Answered step by step

Verified Expert Solution

Question

1 Approved Answer

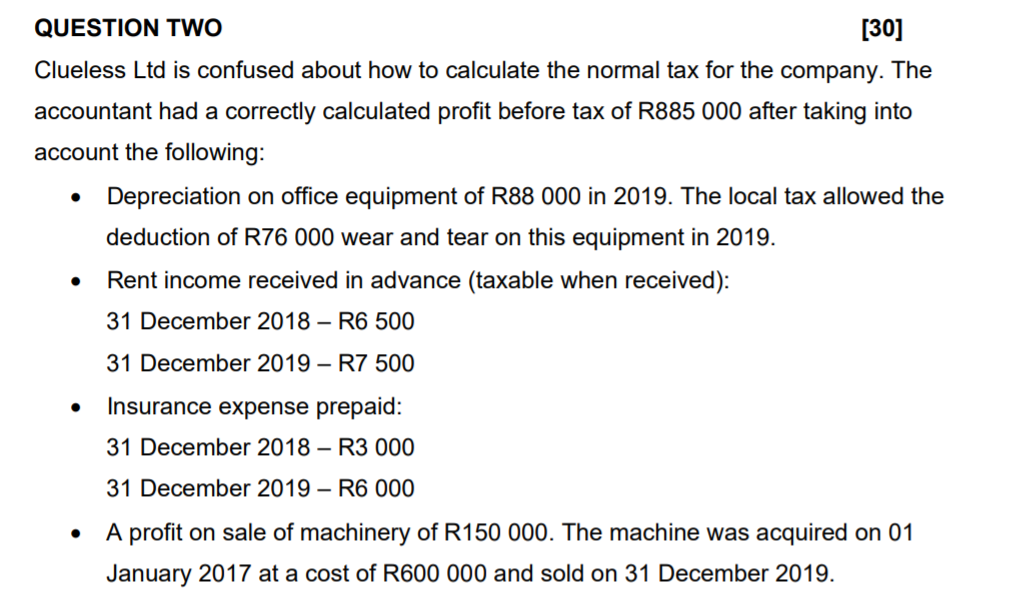

QUESTION TWO [30] Clueless Ltd is confused about how to calculate the normal tax for the company. The accountant had a correctly calculated profit before

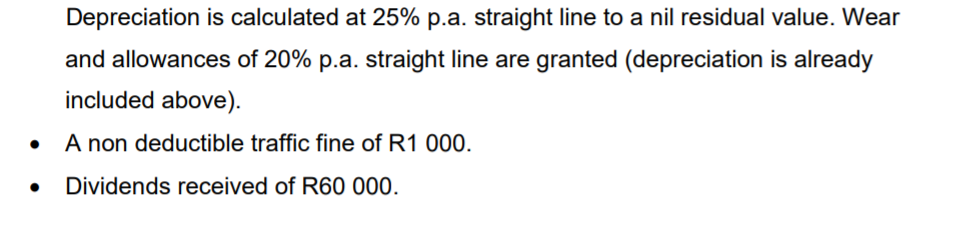

QUESTION TWO [30] Clueless Ltd is confused about how to calculate the normal tax for the company. The accountant had a correctly calculated profit before tax of R885 000 after taking into account the following: Depreciation on office equipment of R88 000 in 2019. The local tax allowed the deduction of R76 000 wear and tear on this equipment in 2019. Rent income received in advance (taxable when received): 31 December 2018 R6 500 . 31 December 2019 - R7 500 Insurance expense prepaid: 31 December 2018 - R3 000 31 December 2019 - R6 000 A profit on sale of machinery of R150 000. The machine was acquired on 01 January 2017 at a cost of R600 000 and sold on 31 December 2019. Depreciation is calculated at 25% p.a. straight line to a nil residual value. Wear and allowances of 20% p.a. straight line are granted (depreciation is already included above). A non deductible traffic fine of R1 000. 0 Dividends received of R60 000. The inclusion rate for capital gains made by companies is 33.3%. The applicable tax rate is 30% on taxable profits. There were no other temporary differences in the year. Required: 2.1. Assist Clueless Ltd with disclosing the taxation note in the Financial Statements. (24) 2.2. Prepare the journal entries relating to taxation only. (6) QUESTION TWO [30] Clueless Ltd is confused about how to calculate the normal tax for the company. The accountant had a correctly calculated profit before tax of R885 000 after taking into account the following: Depreciation on office equipment of R88 000 in 2019. The local tax allowed the deduction of R76 000 wear and tear on this equipment in 2019. Rent income received in advance (taxable when received): 31 December 2018 R6 500 . 31 December 2019 - R7 500 Insurance expense prepaid: 31 December 2018 - R3 000 31 December 2019 - R6 000 A profit on sale of machinery of R150 000. The machine was acquired on 01 January 2017 at a cost of R600 000 and sold on 31 December 2019. Depreciation is calculated at 25% p.a. straight line to a nil residual value. Wear and allowances of 20% p.a. straight line are granted (depreciation is already included above). A non deductible traffic fine of R1 000. 0 Dividends received of R60 000. The inclusion rate for capital gains made by companies is 33.3%. The applicable tax rate is 30% on taxable profits. There were no other temporary differences in the year. Required: 2.1. Assist Clueless Ltd with disclosing the taxation note in the Financial Statements. (24) 2.2. Prepare the journal entries relating to taxation only. (6)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started