Answered step by step

Verified Expert Solution

Question

1 Approved Answer

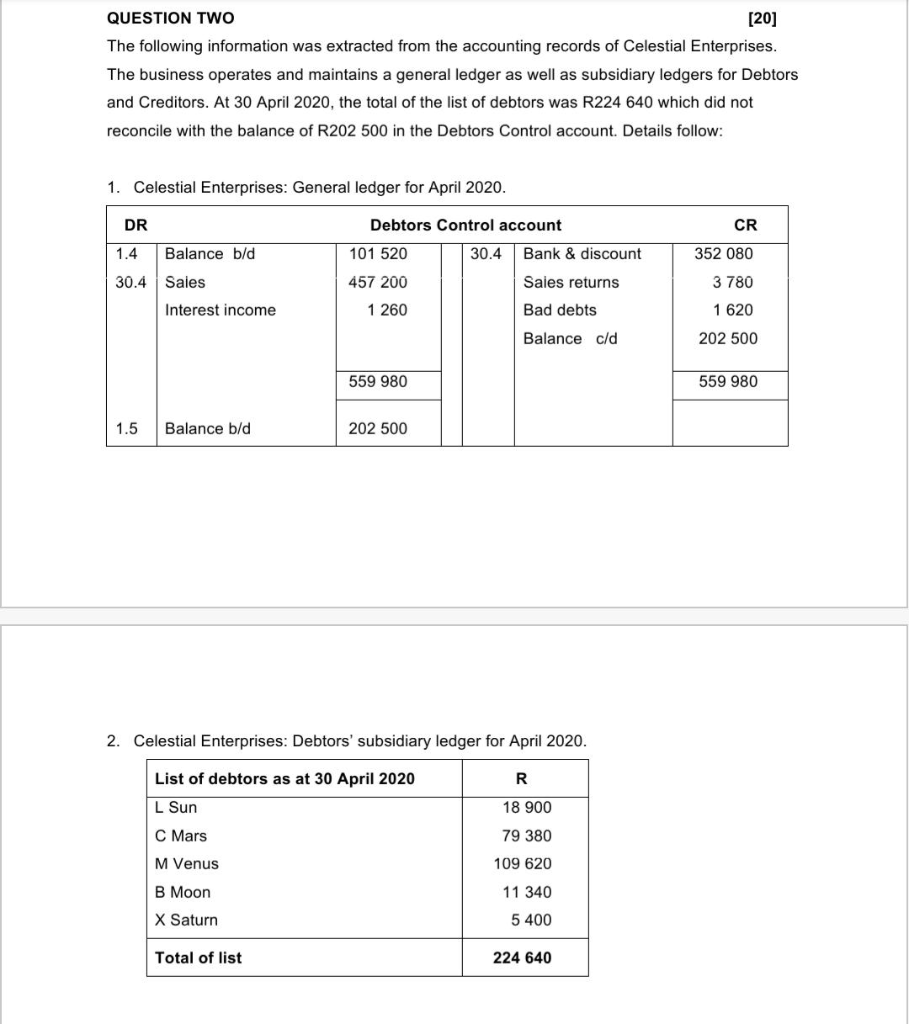

QUESTION TWO [20] The following information was extracted from the accounting records of Celestial Enterprises. The business operates and maintains a general ledger as well

