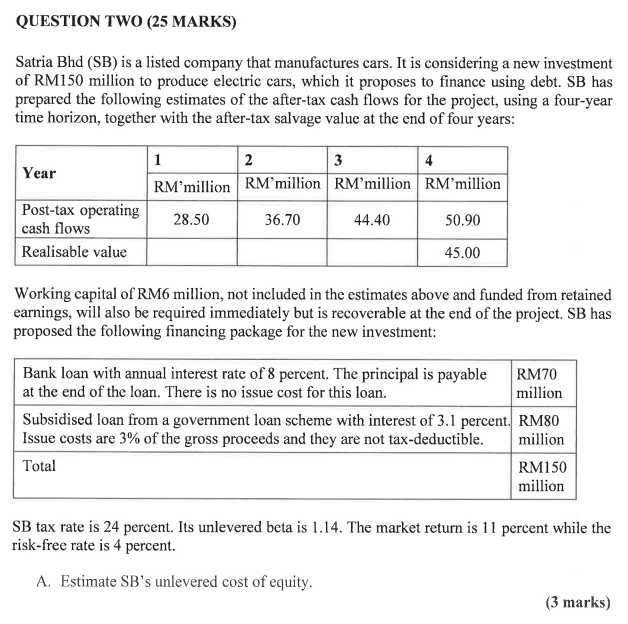

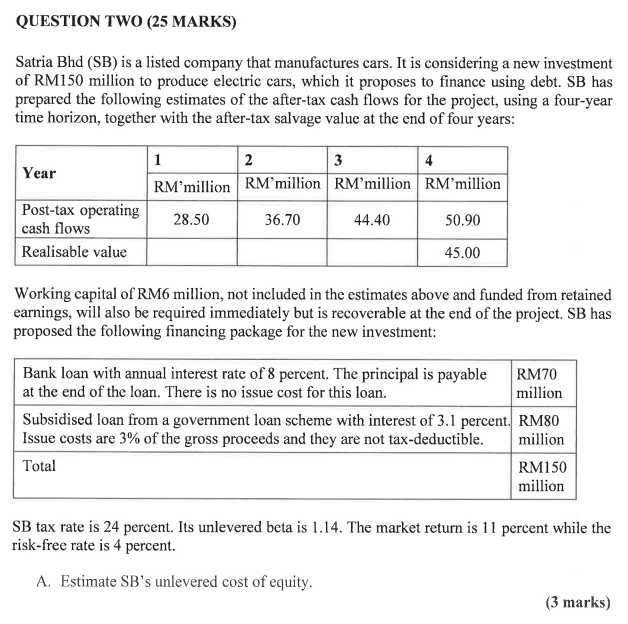

QUESTION TWO (25 MARKS) Satria Bhd (SB) is a listed company that manufactures cars. It is considering a new investment of RM150 million to produce electric cars, which it proposes to finance using debt. SB has prepared the following estimates of the after-tax cash flows for the project, using a four-year time horizon, together with the after-tax salvage value at the end of four years: Year 1 2 3 4 RM'million RMmillion RM'million RM'million 28.50 36.70 44.40 50.90 Post-tax operating cash flows Realisable value 45.00 Working capital of RM6 million, not included in the estimates above and funded from retained earnings, will also be required immediately but is recoverable at the end of the project. SB has proposed the following financing package for the new investment: Bank loan with annual interest rate of 8 percent. The principal is payable RM70 at the end of the loan. There is no issue cost for this loan. million Subsidised loan from a government loan scheme with interest of 3.1 percent. RM80 Issue costs are 3% of the gross proceeds and they are not tax-deductible. million Total RM150 million SB tax rate is 24 percent. Its unlevered beta is 1.14. The market return is 11 percent while the risk-free rate is 4 percent. A. Estimate SB's unlevered cost of equity. (3 marks) QUESTION TWO (25 MARKS) Satria Bhd (SB) is a listed company that manufactures cars. It is considering a new investment of RM150 million to produce electric cars, which it proposes to finance using debt. SB has prepared the following estimates of the after-tax cash flows for the project, using a four-year time horizon, together with the after-tax salvage value at the end of four years: Year 1 2 3 4 RM'million RMmillion RM'million RM'million 28.50 36.70 44.40 50.90 Post-tax operating cash flows Realisable value 45.00 Working capital of RM6 million, not included in the estimates above and funded from retained earnings, will also be required immediately but is recoverable at the end of the project. SB has proposed the following financing package for the new investment: Bank loan with annual interest rate of 8 percent. The principal is payable RM70 at the end of the loan. There is no issue cost for this loan. million Subsidised loan from a government loan scheme with interest of 3.1 percent. RM80 Issue costs are 3% of the gross proceeds and they are not tax-deductible. million Total RM150 million SB tax rate is 24 percent. Its unlevered beta is 1.14. The market return is 11 percent while the risk-free rate is 4 percent. A. Estimate SB's unlevered cost of equity