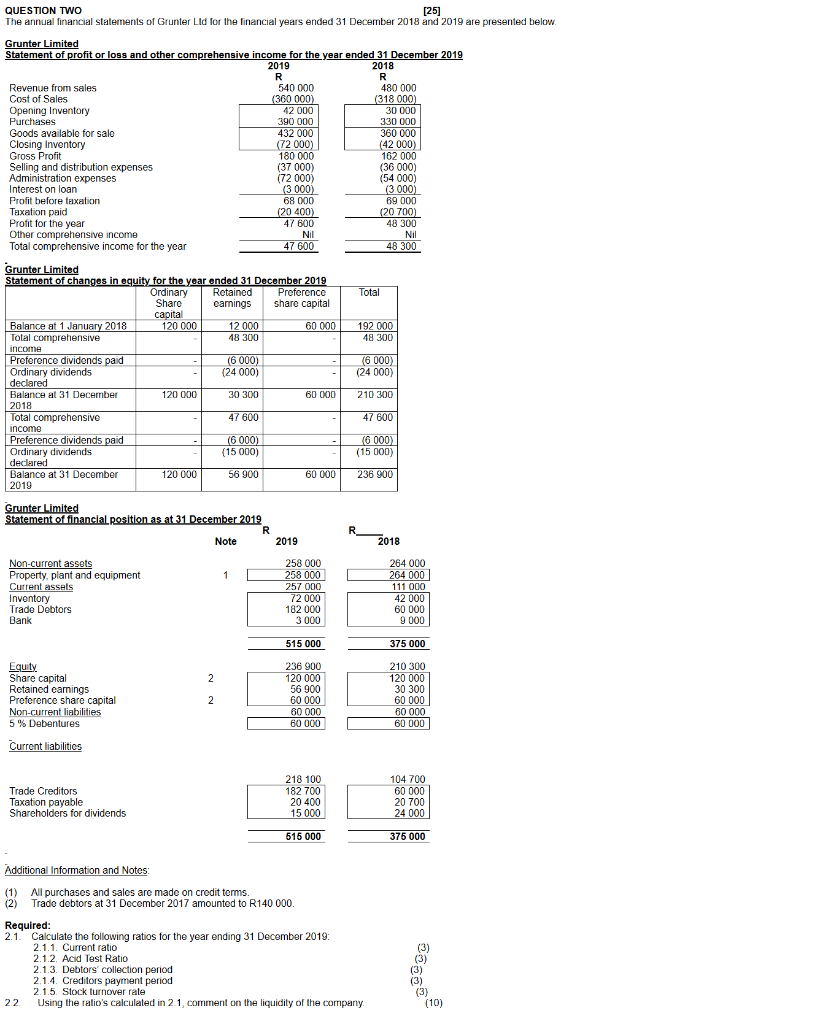

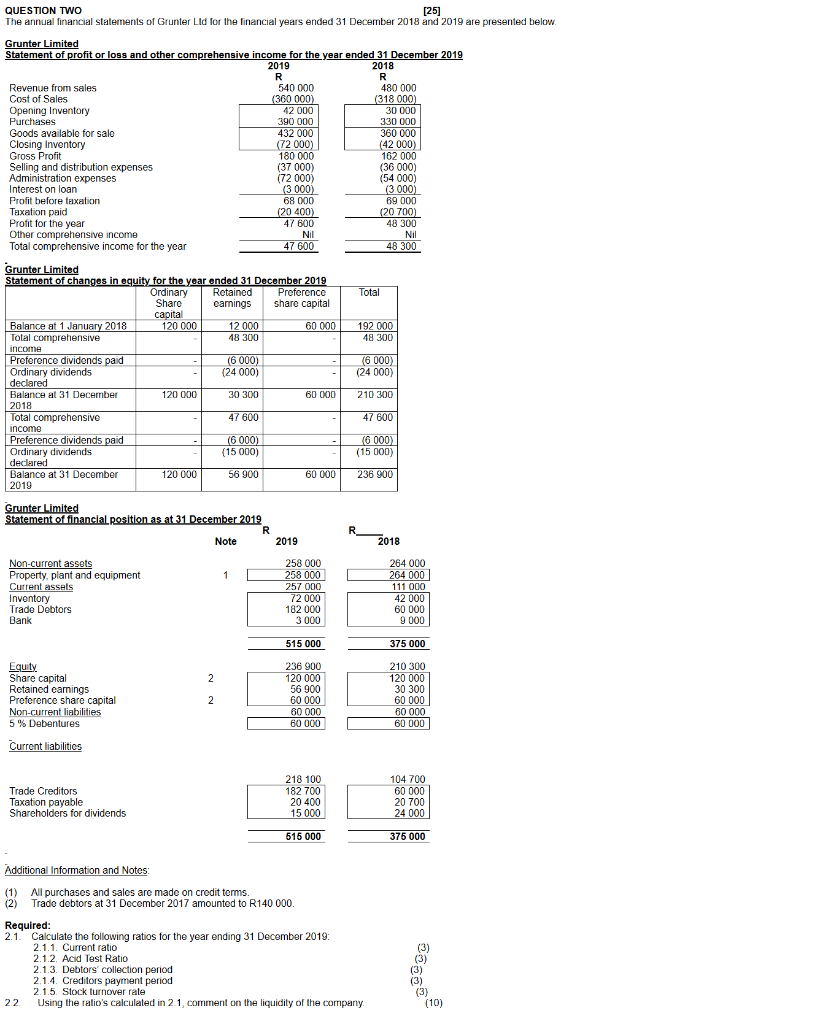

QUESTION TWO [25] The annual financial statements of Grunter Lid for the financial years ended 31 December 2018 and 2019 are presented below. Grunter Limited Statement of profit or loss and other comprehensive income for the year ended 31 December 2019 2019 2018 R R Revenue from sales 540 000 480 000 Cost of Sales (360 000) (318 000) Opening Inventory 42 000 30 000 Purchases 390 000 330 000 Goods available for sale 432 000 360 000 Closing Inventory (72 000) (42 000) Gross Profit 180 000 162 000 Selling and distribution expenses (37 000) (36 000) Administration expenses (72 000 (54 000) Interest on loan (3 000) (3 000) Profit before taxation 68 000 69 000 Taxation paid (20 400) (20 700) Profit for the year 47 600 48 300 Other comprehensive income Nil Total comprehensive income for the year 47 600 48 300 NII Total 192 000 48 300 Grunter Limited Statement of changes in equity for the year ended 31 December 2019 Ordinary Retained Preference Sharo carnings share capital capital Balance at 1 January 2018 120 000 12 000 60 000 Total comprehensive 48 300 income Preference dividends paid (6 000) Ordinary dividends (24 000) declared Balance at 31 December 120 000 30 300 60 000 2018 Total comprehensive 