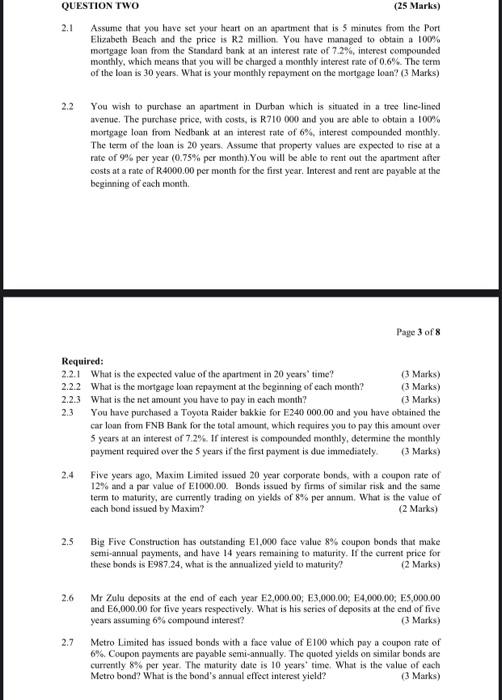

QUESTION TWO (25 Marks) 2.1 Assume that you have set your heart on an apartment that is 5 minutes from the Port Elizabeth Beach and the price is R2 million. You have managed to obtain a 100% mortgage loan from the Standard bank at an interest rate of 7.2%, interest compounded monthly, which means that you will be charged a monthly interest rate of 0.6%. The term of the loan is 30 years. What is your monthly repayment on the mortgage loan? (3 Marks) 2.2 You wish to purchase an apartment in Durban which is situated in a tree line-lined avenue. The purchase price, with costs, is R710 000 and you are able to obtain a 100% mortgage loan from Nedbank at an interest rate of 6%interest compounded monthly The term of the loan is 20 years. Assume that property values are expected to rise at a rate of 9% per year (0.75% per month). You will be able to rent out the apartment after costs at a rate of R4000.00 per month for the first year. Interest and rent are payable at the beginning of each month Page 3 of 8 Required: 2.2.1 What is the expected value of the apartment in 20 years' time? (3 Marks) 2.2.2 What is the mortgage loan repayment at the beginning of each month? (3 Marks) 2.2.3 What is the net amount you have to pay in each month? (3 Marks) 2.3 You have purchased a Toyota Raider bakkie for E240 000.00 and you have obtained the car loan from FNB Bank for the total amount, which requires you to pay this amount over 5 years at an interest of 7.2%. If interest is compounded monthly, determine the monthly payment required over the 5 years if the first payment is due immediately. (3 Marks) 2.4 Five years ago, Maxim Limited issued 20 year corporate bonds, with a coupon rate of 12% and a par value of E1000.00. Bonds issued by firms of similar risk and the same term to maturity, are currently trading on yields of 8% per annum. What is the value of cach bond issued by Maxim? (2 Marks) 2.5 Big Five Construction has outstanding E1,000 face value 8% coupon bonds that make semi-annual payments, and have 14 years remaining to maturity. If the current price for these bonds is E987.24, what is the annualized yield to maturity? (2 Marks) 2.6 2.7 Mr Zulu deposits at the end of each year E2,000.00, E3,000.00, E4,000.00, E5,000.00 and E6,000.00 for five years respectively. What is his series of deposits at the end of five years assuming 6% compound interest? (3 Marks) Metro Limited has issued bonds with a face value of E100 which pay a coupon rate of 6% Coupon payments are payable semi-annually. The quoted yields on similar bonds are currently 8% per year. The maturity date is 10 years time. What is the value of each Metro bond? What is the bond's annual effect interest yield