 901,030 Current liabilities: 25,974,400 Current content liabilities 4,429,536 4,413,561 Accounts payable 656,183 674,347 4,686,019 Accrued expenses and other liabilities 1,102,196 843,043 562,985 Deferred revenue 1,117,992 924,745 477,417 Short-term debt 499,878 0 760,899 Total current liabilities 7,805,785 6,855,696 6,487,320 Non-current content liabilities 2,618,084 Long-term debt 15,809,095 3,334,323 14,759,260 10,360,058 3,759,026 Other non-current liabilities 1,982,155 Total liabilities 28,215,119 1,444,276 129,231 26,393,555 20,735,635 Commitments and contingencies Stockholders' equity: Preferred stock 0 0 0 Common stock 3,447,698 2,793,929 2,315,988 Accumulated other comprehensive income (loss) 44,398 (23,521) (19,582) Retained earnings 7,573,144 4,811,749 2,942,359 Total stockholders' equity 11,065,240 7,582,157 5,238,765 Total liabilities and stockholders' equity $39,280,359 $33,975,712 $25,974,400

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started