47 600 income Preference dividends paid (6 000) Ordinary dividends (15 000) declared Balance at 31 December 120 000 56 900 60 000 2019 (6 000) (24 000) 210 300 47 600 6 000) (15 000) 236 900 Grunter Limited Statement of financial position as at 31 December 2019 R Note 2019 2018 1 Non-current assets Property, plant and equipment Current assets Inventory Trade Debtors Bank 258 000 258 000 257 000 72 000 182 000 3 000 264 000 264 000 111 000 42 000 60 000 9 000 515 000 375 000 2 Equity Share capital Retained earnings Preference share capital Non-current liabilities 5% Debentures 236 900 120 000 56 900 60 000 60 000 60 000 210 300 120 000 30 300 60 000 60 000 60 000 2 Current liabilities Trade Creditors Taxation payable Shareholders for dividends 218 100 182 700 20 400 15 000 104 700 60 000 20 700 24 000 515 000 375 000 Additional Information and Notes (1) All purchases and sales are made on credit terms. (2) Trade debtors at 31 December 2017 amounted to R140 000. Required: 2.1 Calculate the following ratios for the year ending 31 December 2019: 2.1.1. Current ratio 2.1.2. Acid Test Ratio 2.1.3. Debtors' collection period 2.1.4. Creditors payment period 2.1.5. Slock turnover rale 22 Using the ratio's calculated in 21, comment on the liquidity of the company (3) (3) (3) (3)