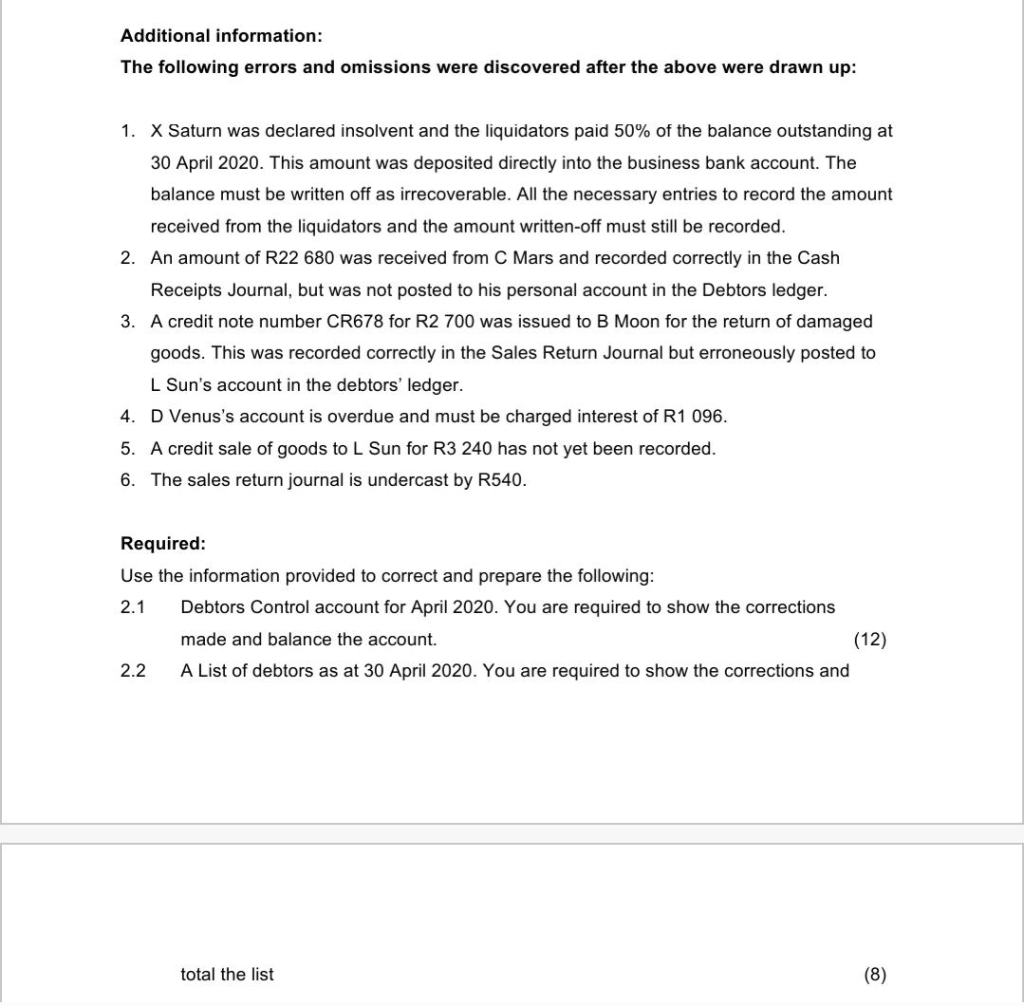

QUESTION TWO [20] The following information was extracted from the accounting records of Celestial Enterprises. The business operates and maintains a general ledger as well as subsidiary ledgers for Debtors and Creditors. At 30 April 2020, the total of the list of debtors was R224 640 which did not reconcile with the balance of R202 500 in the Debtors Control account. Details follow: 1. Celestial Enterprises: General ledger for April 2020. DR Debtors Control account CR 1.4 Balance b/d 101 520 30.4 Bank & discount 352 080 30.4 Sales 457 200 Sales returns 3 780 Interest income 1 260 Bad debts 1 620 Balance cld 202 500 559 980 559 980 1.5 Balance b/d 202 500 2. Celestial Enterprises: Debtors' subsidiary ledger for April 2020. List of debtors as at 30 April 2020 R L Sun C Mars 18 900 79 380 109 620 M Venus B Moon 11 340 X Saturn 5 400 Total of list 224 640 Additional information: The following errors and omissions were discovered after the above were drawn up: 1. X Saturn was declared insolvent and the liquidators paid 50% of the balance outstanding at 30 April 2020. This amount was deposited directly into the business bank account. The balance must be written off as irrecoverable. All the necessary entries to record the amount received from the liquidators and the amount written-off must still be recorded. 2. An amount of R22 680 was received from C Mars and recorded correctly in the Cash Receipts Journal, but was not posted to his personal account in the Debtors ledger. 3. A credit note number CR678 for R2 700 was issued to B Moon for the return of damaged goods. This was recorded correctly in the Sales Return Journal but erroneously posted to L Sun's account in the debtors' ledger. 4. D Venus's account is overdue and must be charged interest of R1 096. 5. A credit sale of goods to L Sun for R3 240 has not yet been recorded. 6. The sales return journal is undercast by R540. Required: Use the information provided to correct and prepare the following: 2.1 Debtors Control account for April 2020. You are required to show the corrections made and balance the account. (12) A List of debtors as at 30 April 2020. You are required to show the corrections and 2.2 total the list (8)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started