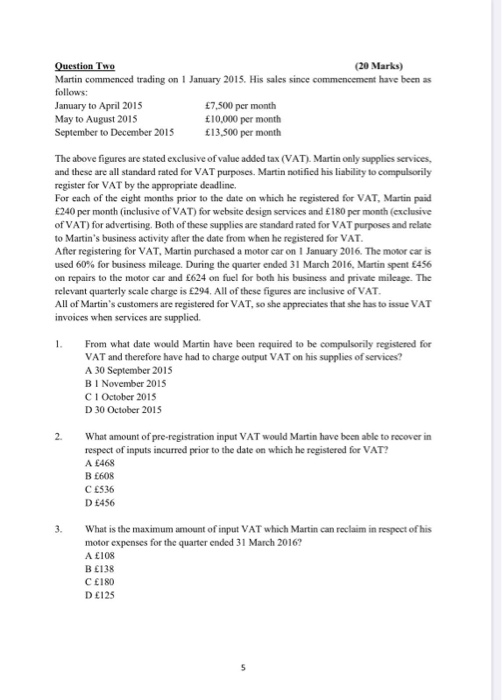

Question Two (20 Marks) Martin commenced trading on 1 January 2015. His sales since commencement have been as follows: January to April 2015 May to August 2015 September to December 2015 7,500 per month 10,000 per month 13.500 per month The above figures are stated exclusive of value added tax (VAT). Martin only supplies services, and these are all standard rated for VAT purposes. Martin notified his liability to compulsorily register for VAT by the appropriate deadline. For each of the eight months prior to the date on which he registered for VAT, Martin paid E240 per month (inclusive of VAT) for website design services and 180 per month (exclusive of VAT) for advertising. Both of these supplies are standard rated for VAT purposes and relate to Martin's business activity after the date from when he registered for VAT. After registering for VAT, Martin purchased a motor car on 1 January 2016. The motor car is used 60% for business mileage. During the quarter ended 31 March 2016, Martin spent 456 on repairs to the motor car and 624 on fuel for both his business and private mileage. The relevant quarterly scale charge is 294. All of these figures are inclusive of VAT. All of Martin's customers are registered for VAT, so she appreciates that she has to issue VAT invoices when services are supplied. From what date would Martin have been required to be compulsorily registered for VAT and therefore have had to charge output VAT on his supplies of services? A 30 September 2015 BI November 2015 C1 October 2015 D 30 October 2015 What amount of pre-registration input VAT would Martin have been able to recover in respect of inputs incurred prior to the date on which he registered for VAT? A 468 B 608 C 536 D 456 What is the maximum amount of input VAT which Martin can reclaim in respect of his motor expenses for the quarter ended 31 March 2016? A 108 B 138 C 180 D 125 How and by when does Martin have to pay any VAT liability for the quarter ended 31 March 2016? A Using any payment method by 30 April 2016 B Electronically by 7 May 2016 C Electronically by 30 April 2016 D Using any payment method by 7 May 2016 Which of the following items of information is Martin NOT required to include on a valid VAT invoice? A The customer's VAT registration number B An invoice number C The customer's address D A description of the services supplied