Answered step by step

Verified Expert Solution

Question

1 Approved Answer

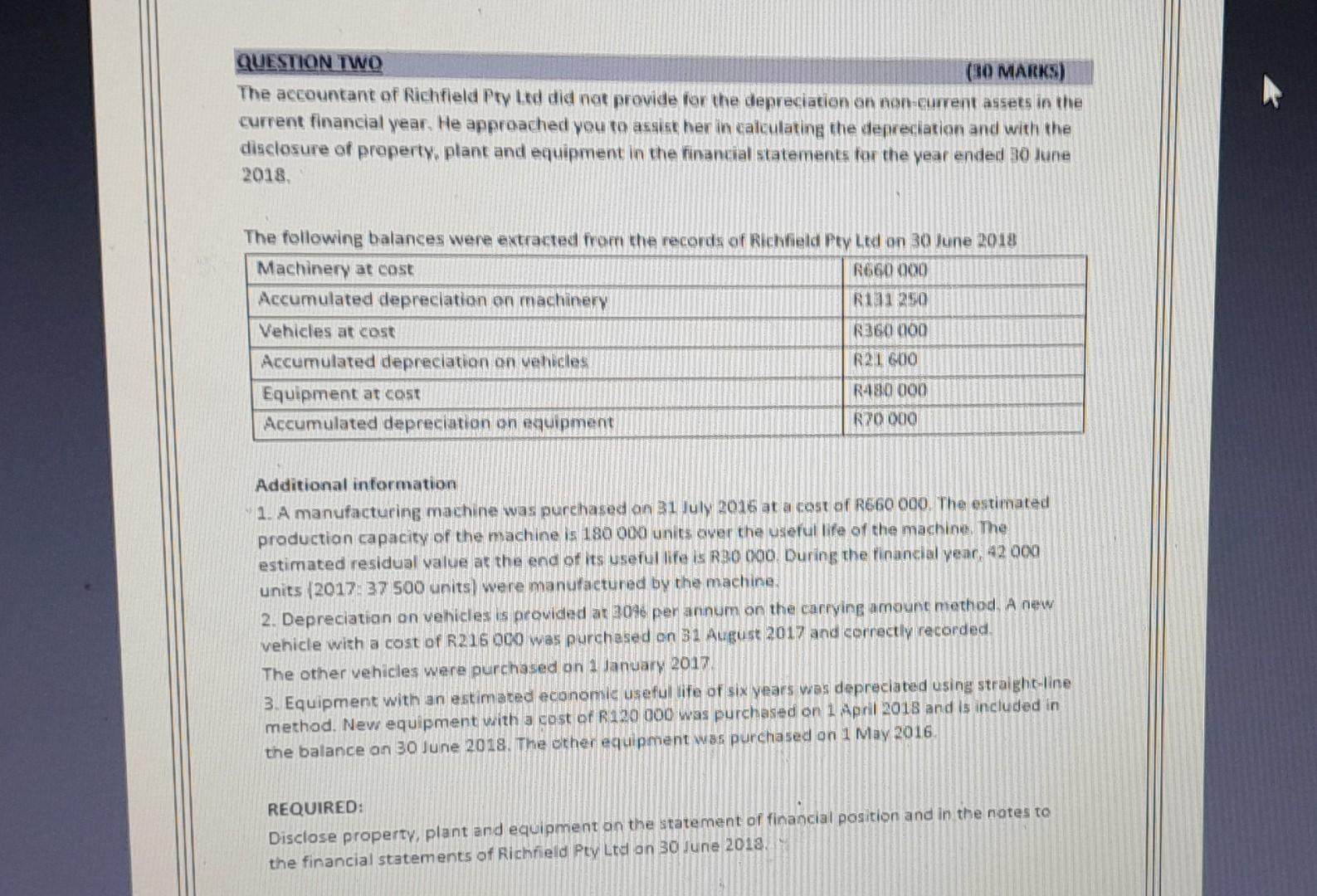

QUESTION TWO (30 MAItKS) The accountant of Richfield Pty Led did not provide for the depreciation on non-current assets in the current financial year. He

QUESTION TWO (30 MAItKS) The accountant of Richfield Pty Led did not provide for the depreciation on non-current assets in the current financial year. He approached you to assist her in calculating the depreciation and with the disclosure of property, plant and equipment in the financial statements for the year ended 30 sune 2018 . The following balances were extracted from the records of Richfield Ptv Ltd on 30 lune 2018 Additional information 1. A manufacturing machine was purehased on 31 July 2016 at a cost of R660000. The estimated productian capacity of the machine is 180000 units over the useful life of the machine. The estimated residual value at the end of its useful life is R30000. During the financial vear, 42000 units {2017:37500 units\} were manufactured by the machine. 2. Depreciatian on vehicles is provided at 3046 per annum on the carrying amount method. A new vehicle with a cost of R215 OCO was purchased on 31 August 2017 and correctly recorded. The other vehicles were purchased on 1 January 2017. 3. Equipment with an estimated economic useful life of six years was depreciated using straight-line method. New equipment with a cost of R120 000 was purchased on 1 April 2018 and is included in the balance on 30 June 2018. The other equipment was purchased on 1 May 2016. REQUIRED: Disclose property, plant and equipment on the statement of financial position and in the notes to the financial statements of Richrield Pty Ltd on 30 June 2018

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started